- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

The supply-demand dynamics of the 8-inch wafer market have shifted according to TrendForce’s latest foundry survey. As TSMC and Samsung gradually scale back 8-inch production, demand for AI-related power ICs continues to grow steadily. Meanwhile, customers for consumer electronics, concerned over rising IC costs and potential capacity crowding in the second half of the year, have begun pulling in orders earlier than planned.

As a result, Chinese foundries have already seen 8-inch utilization rates rebound to high levels in 2025. Foundries in other regions are also receiving upward revisions to 2026 orders, prompting broad improvements in utilization and encouraging foundries to prepare for price increases.

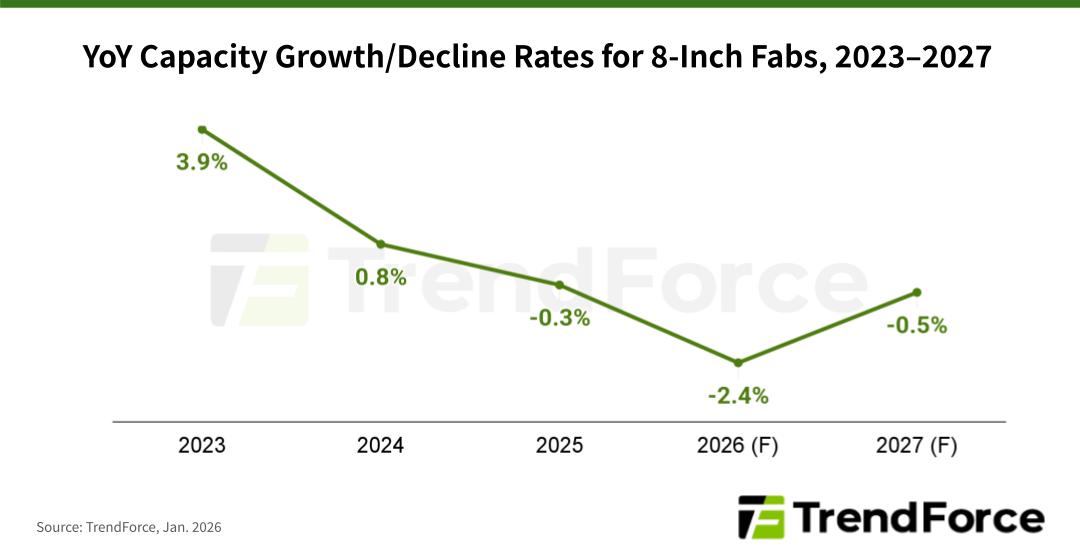

TSMC formally began phasing down 8-inch capacity in 2025, with plans to fully shut down some fabs by 2027. Likewise, Samsung also initiated 8-inch capacity reductions in 2025, adopting an even more aggressive stance. TrendForce estimates that global 8-inch capacity will decline by about 0.3% year-over-year in 2025, marking the start of negative growth. Although players such as SMIC and Vanguard have planned modest capacity additions in 2026, these will fall short of offsetting the cuts by the two leading foundries, widening the projected capacity decline to 2.4%.

Growth in AI server power IC orders in 2025, combined with China’s localization push for ICs, has driven stronger demand for BCD and PMIC processes at domestic foundries. Utilization rates at some Chinese fabs rose sharply from mid-2025, leading them to initiate catch-up price increases that took effect in the second half of the year. With Chinese foundries operating at full capacity, spillover orders have also benefited Korean foundries.

A look at the year ahead reveals that rising compute intensity and power consumption in AI servers and edge AI applications are expected to sustain strong demand for power-related ICs, making them the primary support for 8-inch fab utilization throughout the year. In addition, PC and notebook supply chains—concerned that surging AI server demand could squeeze 8-inch capacity—have begun advance procurement of power ICs for PCs and notebooks, and even some non-power components.

These factors are helping Tier-2 Chinese and Korean foundries maintain high 8-inch utilization, while foundries in other regions are also seeing a clear recovery. TrendForce projects that global average 8-inch utilization will rise to 85–90% in 2026, up significantly from 75–80% in 2025.

With expectations that 8-inch capacity will tighten in 2026, some foundries have notified customers of planned price increases ranging from 5% to 20%. TrendForce notes that, unlike in 2025, when price adjustments were limited to certain legacy nodes or platforms, this round of increases would apply broadly across customers and process platforms.

However, concerns over consumer end-markets, together with cost pressures from rising memory and advanced-node prices squeezing peripheral IC margins, may ultimately limit the extent of actual price hikes.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports