- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

TrendForce’s latest research indicates that the smartphone market entered its peak season in the second half of the year, with new product launches further boosting output. In 3Q25, global smartphone production hit 328 million units, representing a 9% QoQ growth and a 7% YoY rise. These numbers highlight a distinct seasonal uptick.

TrendForce notes that demand in the fourth quarter will be supported by the release of new flagship models and extensive inventory buildup for global e-commerce sales. Nevertheless, constrained memory supply and increasing prices are likely to reduce profit margins, particularly for entry-level devices, potentially limiting expected growth. At present, TrendForce predicts a 1.6% YoY increase in production for 2025, but cautions that ongoing memory supply issues could lead to a further downward revision.

In 2025, China experienced a significant boost from subsidy programs in the first quarter, but their impact has gradually weakened. Full-year sales are projected to grow 2%, maintaining China's position as the largest smartphone market globally with a 23% share. India follows with a 13% share, supported by recovering demand and an expected 2% annual growth.

North America, the third-largest market, initially stocked up inventory in the first half due to tariff concerns; however, demand has softened since then, and full-year sales are projected to fall by 1%, accounting for an 11% market share.

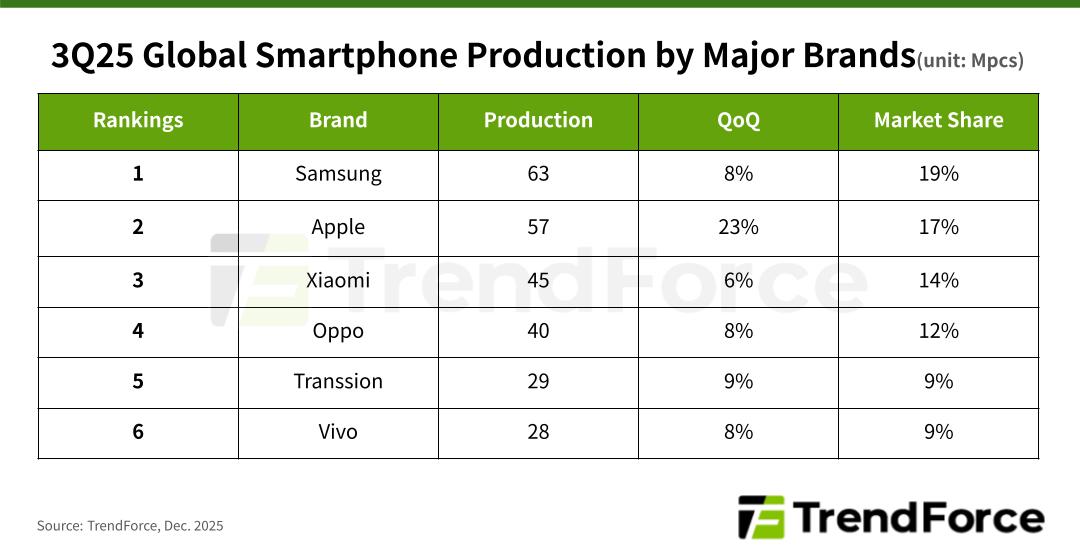

Samsung produced nearly 63 million units in the third quarter, an 8% increase QoQ, maintaining its leading position with a 19% market share. The Galaxy A series continued to boost volume, and the updated foldable lineup received positive market response, supporting high-end sales.

Apple closely followed with 57 million units—its highest third-quarter production ever. Its tactic of keeping the iPhone 17 base models’ prices the same while increasing storage was successful. Additionally, improved design differentiation in the Pro series helped maintain strong sales momentum.

Xiaomi (including Redmi and POCO) took third place with nearly 45 million units produced, a 6% QoQ growth, supported by new model launches and holiday stocking. OPPO (including OnePlus and Realme) ranked fourth with around 40 million units, an 8% growth supported by recovering sales in India, Southeast Asia, and Latin America.

Transsion (TECNO, Infinix, itel) experienced robust demand in emerging markets across Africa and Asia, manufacturing over 29 million units—a 9% increase QoQ—and ranking fifth. Vivo (including iQOO) closely followed, with its market share less than 0.5 percentage points below Transsion. The strong sales of mid-to-high-end models from the iQOO series and active stocking during the festival season have boosted its third-quarter production by over 8%, reaching approximately 28 million units.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports