- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

TrendForce’s latest investigations indicate that global TV shipments in 3Q25 totaled 49.75 million units, representing a 6% increase QoQ but a 4.9% decrease YoY. This is the first time in history that third-quarter shipments have fallen below 50 million. The decline is attributed to extended TV replacement cycles, increased demand driven by tariff concerns, and the reduced influence of China’s subsidy initiatives.

With key year-end sales events coming up—such as Black Friday and Christmas in Europe and the U.S., along with Double 11/Double 12 in China—brands are gearing up for their last sales push. Global shipments in 4Q25 are expected to increase by 7.3% QoQ to reach 53.21 million units.

The overall effect of tariffs is projected to be minimal this year, despite worries in the U.S. However, as China’s subsidy benefits decline in the second half of 2025, global TV shipments are expected to reach 195.59 million units, reflecting a 1.2% decrease YoY.

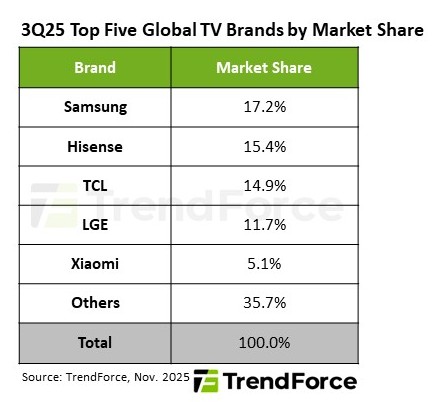

Hisense reclaims the No. 2 spot in 3Q25

In 3Q25, the leading TV brands were Samsung, Hisense, TCL, LGE, and Xiaomi, together holding 64.3% of the market. Hisense shifted from a defensive to an offensive strategy in the second half of 2025, sharply lowering prices both domestically and internationally. This resulted in shipments reaching 7.66 million units, a 9.7% increase QoQ, and allowing it to regain the global No. 2 spot and achieve a record market share of 15.4% for the quarter.

Large-screen TVs gain momentum as 60”+ share surpasses 28% for the first time

The global TV size distribution continues its upward trend, supported by China’s subsidies, with 60“+ models making up 28.2% of shipments in 2025—surpassing 28% for the first time. Market segments by size show: 65"/75”—Samsung led the 65” market with 26% while Hisense took the lead in the 75”segment with 22%; 85/86"—Hisense and TCL each held nearly 25%, driven by subsidy demand; 98"—TCL was the top brand, benefiting from vertical panel integration; 100"—Hisense remained the leader with nearly 50% market share.

Despite a decline in Samsung’s overall TV shipments over recent years, driven by less emphasis on smaller sizes and increased competition from Chinese brands, its standing in the 60”+ segment remains strong with a 22% market share. Interestingly, overall shipments of 65” TVs are roughly 12 percentage points higher than those of 70”+ models in 2025, suggesting that mid-to-premium large-screen TVs continue to be the popular choice.

TrendForce observes that as China’s subsidy increase diminishes, the growth momentum for large-screen TVs is notably weakening. In 2025, shipments of 65” models remained nearly unchanged, while 75” shipments grew by only 13% year-on-year, half of the growth rate seen last year. Sizes like 85/86”, 98”, and 100” are experiencing similar slowdown.

The trend indicates a strategic shift among brands—from expanding in size to focusing on premium quality. The next stage of competition will emphasize increasing product value with advanced features such as RGB Mini LED, high refresh rates, and AI-powered AV integration. These upgrades will influence the differentiation strategy for future TV models.

For more information on reports and market data from TrendForce’s Department of Display Research, please click here, or email the Sales Department at DR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports