- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

According to the latest electric vehicle industry research from TrendForce, range-extended electric vehicles (REEVs) are increasingly emerging as a pivotal transitional solution for automakers shifting toward full electrification. The European Union’s recent announcement regarding adjustments to its 2035 ban on internal combustion engine (ICE) vehicles offers significant regulatory flexibility and expands the development landscape for REEVs. TrendForce projects that, driven by this policy flexibility alongside technological maturity and rising market acceptance, global annual sales of REEVs will reach 3 million units by 2030—a twofold increase from 2025 levels.

In late 2025, the EU announced plans to relax its original mandate requiring “100% zero emissions” for new cars, adjusting the target to an “average overall emission reduction of 90%.” Under the revised proposal, the remaining emissions could be offset through measures such as the use of low-carbon steel and synthetic fuels. This proposal is currently pending final approval by EU member states and the European Parliament.

TrendForce notes that while the architecture of REEVs resembles that of plug-in hybrid electric vehicles (PHEVs), the internal combustion engine in a REEV functions solely as a power generator and does not directly drive the wheels. Consequently, REEVs provide a driving experience comparable to battery-electric vehicles (BEVs) while achieving lower actual carbon emissions than PHEVs. Crucially, because REEVs draw power from both the internal generator and the battery pack, they significantly mitigate driver range anxiety.

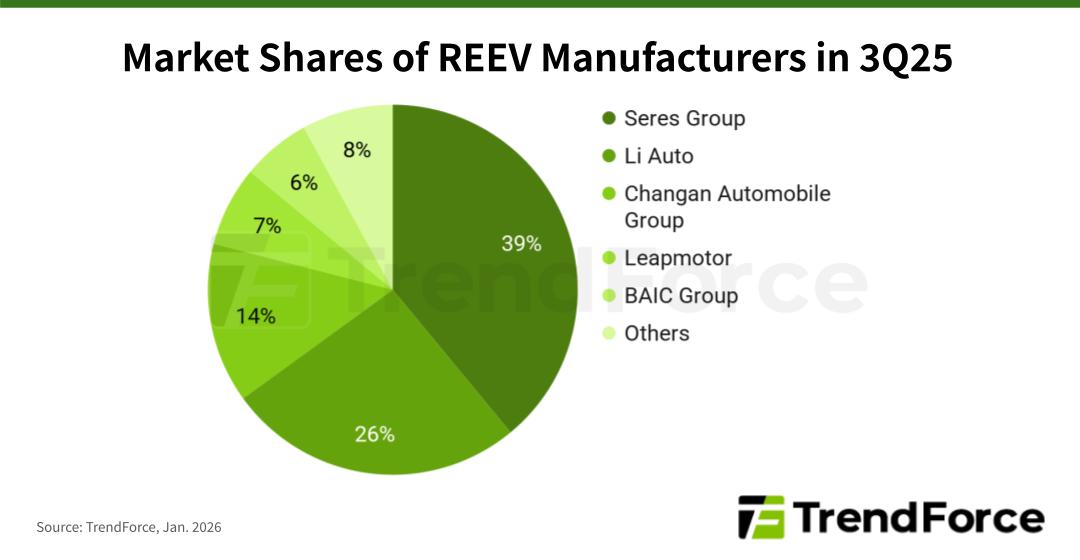

The penetration rate of REEVs in the global new car market has risen from less than 3% to stabilize at approximately 4% as of 3Q25. Chinese automakers currently dominate the market by leveraging advantages in vehicle pricing and battery costs, with key players including Seres Group, Li Auto, and Changan Automobile Group. However, European automakers such as BMW, Volkswagen, Volvo, and Stellantis have either announced or are reportedly planning to introduce REEV models in 2026, utilizing the technology as a strategic bridge before the pure EV market fully matures. Toyota, a leader in ICE technology, and Hyundai have outlined similar strategic plans.

From a supply chain perspective, REEVs incorporate an internal combustion engine, a power battery, and a fully electric powertrain system; therefore, increased market penetration is poised to benefit component suppliers across these sectors. Furthermore, the mainstream power output range of REEVs aligns closely with the target market for silicon carbide (SiC) power component chips, helping to bolster demand for SiC in automotive applications.

Despite the positive outlook, challenges to mass adoption remain. Due to the high complexity of REEV systems, models are currently concentrated in the high-end SUV segment, resulting in higher price points that may hinder widespread accessibility. Furthermore, because REEVs utilize an internal combustion engine for power generation, their energy conversion efficiency is significantly lower than that of BEVs. Lastly, the added weight of a larger battery pack and electric powertrain system compared to other hybrid models can compromise driving range.

For more information on reports and market data from TrendForce’s Department of ICT Applications Research, please click here, or email the Sales Department at TRI_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://www.trendforce.com/news/

Subject

Related Articles

Related Reports