- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

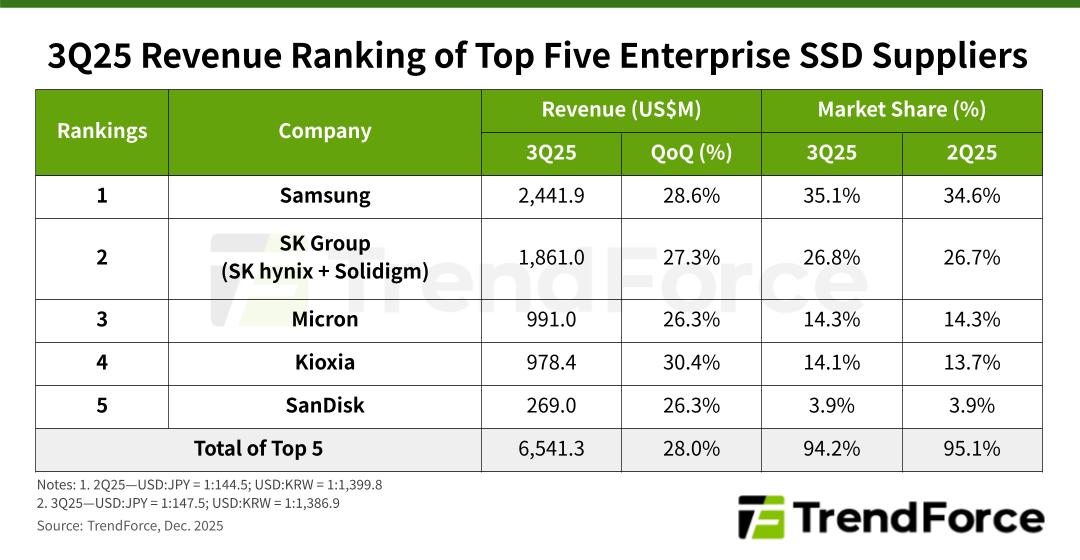

The enterprise SSD market experienced robust growth in the third quarter of 2025. TrendForce’s latest reports reveal that AI demand continued to expand from training to inference tasks. Meanwhile, North American CSPs simultaneously scaled out both AI infrastructure and general-purpose servers. This led to a significant boost in enterprise SSD shipments and prices, resulting in a 28% increase in combined revenue for the top five brands that reached approximately US$6.54 billion and set a new record for the year.

TrendForce observes that in the fourth quarter, market sentiment is shifting from recovery to scrambling for components. Major NAND Flash suppliers are cautious about increasing production due to past volatility, resulting in enterprise SSD output growth significantly lagging demand. CSPs are also actively increasing inventory to prevent SSD shortages that might delay expensive AI server deployments. With the market tilted in favor of sellers, TrendForce predicts that average enterprise SSD contract prices will rise by more than 25% QoQ in Q4, potentially leading to another industry revenue record.

Breaking down the performance of the top suppliers, Samsung, the market leader, capitalized on a rebound in general-purpose server demand. With Intel’s Ice Lake platform still dominant and Samsung offering the industry’s most complete TLC portfolio, the company secured substantial orders for mature-node SSDs. Its Q3 revenue rose 28.6% to approximately $2.44 billion.

SK group (SK hynix + Solidigm) experienced modest growth in high-capacity shipments. However, strong demand from servers for TLC SSDs led to a notable rise in overall volume. The group's revenue grew by 27.3% to roughly $1.86 billion and keeping its second-place position. Meanwhile, Micron continued to enhance its competitiveness in PCIe SSDs, gaining more customer sockets. Its shipments throughout Q3 increased, leading to a revenue increase of 26.3% to $991 million, securing the third position.

Kioxia experienced the fastest growth among major suppliers, with revenue soaring over 30% to slightly above $978 million. Unlike competitors who mainly focus on finished SSDs, the company adopts a flexible approach by providing enterprise-grade NAND Flash die to CSPs that develop their own SSDs. This strategy underscores its importance as a key die supplier.

SanDisk reported a Q3 revenue of $269 million. As it increases production of its 218-layer products and demand for QLC rises, the company is projected to experience more robust growth than its competitors next year.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports