- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

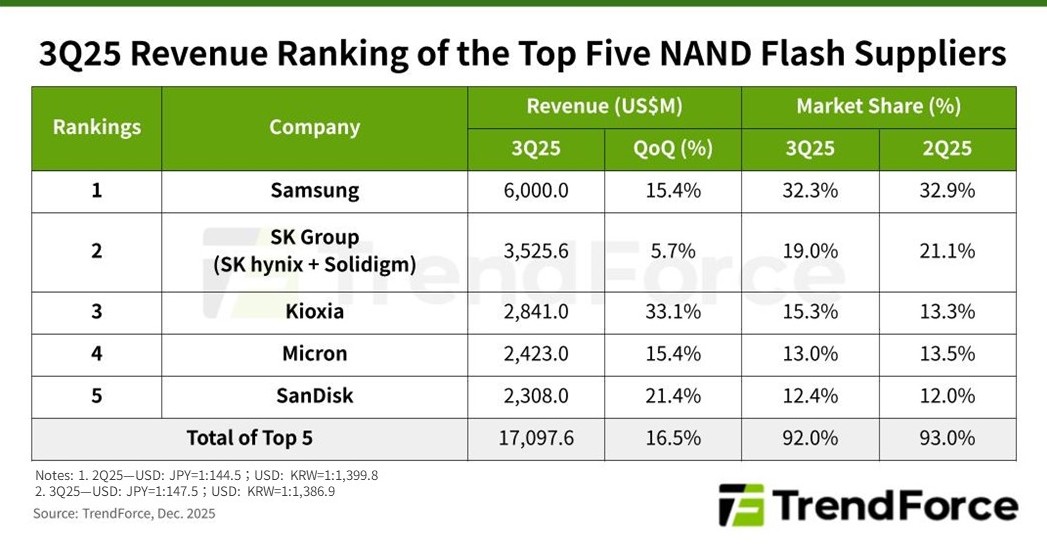

TrendForce’s recent research indicates that the ongoing expansion of AI infrastructure by CSPs fueled strong demand for enterprise SSDs in 3Q25. As a result, the combined revenue of the top five NAND Flash vendors grew by 16.5% QoQ, approaching US$17.1 billion. The production cuts enacted earlier in the year are now impacting the market, helping to balance supply and demand in the latter half. Additionally, the rising proportion of enterprise SSD shipments contributed to increased ASPs among suppliers.

A forecast for 4Q25 indicates that demand driven by AI for high-performance TLC and QLC enterprise SSDs will keep growing. However, as suppliers’ inventories normalize and node migrations cause typical yield-related losses, the growth in shipments will be more restrained. Ongoing shortages in HDD supply will continue to push NAND Flash prices upward. TrendForce predicts total NAND Flash prices will rise by 20–25%, further boosting quarterly revenue.

Over the third quarter of 2025, Samsung retained the top position with $6 billion in revenue, up 15.4% QoQ. Despite facing intensified competition from local brands in China for mobile NAND, its enterprise SSD shipments remained robust, securing a 32.3% market share.

SK Group (SK hynix + Solidigm) ranked second at around $3.53 billion, an increase of 5.7% QoQ. Subsidiary Solidigm continued to benefit from rising demand for QLC enterprise SSDs used in generative AI workloads, which played a major role in boosting the group's revenue.

Kioxia delivered the best performance among all suppliers. Boosted by demand from AI servers, seasonal smartphone inventory buildup, and its continued shift to BiCS8 technology, its bit shipments increased significantly—propelling revenue up 33.1% QoQ to exceed $2.84 billion. The company moved up to third place, increasing its market share by 2 percentage points.

Micron ranked fourth with around $2.42 billion in revenue, a 15.4% QoQ growth, fueled by record-high data center SSD shipments. SanDisk finished fifth, with cloud and edge-computing applications boosting revenue to nearly $2.31 billion, marking a 21.4% QoQ growth.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports