Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Korea, U.S. DRAM Giants Reportedly Halt Pricing for a Week, Memory Module Makers Follow

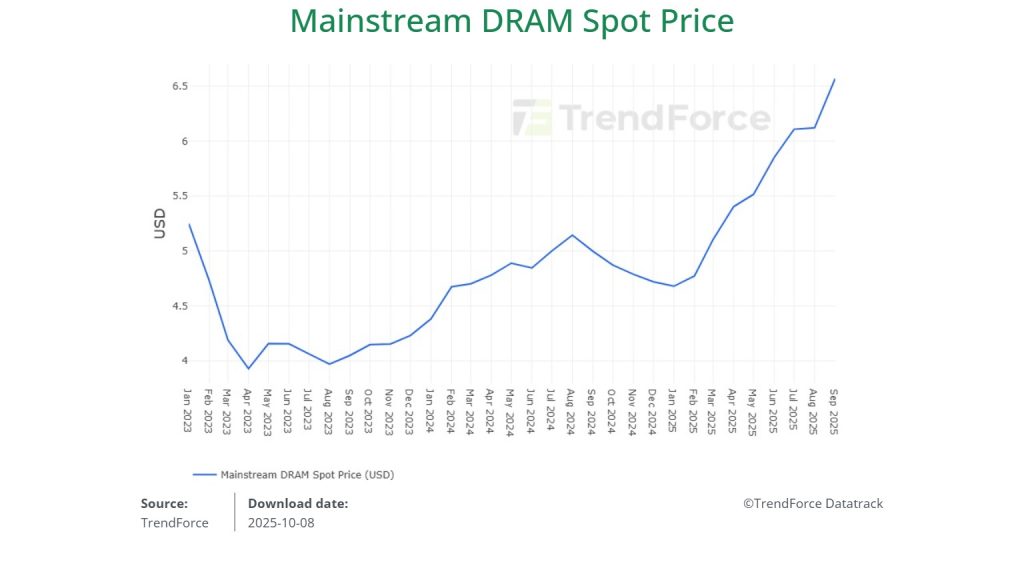

The DRAM price surge shows no sign of cooling off. According to the Commercial Times, Korean and U.S. chipmakers have suspended new enterprise quotes for a week, hinting at an even steeper climb ahead as supply remains constrained. Citing supply chain sources, the report notes that DDR4 contract prices may rise more than 30% in Q4, with certain models soaring over 50%, likely driving DDR3 upward as well.

Notably, the Economic Daily News reports that the rally has now spilled over to memory modules, with Taiwan’s ADATA and Team Group both suspending price quotes — the first such move since 2017, underscoring a severe supply-demand imbalance.

DDR4 Shortages Drive Price Rally Through Q1 2026

As per Commercial Times, the DDR4 supply gap could widen to 10–15% over the next three quarters, with backend packaging and testing bottlenecks adding more pressure.

The Commercial Times report suggests that against this backdrop, major DRAM makers have again halted new quotes, cutting their validity from a full quarter to under a month, with some now adjusting every few weeks. It adds that leading Korean and U.S. suppliers are pausing quotes for about a week to gauge buyer reactions before reopening bids — a move that further highlights the market’s tightening supply.

Industry veterans cited by the report further note this is no longer a partial hike but a broad-based shortage driving across-the-board price adjustments, with DDR4 contract prices expected to rise most actively from Q4 2025 through Q1 2026, climbing another 30–50% during that period.

Legacy Memory and NAND Flash Faces Structural Shortages

Commercial Times reports that NOR Flash prices are set to rise another 5–10% in Q4, fueled by strong IoT and wearable device demand. On the NAND side, SanDisk is reportedly in capacity talks with Taiwan’s PSMC, highlighting a tightening supply environment.

Meanwhile, as Samsung, SK hynix, and Micron continue shifting production toward HBM, the market is now confronting structural shortages in legacy DRAM (DDR4 and DDR3) and NOR Flash, the report adds.

Memory Module Makers Join the Rally

The Economic Daily News notes that ADATA, the world’s second-largest memory module maker, and Team Group, Taiwan’s No. 2, have both suspended price quotes.

Citing ADATA Chairman Simon Chen on Oct 7, the report adds that this quarter could mark the start of a major memory bull run — and the onset of a severe shortage, with the industry poised for a boom through 2026. It notes that ADATA confirmed it will extend the suspension through mid-October, citing severe DRAM shortages and the need to manage inventory and adjust allocation strategies.

On the other hand, the Economic Daily News reports that Team Group halted price quotes ahead of the Western consumer electronics peak season, citing limited upstream DRAM supply and rapid inventory depletion.

Industry insiders cited by the report highlight two main effects of quote suspensions. First, they reinforce expectations of further price hikes, prompting clients to pull orders forward or even panic buy, which pushes prices higher. Second, they help control shipment pacing: a halt in quoting doesn’t stop deliveries, but creates a temporary “price blackout”, delaying transactions while awaiting better pricing conditions.

Read more

- [News] Taiwan DRAM Makers Reportedly Eye 20-50% Q4 Contract Price Hikes amid DDR4 Supply Squeeze

- [News] Samsung, SK hynix Reportedly Delay Phase-out to 2026 as DDR4 Becomes Unexpected Cash Cow

- DDR4 and LPDDR4 Supply Tightens Sharply in 2H25 as Structural Shortage Drives Strong Price Surge, Says TrendForce

(Photo credit: SK hynix)