- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

On January 20, TCL (TCL Electronics Holdings) and Sony announced they signed an MOU to explore strategic cooperation in the home entertainment sector. This includes plans to form a joint venture that would manage Sony’s home entertainment business. The partnership aims to leverage each company's strengths in branding, technology, and key component supply chains, according to TrendForce’s latest insights into the TV industry.

In the short to medium term, Sony is likely to capitalize on TCL Group’s strengths in Mini-LED supply, moving its premium product lineup more towards Mini-LED TVs. In the longer term, Sony might also serve as a key international channel for TCL CSOT’s OLED TV panel capacity.

Under the proposed structure, TCL will own a 51% stake in the joint venture, while Sony will hold the remaining 49%. The venture will focus on televisions and home audio products and will operate worldwide. Both parties aim to finalize the agreement by the end of March this year.

TrendForce notes that TCL’s TV shipments exceeded 20 million units in 2019. Since then, the company has expanded its shipments and market share through vertical panel integration and cost efficiency. By 2024, TCL became the world’s second-largest TV brand, with forecasted shipments of nearly 31 million units in 2025, representing a 15.7% global market share.

In 2010, Sony reached its peak with 21.5 million TV units shipped and an 11.4% market share, ranking third worldwide. However, aggressive pricing by Chinese brands has steadily reduced Sony’s shipment numbers. As a result, Sony shifted its focus to the mid- and high-end TV markets. TrendForce predicts that by 2025, Sony’s TV shipments will drop below 4 million units, with its market share falling to just 1.9%, making it less competitive on a global scale.

Sony predominantly sources mid- to high-end TV panels. After the joint venture is formed, with TCL as the controlling partner, procurement approaches are expected to become much more streamlined. TCL CSOT is likely to take on a central role, with its panel supply share increasing notably. Additionally, AUO, which has strengthened its collaboration with TCL in recent years, may also experience a rebound in shipment volumes and benefit from heightened demand for premium panels.

A review of Sony’s TV manufacturing shows that roughly 45% is produced in-house while about 55% is outsourced. Historically, Foxconn managed around 80% of Sony’s outsourced TVs, but recently has been scaling back its TV OEM activities. Meanwhile, MOKA—a subsidiary of TCL Group—has been expanding its capacity and targeting international brands, positioning itself as a likely primary OEM partner for Sony’s new TV lineup. As a result, Sony’s manufacturing approach is gradually becoming more TCL-oriented.

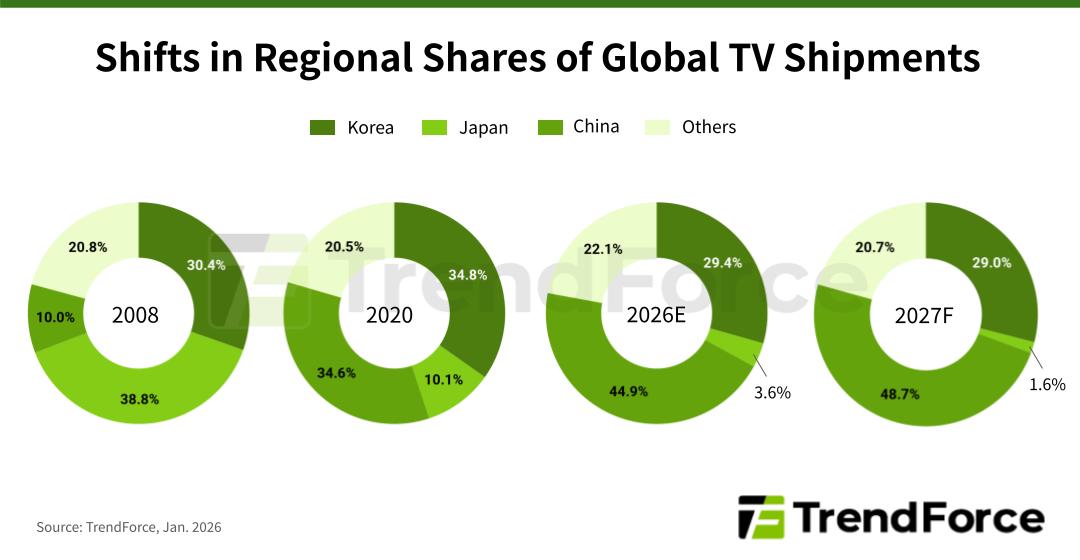

Japanese brands once held almost 40% of the global TV market, but rapid expansion by Chinese brands and fierce price competition have caused Toshiba, Funai, and Panasonic to license or sell off their TV divisions. After regulatory approval, the TCL-Sony joint venture is set to start operations in April 2027. By then, TrendForce predicts that Chinese brands’ combined global market share will near 50%, reinforcing the continuing shift in market dominance.

For more information on reports and market data from TrendForce’s Department of Display Research, please click here, or email the Sales Department at DR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports