- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

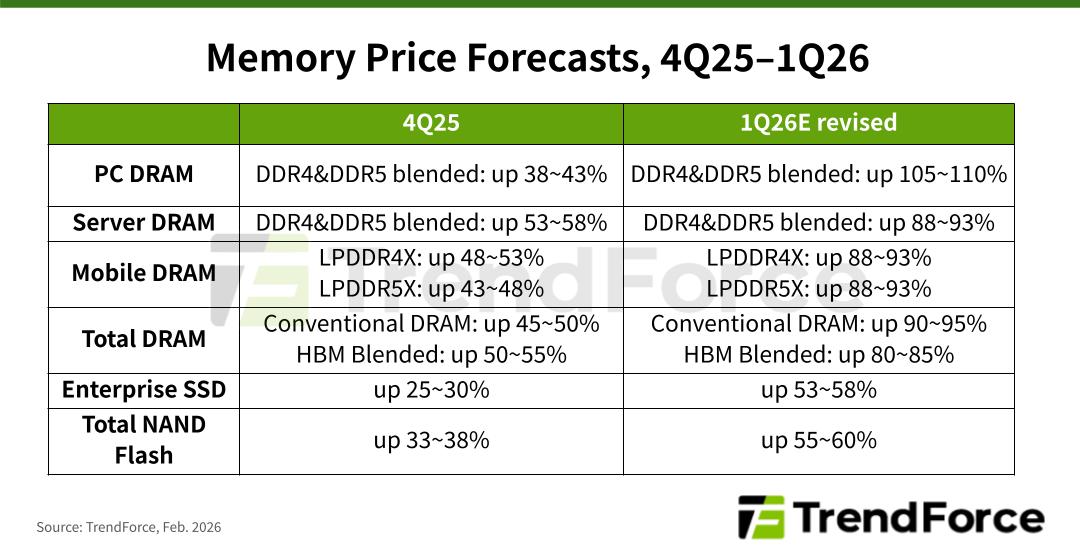

TrendForce’s latest memory industry survey indicates that persistent AI and data center demands in 1Q26 are further worsening the global memory supply and demand imbalance, thereby increasing suppliers’ pricing power. As a result, TrendForce has significantly raised its 1Q26 price forecasts for both DRAM and NAND Flash products. The quarter-over-quarter increase in conventional DRAM contract prices has been revised upward, from a previous estimate of 55–60% to now 90–95%. Similarly, NAND Flash contract prices are now expected to rise from 33–38% to 55–60%. Further upward adjustments may still occur.

TrendForce reports that PC shipments in 4Q25 exceeded expectations, resulting in a widespread shortage of PC DRAM. Even tier-1 PC OEMs with secured allocations from memory suppliers are experiencing declining inventory levels. In a market dominated by sellers, which is driving contract prices higher, PC DRAM prices in 1Q26 are projected to increase by over 100% QoQ, setting a new record for a quarterly surge.

For server DRAM, major CSPs and server OEMs in North America and China have continued to negotiate annual long-term DRAM agreements (LTA) with memory suppliers as of January. Intense competition among buyers for the limited supply is expected to drive server DRAM prices up by around 90% QoQ in 1Q26, marking the largest quarterly increase on record. Suppliers must carefully allocate capacity based on assessments of customers’ actual demand while maintaining balance across strategic accounts.

The widening supply–demand gap in the DRAM market has led end-device segments to compete more aggressively for allocations. Contract prices for LPDDR4X and LPDDR5X are both expected to surge by around 90% QoQ in 1Q26, also representing the steepest increases in their history. Most contracts with U.S.-based smartphone brands were finalized starting late last year, while negotiations with Chinese vendors are anticipated to make significant progress toward the end of February, after completing 4Q25 contracts and the Lunar New Year holiday.

On the NAND Flash side, despite 1Q26 order volumes greatly surpassing suppliers’ production capacity, memory manufacturers remain optimistic about DRAM profitability and are proactively reallocating parts of their production lines to DRAM. This shift further limits the expansion of NAND Flash capacity. Gains in output can be achieved only through incremental process upgrades, making short-term capacity tightness difficult to resolve.

The demand for high-performance storage has far surpassed initial expectations as AI applications driven by inference continue to grow. Since late 2025, leading North American CSPs have been rapidly increasing their procurement, resulting in a surge of enterprise SSD orders. As the supply gap widens and buyers actively stockpile inventory, enterprise SSD prices are expected to rise by 53–58% QoQ in 1Q26, marking a new record for quarterly price increases.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports