Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

[News] Strengthening Controls on Semiconductor Equipment Exports to China, Japan Reportedly Tightens Export Control Measures Further

Japan is reportedly planning to expand export restrictions on four technologies related to semiconductors or quantum computing, as per a report from Bloomberg. This move is said to represent the latest initiative in global efforts to control the transfer of strategic technologies.

The same report indicates that Japan’s new measures will affect the export of scanning electron microscopes used for analyzing nano-particle images, as well as the technology for improving semiconductor design known as Fully Depleted Silicon on Insulator (FD-SOI) technology. Japan will also require licenses for the low-temperature CMOS circuits used in quantum computers, as well as for the outputs of quantum computers themselves. These restrictions apply to Japan’s most significant trading partners, including South Korea, Singapore, and Taiwan.

The Japanese Ministry of Economy, Trade, and Industry recently stated that the purpose of this plan is to better regulate the export of components for military purposes and to align with similar initiatives around the world. Reportedly, the Ministry emphasized that after public consultations ending on May 25th, while this plan is expected to take effect as early as July.

In fact, in 2023, Japan expanded export restrictions on 23 types of cutting-edge semiconductor manufacturing technologies. The implementation of these controls followed after the United States restricted China’s access to crucial semiconductor fabrication technologies. At that time, reportedly, Washington officials lobbied international partners such as Japan and the Netherlands to impose trade sanctions on China, aligning with the U.S. view of China as a geopolitical and potential military competitor.

Export controls chief Alan Estevez, as reported by Reuters during an annual conference, emphasized the importance of discussions with allies regarding key component servicing. He mentioned ongoing efforts to assess which components require servicing, hinting at the US’s reluctance to impose restrictions on non-core components that Chinese firms can repair independently.

Since then, the US has reportedly been urging allies such as the Netherlands, Germany, South Korea, and Japan, urging them to further tighten restrictions on China’s access to advanced chip technology.

According to a previous report from Nikkei News, the U.S. government initiated semiconductor export controls in various fields, including manufacturing equipment, in October 2022. This decision stems from the belief that semiconductors, which play a crucial role in new-generation technologies such as AI and autonomous driving, are strategic commodities directly related to national power.

Consequently, the U.S. government requested further cooperation from Japan and the Netherlands, leading to both countries strengthening their controls in 2023. However, despite these measures, exports of related products, excluding those under control, to China are sharply increasing. Therefore, the U.S. government believes it is necessary to urge Japan and the Netherlands, which have advantages in semiconductor manufacturing equipment, to take further actions.

Currently, manufacturing equipment required for advanced semiconductors with range of 10 to 14 nanometers and below are subject to export control restrictions. The United States is pushing to expand regulations to include certain equipment for what are known as general-purpose semiconductors.

This request is believed to potentially encompass exposure equipment used on silicon wafers, as well as etching equipment for three-dimensional stacking in. Among Japanese companies, Nikon and Tokyo Electron possess advanced capabilities in this field.

The same report from Nikkei News further notes that the restrictions also extend to materials related to Shin-Etsu Chemical Industries, such as photosensitive materials, and demand restrictions on exports to China. Additionally, the United States is preparing to request that the Netherlands cease providing maintenance and services for manufacturing equipment sold to China before the 2023 regulations. The strengthened control will also have a certain impact on allied countries.

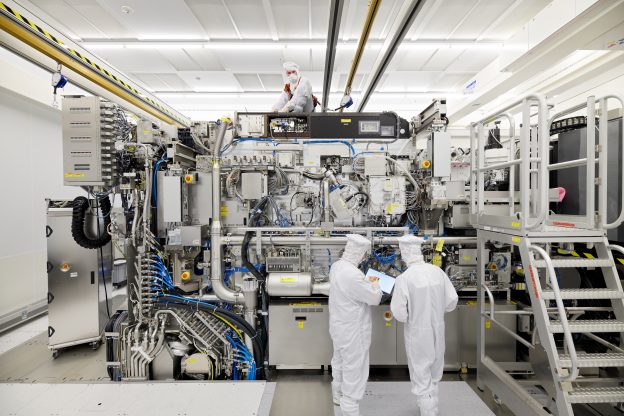

Currently, Dutch company ASML is believed to still be providing such services to Chinese buyers. Per ASML’s financial report, during Q1, machine revenue from the Chinese market increased significantly from the previous quarter’s 39% to 49%.

Read more

- [News] US Reportedly Targets Key Chip Manufacturing Equipment, Urges Allies to Tighten Maintenance Services

- [News] US Considers Sanctioning Huawei-Linked Chinese Chip Network, Huawei-Related Enterprises Blacklisted

(Photo credit: ASML)

Please note that this article cites information from Bloomberg, Reuters and Nikkei News.

Subject

Related Articles

Recent Posts

- [News] Strengthening Controls on Semiconductor Equipment Exports to China, Japan Reportedly Tightens Export Control Measures Further

- [News] Overseas Expansion of Testing and Packaging Facilities – Japan, Malaysia, and Singapore Emerge as Top Choices

- [News] Following TSMC, ASE Reportedly Plans to Establish Plant in Kumamoto

- [News] Battle of the Titans in the Angstrom Era – TSMC’s A16 Competes with Intel’s 14A and Samsung’s SF1.4

- [News] Memory Giant WD out of the Red in 1Q24 Driven by the AI Wave, 2Q24 to Keep Improving

Recent Comments

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED

- LED Backlight

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 未分類