- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

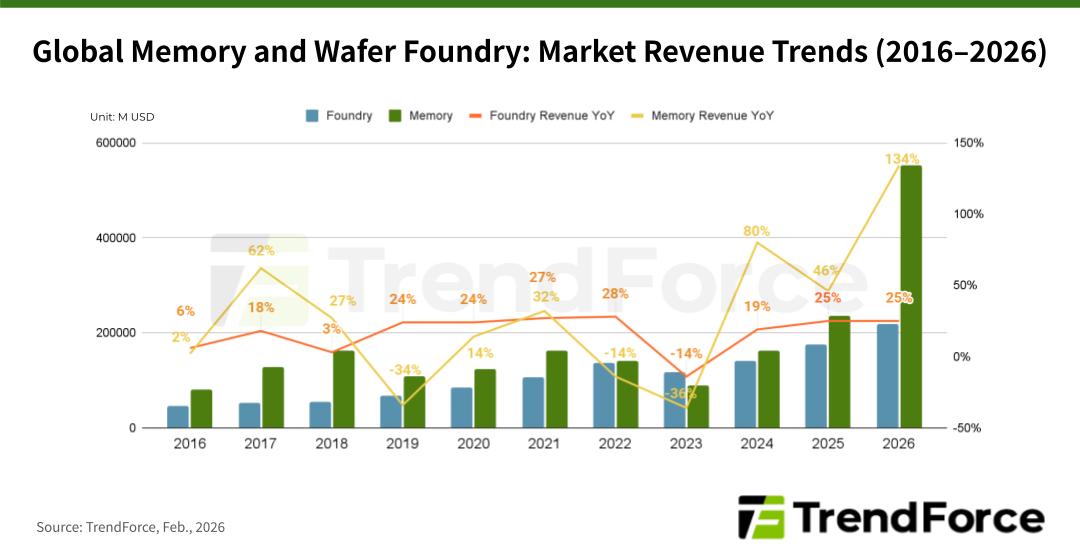

The current AI surge is anticipated to boost both the memory and wafer foundry sectors to record-breaking revenues by 2026, based on TrendForce’s recent data. Limited supply and rapidly increasing prices are likely to grow the memory market's total worth to $551.6 billion. Meanwhile, the global foundry market is also expected to reach a new peak of $218.7 billion, but the memory industry's scale will have more than doubled that of wafer foundries.

A new memory supercycle: Demand resilience and pricing power far stronger than in 2017

The previous memory supercycle from 2017 to 2019 was primarily driven by cloud data center expansions and resulted in a significant gap between memory and foundry revenues.

This time, the AI-driven cycle is even more supply-constrained and structurally tighter. There's a greater focus on real-time responsiveness and efficient data access as the AI industry shifts from model training to large-scale inference, which sustains growth in server-side demand for high-capacity, high-bandwidth DRAM, with per-server memory configurations also increasing.

Furthermore, NVIDIA’s promotion of its Vera Rubin platform has boosted the demand for high-performance storage, emphasizing the need for enterprise SSDs. To optimize token-generation performance while maintaining cost efficiency, operators will increasingly use high-capacity QLC SSDs to meet large data access demands.

Another key difference from past cycles lies in the buyer profile. Rather than being led primarily by end-device manufacturers, the current wave is driven by CSPs. CSP procurement volumes are growing exponentially, and their relatively lower sensitivity to pricing has enabled record-high price increases exceeding those seen in the previous supercycle.

Foundry growth is more moderate due to capacity structure and pricing mechanisms

Although wafer foundries are gaining from the high demand for AI chips, their revenue growth is generally steadier compared to the memory industry. This difference mainly stems from industry structure and pricing factors.

Advanced-node processes command very high unit prices and have supported industry growth in recent years. However, significant technical barriers and capital intensity have led to a highly concentrated supplier landscape, thereby limiting the pace of capacity expansion. Furthermore, mature nodes still account for roughly 70–80% of total foundry capacity, while advanced nodes represent only about 20–30%. This means, even with premium pricing, advanced processes contribute less to overall revenue.

Additionally, the foundry industry’s reliance on contract-based business and long-term agreements reduces price volatility, resulting in less frequent sharp price swings—whether upward or downward—compared to the memory market.

Memory capacity expansion is more flexible than foundry

The growing revenue disparity between the memory and foundry sectors also stems from differences in how they expand their capacity. A key factor is the level of product standardization: memory makers mainly produce standardized, basic product mixes, while foundries that produce mature-node chips, must accommodate a diverse array of process technologies, from 28 nm to beyond 90 nm.

Another factor is that memory products typically require fewer mask layers than logic chips. Consequently, memory makers can convert capital expenditures into effective output more efficiently than pure-play foundries.

TrendForce observes that, since the AI boom is still gaining momentum and supply shortages are unlikely to be resolved soon, memory suppliers maintain very strong pricing power. With ASPs rising due to ongoing supply-demand gaps, the memory industry's revenue growth is projected to outstrip that of wafer foundries.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports