- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

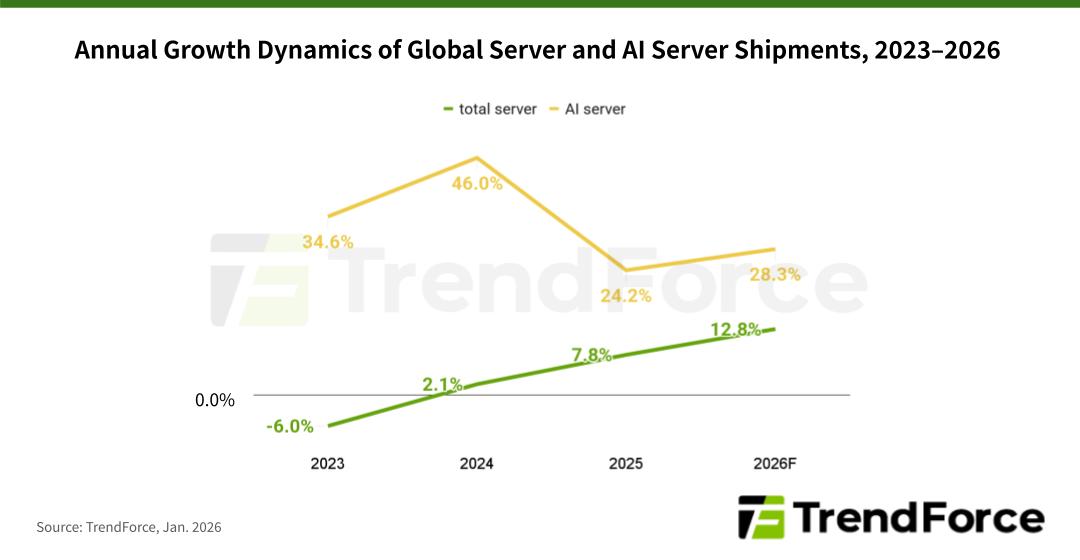

North American CSPs' continued investments in AI infrastructure are expected to increase global AI server shipments by more than 28% YoY in 2026, according to the latest market research from TrendForce. The rapid growth of AI inference services is boosting demand for general-purpose servers, supporting both replacement and expansion efforts. Consequently, TrendForce predicts that total global server shipments, including AI servers, will accelerate from 2025, with a 12.8% YoY growth in 2026.

The server market from 2024 to 2025 primarily centered on training advanced large language models (LLMs), utilizing AI servers with GPUs and HBM for parallel computing. However, starting in the second half of 2025, the growth of AI agents, LLaMA-based applications, and Copilot upgrades shifted CSP's focus toward inference services as a monetization strategy. AI inference workloads are now deployed not only on dedicated AI server racks but also on general-purpose servers that handle pre- and post-inference computing and storage.

TrendForce data show that the combined capital expenditures of the top five North American CSPs—Google, AWS, Meta, Microsoft, and Oracle—are expected to increase by 40% YoY in 2026. In addition to large-scale infrastructure buildouts, part of this spending will go toward replacing general-purpose servers purchased during the 2019–2021 cloud investment boom. Google and Microsoft are likely to lead in expanding the procurement of general-purpose servers to handle the massive daily inference traffic generated by Copilot and Gemini services.

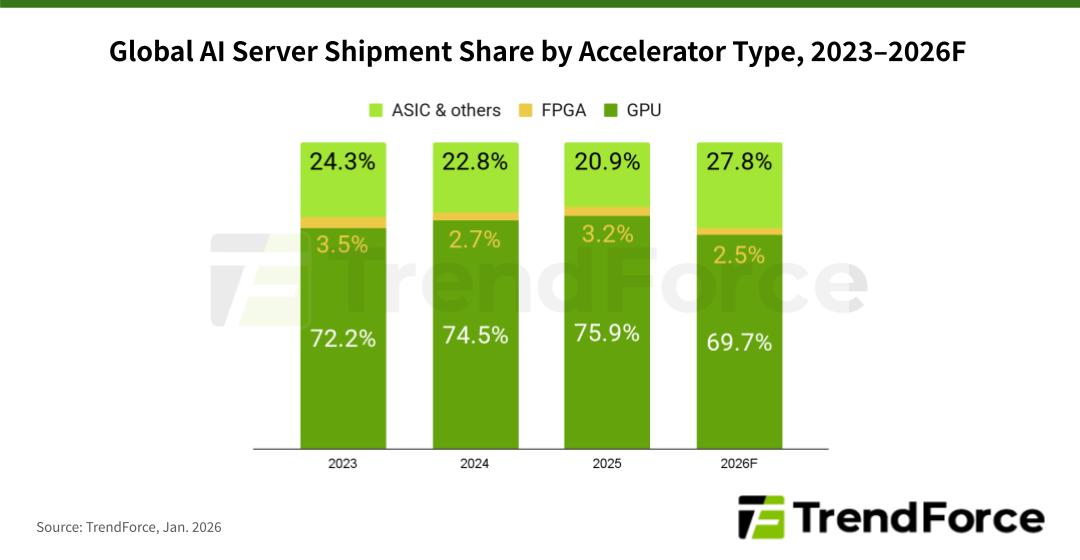

In the 2026 AI server market, shipment growth will mainly come from North American CSPs, government sovereign cloud projects, and the increasing development of in-house ASICs and edge AI inference solutions by large CSPs. GPUs will remain the leading category, accounting for 69.7% of shipments. Systems using NVIDIA’s GB300 are expected to drive most shipments, while VR200-based platforms will gradually increase in the second half of the year.

The share of ASIC-based AI servers is expected to reach 27.8% by 2026, the highest since 2023, as North American firms like Google and Meta expand their own ASIC efforts. Shipment growth for ASIC AI servers is also projected to outpace that of GPU-based systems. Notably, Google is investing more in its own ASICs than most CSP competitors and is positioned to become a leading market player. Its TPUs, which support Google Cloud Platform, are increasingly being sold to external clients such as Anthropic.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports