- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

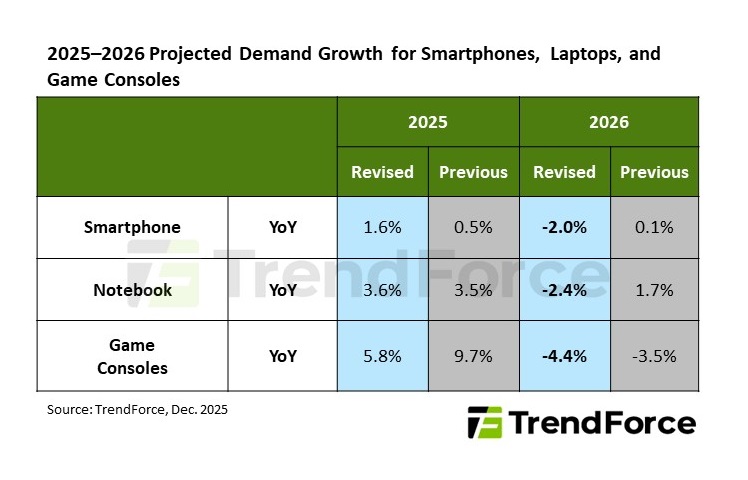

TrendForce’s latest report states that rising memory prices have significantly increased BOM costs in consumer electronics, leading brands to hike retail prices and dampening market demand. After reducing its 2026 shipment forecasts for smartphones and laptops earlier in November, TrendForce has also downgraded its 2026 forecast for game console shipments—from an initial YoY decline of 3.5% to 4.4%.

TrendForce notes that the swift rise in memory prices is affecting a range of consumer devices, including game consoles. Historically, game console manufacturers earned the majority of their profits from software and subscription services. As such, they depended significantly on incremental retail price reductions and occasional promotions to expand their user base.

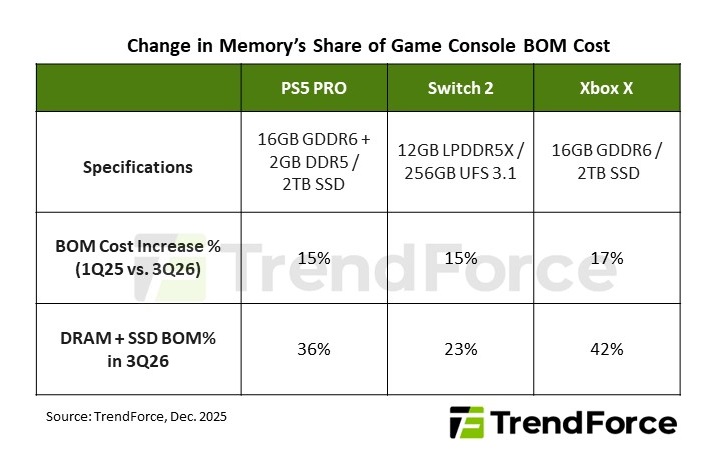

However, this strategy is being disrupted. For instance, the Switch 2's launch price of $450 is higher than its predecessor’s, due to a doubled memory capacity and increased component costs. Memory modules are projected to account for 21–23% of total hardware costs in 2026. This severely reduces profit margins and limits Nintendo's flexibility for future discounts.

Sony and Microsoft anticipate that memory costs will make up over 35% of the total BOM costs by 2026. This trend complicates the traditional mid-cycle price-cut approach, especially years after launch. Some regions might see console prices increase to compensate for rising expenses.

Microsoft, for example, is rumored to be considering another price increase for the Xbox, despite recently adjusting prices in September. Given these circumstances, console manufacturers might need to move away from the industry’s historic “price-for-volume” strategy, adopting more defensive pricing tactics to maintain profitability.

The inability to lower retail prices—or even the need to keep them elevated—will likely weaken promotional efforts in 2026. With the PS5 and Xbox Series now mature, the absence of price incentives could notably reduce consumer demand. While the new Switch 2 benefited from early-cycle momentum, Nintendo has admitted that achieving economies of scale is essential for controlling manufacturing costs, and external market changes could still impact profitability.

Considering the dynamics of all three major console makers, TrendForce now forecasts that the shipments within the global game console market will decline 4.4% YoY in 2026.

TrendForce also highlights how supply and demand fluctuations in key components have previously disrupted console shipments. In 2021, Sony reduced PS5 production from 16 million to 15 million units because of semiconductor shortages. Similarly, Nintendo, affected by the global supply crunch, lowered its Switch sales forecast from 21 million to 19 million in November 2022, and then to 18 million after weaker holiday sales, finishing the fiscal year at 17.97 million units.

Overall, the increase in memory costs is prompting console makers to rethink their usual growth strategies, which could further slow down shipment growth. If supply and demand for memory do not improve next year, global console adoption might stagnate.

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports