- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

TrendForce’s latest investigations indicate that total global traction inverter installations for EVs1 reached 8.35 million units in 3Q25, representing a 22% increase YoY, driven by ongoing growth in the NEV2 market. BEVs and PHEVs were the main contributors to this expansion, with installation increases of 36% and 13.6%, respectively.

Automakers are progressively enhancing the integration of chassis electric drive systems to achieve goals for smarter and more efficient EVs. This aims to reduce wiring and hardware costs while bolstering communication efficiency and increasing driving range.

In 3Q25, over 70% of inverter installations were part of “3-in-1” or greater configurations, including components like reducers and motors. The adoption of “4-in-1” or higher integrated systems increased from 16% in the same period of 2024 to 23%.

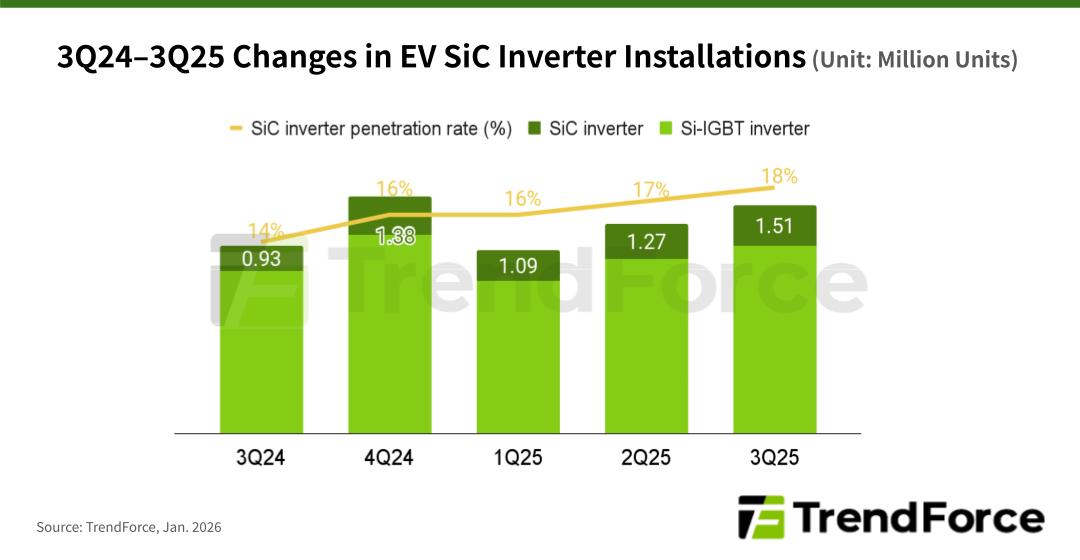

TrendForce highlights that SiC power semiconductors, due to their compact size and higher voltage capacity, are now crucial for advanced electric-drive systems. In 3Q25, worldwide SiC inverter installations reached a record high, surpassing 1.5 million units. The adoption rate in EVs rose from 14% in the same period of 2024 to 18%, and when focusing solely on NEVs, it reached 22%.

A detailed analysis of vehicle models fitted with SiC inverters reveals that 84% of these installations are in BEVs, with the remainder in PHEVs and REEVs. China remains the leading market, accounting for approximately 75% of all SiC inverter installations, whereas demand in Europe and the U.S. is declining. Against a backdrop of geopolitically driven global dynamics, this structural concentration poses a risk that is difficult for IDM suppliers to mitigate or relocate.

While inverter installation volumes keep rising with the overall vehicle market, the total market value in 3Q25 dropped by 10% YoY. This suggests that despite market growth, automakers are exerting greater pricing pressure on the supply chain.

References:

1 EVs encompass HEVs, BEVs, PHEVs, REEVs, and FCVs.

2 NEVs encompass BEVs, PHEVs, REEVs, and FCVs.

For more information on reports and market data from TrendForce’s Department of ICT Applications Research, please click here, or email the Sales Department at TRI_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://www.trendforce.com/news/

Subject

Related Articles

Related Reports