- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

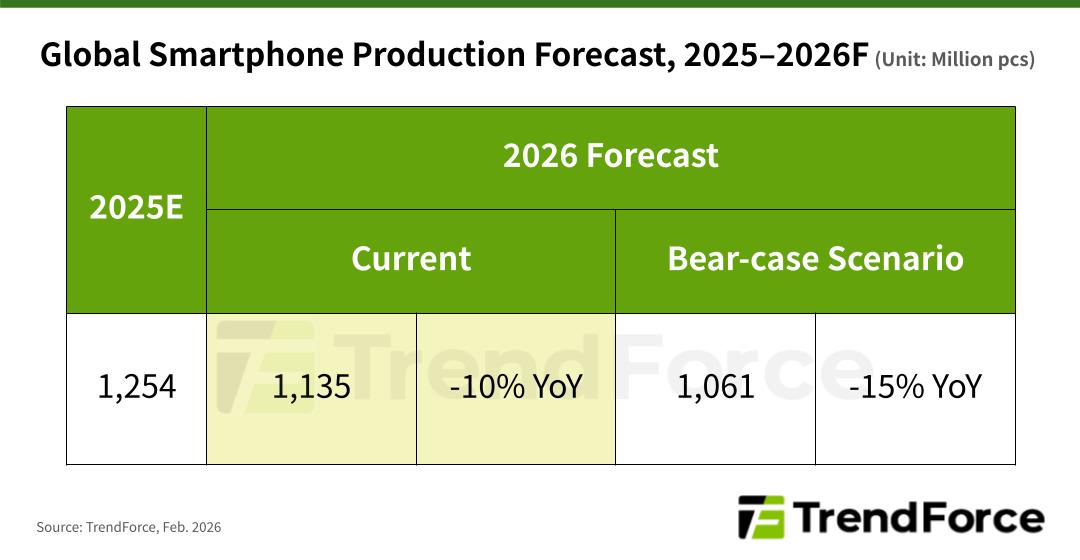

TrendForce’s latest smartphone industry research predicts that soaring memory prices are set to weigh heavily on global smartphone production in 2026. Total output is forecast to decline 10% YoY to approximately 1.135 billion units. With memory prices showing no clear signs of easing, the growing gap between higher retail prices and consumer price tolerance is expected to further dampen end demand.

Under a bear-case scenario, TrendForce warns that the annual contraction in global smartphone production could widen to 15% or more. The extent of the impact, however, will vary by brand, depending on differences in product mix and regional exposure.

Taking a mainstream 8GB + 256GB memory configuration as an example, estimated contract prices in 1Q26 have surged nearly 200% YoY—roughly tripling from the same period last year. Memory, which historically accounted for around 10–15% of a smartphone’s BOM, has now surged to 30–40%. TrendForce believes that raising end-product prices will become unavoidable for many brands seeking to protect margins, while product portfolios and specifications will also need to be adjusted to manage persistently elevated memory costs.

Assuming a 15% production decline under the bear-case scenario, TrendForce analyzed 2026 production trends among the world’s top eight smartphone brands. Samsung, the global market leader and a major memory supplier, benefits from vertical integration and is therefore expected to see a smaller production decline than Chinese brands. However, overall volumes will still soften amid weaker market conditions.

Apple, which shares the top market position, is comparatively better positioned to absorb higher memory costs due to its higher proportion of premium models. Its customer base also shows greater tolerance for price increases, providing partial support for production stability.

In contrast, Xiaomi and Transsion, which rely heavily on entry-level models, are more vulnerable to cost volatility. Their price-sensitive target markets leave limited room to pass through higher costs, making them more likely to see significant downward revisions to production in 2026 if memory prices remain elevated.

Brands with a strong focus on the Chinese market, such as vivo, OPPO, Xiaomi, and Honor, are facing intensifying competition from Huawei, in addition to rising memory costs. Huawei is prioritizing the expansion of its HarmonyOS ecosystem and maintains relatively flexible pricing strategies. Combined with its unique market position and strong brand loyalty in China, Huawei is expected to exert substantial pressure on the market share and production volumes of other domestic brands.

Based on current projections, TrendForce believes Huawei is likely to experience the smallest production adjustment under the bear-case scenario, and could even post growth against the broader market trend.

TrendForce concludes that while the current downturn is being triggered by rising memory prices, deeper structural factors are also at play. Today’s smartphones already offer functionality sufficient to meet most consumers’ daily needs, meaning replacement cycles are lengthening and incentives to upgrade are weakening. Even if memory prices stabilize in the future, this structural shift in demand is unlikely to reverse in the near term.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports