- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

TrendForce’s latest research indicates that AI innovation is causing a fundamental shift in the memory market. As data access volumes continue to grow, AI systems depend more on high-bandwidth, high-capacity, low-latency DRAM to handle large-scale model parameters, long-sequence inference, and multi-task parallel processing. Additionally, NAND Flash has become essential for fast data transfer, making memory a key component in AI infrastructure and a strategic focus for CSPs.

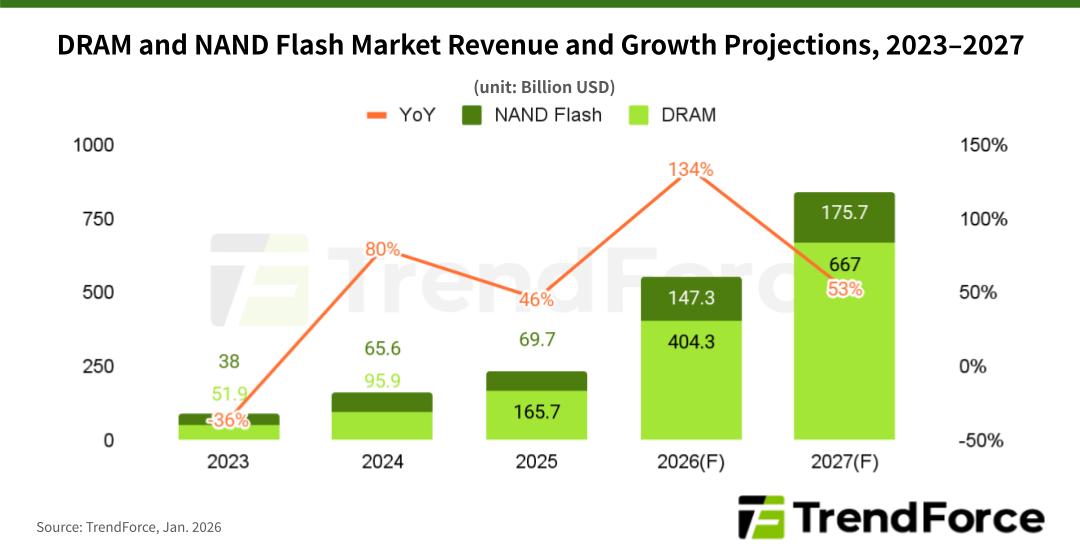

Memory prices have continuously increased due to limited capacity and rising demand for allocations, pushing industry revenue to new record levels. TrendForce projects the memory market to be worth $551.6 billion in 2026 and to surge to a peak of $842.7 billion in 2027, reflecting a 53% YoY growth.

In early 2025, the DRAM segment was affected by geopolitical tensions and macroeconomic uncertainty, which dampened end-market sentiment and especially hindered the recovery of consumer applications. However, as market clarity improved in the latter half of the year, North American CSPs greatly raised their capital expenditures. The rapid deployment of AI servers and substantial increases in memory procurement sparked a new rise in prices.

Driven by surging data-access requirements, DRAM demand has grown at a disproportionately rapid pace. TrendForce predicts that in 2025, the DRAM market will generate $165.7 billion—reflecting a 73% annual increase—and significantly surpass NAND Flash revenue of $69.7 billion for the same year. This gap has led suppliers to focus more on expanding DRAM capacity in their production strategies.

Furthermore, AI workloads have evolved from initial large-model training to systems that combine inference, memory, and decision-making. This development has led to a rapid increase in the need for greater memory capacity, bandwidth, and access efficiency. Consequently, the current upward trend in DRAM prices has significantly surpassed historical levels.

Historically, peak quarterly price hikes were around 35%, but last year's fourth quarter saw DRAM prices jump by 53–58% due to strong DDR5 demand. Even with already high prices, CSP memory demand stays strong, further driving prices up. TrendForce predicts price increases of over 60% in the first quarter, with some categories nearly doubling. As bullish momentum is expected to continue for the next three quarters, DRAM market revenue could reach $404.3 billion, surging 144% YoY.

Reviewing revenue trends in the NAND Flash segment, Nvidia stated at CES 2026 that AI is fundamentally reshaping the entire computing stack. As generative AI progresses towards agent-based systems capable of long-term reasoning, AI agents need frequent access to extensive vector databases to support retrieval-augmented generation (RAG). These tasks involve large data sets and highly random access patterns, which greatly increase the need for high-IOPS enterprise SSDs.

This change is anticipated to boost NAND Flash prices further, with TrendForce predicting a QoQ rise of 55–60% in the first quarter, and a sustained upward trend through the rest of the year. The NAND Flash market revenue in 2026 is expected to jump by 112% YoY to $147.3 billion.

Across the wider memory market, supply tightness shows no signs of easing, keeping pricing power with suppliers. TrendForce highlights that the AI boom is progressing across hardware stacks, system architectures, and software, making memory an essential, irreplaceable component in AI computing.

Supported by ongoing demand from AI servers, high-performance computing, and enterprise storage, contract prices for DRAM and NAND Flash are projected to rise through 2027. As a result, the revenue growth of the memory industry is expected to continue expanding until 2027, strengthening its role as a key beneficiary in the AI era.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports