- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

The U.S. government’s approval for Nvidia to export the H200 to China has shifted market expectations. TrendForce highlights that the H200 offers a significant performance boost compared to the H20, making it very attractive to Chinese end users. If sales go well in 2026, China’s CSPs and leading OEMs are likely to acquire chips aggressively.

TrendForce notes that while the H200 lags behind Nvidia’s Blackwell-series GPUs in terms of compute and memory specs, it still surpasses China’s domestically produced AI chips and the H20. Development among Chinese AI chip makers and CSP-designed ASICs continues to be limited by upstream bottlenecks, such as restricted wafer capacity and HBM access, which hinder progress. As such, the H200 is expected to stay in high demand. Still, its final approval depends on how U.S. export regulations are implemented and whether Chinese authorities allow the H200 to launch or impose further restrictions during review.

If this trajectory persists, the U.S. is likely to keep an N-1 or N-2 export gap. This means that while the global market transitions to the B300 series in the second half of 2025 and the Rubin platform in the second half of 2026, China will continue to receive the H200, which is still one generation behind Hopper-based products available elsewhere.

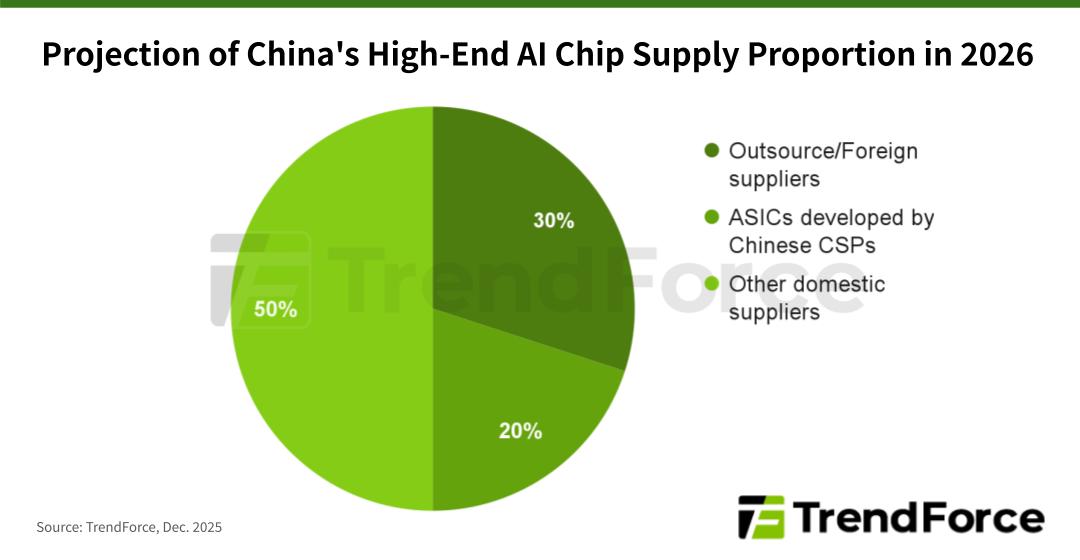

TrendForce predicts that China’s high-end AI chip market will grow by over 60% in 2026. The Chinese government is likely to keep supporting local AI chip independence, helping top IC design companies benefit from government and corporate projects. Consequently, domestic AI chips might increase their market share to about 50%. At the same time, imported products like Nvidia’s H200 and AMD’s MI325 are expected to hold nearly 30% of the market.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports