- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

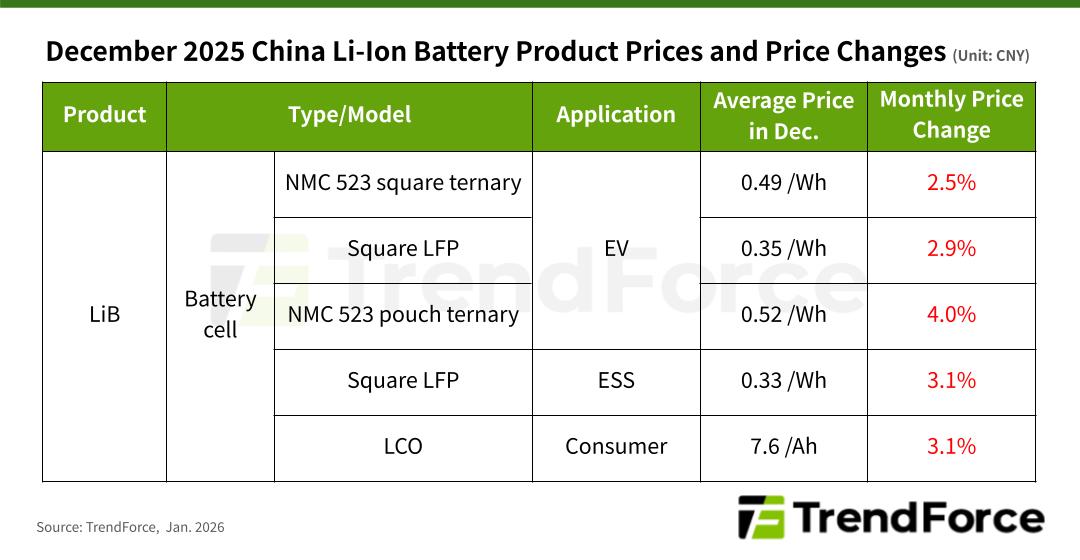

TrendForce’s latest“Lithium Battery Industry Chain Monthly Price Report”indicates that the average price of battery-grade lithium carbonate surged 17% MoM in December 2025 to CNY 103,000 per metric ton. Prices of key raw materials, including copper, aluminum, cobalt, and electrolytes, also increased, driving up EV cell prices for square LFP, square ternary, and pouch ternary cells by 2–4% compared to November.

As for ESS cells, downstream restocking demand in December 2025 continued to provide support for the ESS segment, keeping overall capacity utilization at relatively high levels. Meanwhile, rising costs for LFP cathode materials, liquid electrolytes, and copper foil prompted battery makers to raise quotations, pushing average ESS cell prices up by 2–3% MoM.

TrendForce notes that in 2025, global ESS market expansion significantly exceeded expectations, while the EV market maintained relatively strong growth. Together, these factors have gradually shifted the lithium-ion battery industry from oversupply toward a supply–demand balance, with certain segments even entering a “tight balance” during the peak season in 2H25. As a result, materials suppliers involved in lithium resources, lithium carbonate, electrolytes, and cobalt have been the first to reverse previous earnings pressure.

ESS cells to lead lithium-ion battery demand growth in 2026

Looking ahead to 2026, growth in the supply of key minerals such as lithium, cobalt, and nickel has slowed in recent years due to production controls and supply restrictions. As demand accelerates again, these critical resources may become more scarce. In particular, leading players in the ESS market predict shipment growth of 40–50% YoY in 2026.

Under an optimistic scenario, annual ESS battery shipments could exceed 1,000 GWh, making ESS the fastest-growing demand segment in the lithium-ion battery industry next year. In the near term, ESS cell prices are expected to remain stable, with the possibility of gradual increases later on.

In 2026, growth in the EV market will diverge across regions due to policy adjustments, subsidy rollbacks, and trade barriers. China continues to lead, with passenger EV penetration exceeding 60%. However, slower electrification progress in Europe and the US is expected to weigh on global EV sales growth in 2026.

Although the first quarter typically marks a seasonal lull in auto demand—leading to weaker EV battery procurement and scaled-back production plans—rising chemical and non-ferrous metal prices will continue to provide cost support. TrendForce expects price increases for EV cells to narrow in 1Q26, with prices largely stabilizing.

For more information on reports and market data from TrendForce’s Department of Green Energy Research, please click here, or email the Sales Department at GER_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://www.trendforce.com/news/