- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

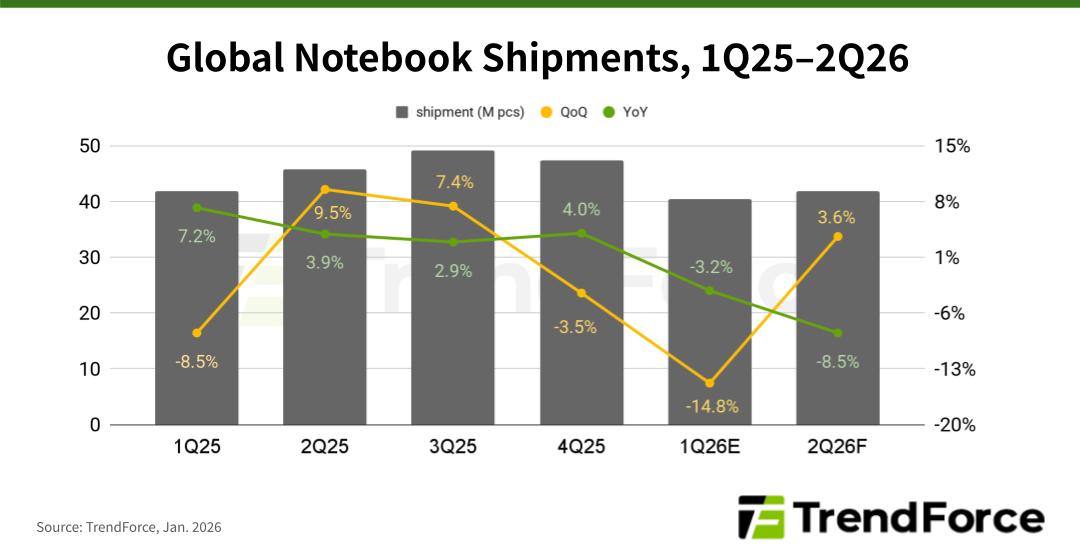

TrendForce’s latest survey of the notebook industry reveals that global notebook brands have been grappling with sharp increases in memory prices since 2H25. Entering early 2026, they are now also facing a temporary CPU supply shortfall and price hikes. These challenges are compounded by rising costs for PCBs, batteries, and PMICs, which together are expected to drive global notebook shipments down 14.8% QoQ in 1Q26, falling below brands’ original expectations.

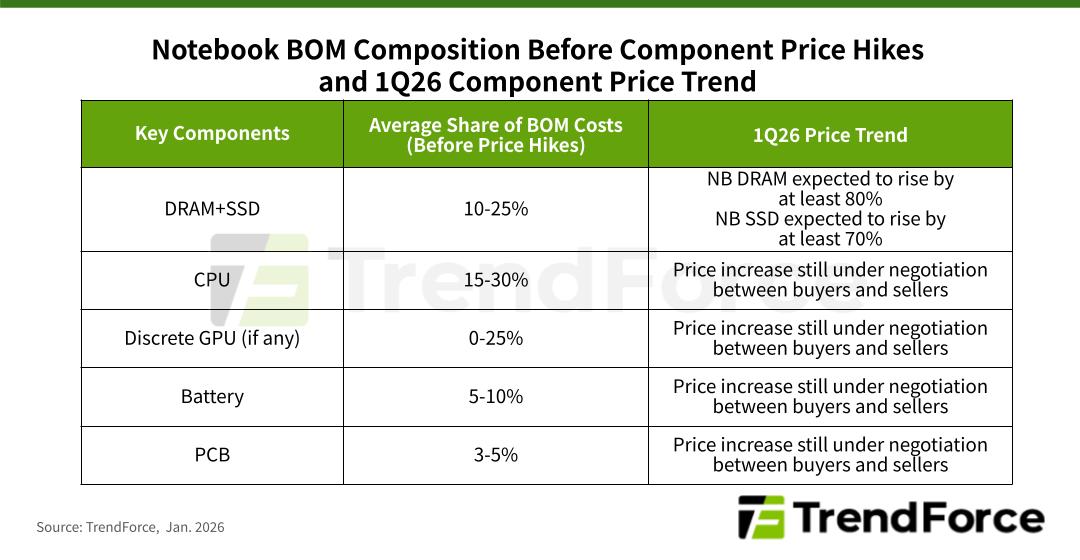

TrendForce observes that, depending on the system setup, CPUs generally make up about 15–30% of a notebook’s total BOM cost. Currently, most entry-level and mainstream notebooks mainly use Intel processors. However, Intel’s recent price hikes on lower-end CPUs and ongoing supply shortages—expected to persist until after March—are adding pressure to product planning and shipment timing.

Contract prices for notebook DRAM and SSDs in 1Q26 are expected to significantly exceed previous forecasts, increasing by over 80% and 70% QoQ, respectively. Additionally, aggressive shipment efforts by notebook manufacturers since 4Q25 have quickly reduced memory inventories. As fulfillment rates from memory producers decline in 1Q26, brands’ ability to source memory is limited, disrupting production schedules and shipment timelines.

TrendForce points out that PCB costs are also rising due to increased design complexity and surging copper prices. Structurally higher PCB costs are set to become a long-term trend as motherboard layer counts grow in line with mid- to high-end notebook specification upgrades.

Specification upgrades are driving up the cost per battery unit, and rising prices for lithium battery materials are further increasing battery quotes. Meanwhile, higher CPU and NPU power consumption boosts demand for PMICs. The adoption of new standards like Wi-Fi 7 and USB4 is also increasing the costs of associated chips and connectors. While these component price hikes are smaller than those for memory or CPUs individually, their combined effect creates a significant financial burden for notebook brands, which generally work with thin margins.

Brands remain relatively optimistic about their 1Q26 shipment outlook despite increasing supply-side risks. However, TrendForce believes brands might face difficulties in securing all necessary components on time, leading to a projected 14.8% QoQ decline in 1Q26 shipments. A mild QoQ rebound is expected in 2Q26 as Intel’s supply of CPUs improves.

For 2026, TrendForce has lowered its forecast for notebook shipments from a 5.4% YoY decline to a more significant 9.4% decrease. The market faces increased short-term uncertainty due to high memory prices and unstable CPU supply. Moving forward, factors such as changes in key component supply, brands’ adjustments to costs, inventory levels, product strategies, and consumer acceptance of higher prices will be crucial in shaping the second half of 2026.

For more information on reports and market data from TrendForce’s Department of Display Research, please click here, or email the Sales Department at DR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports