- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

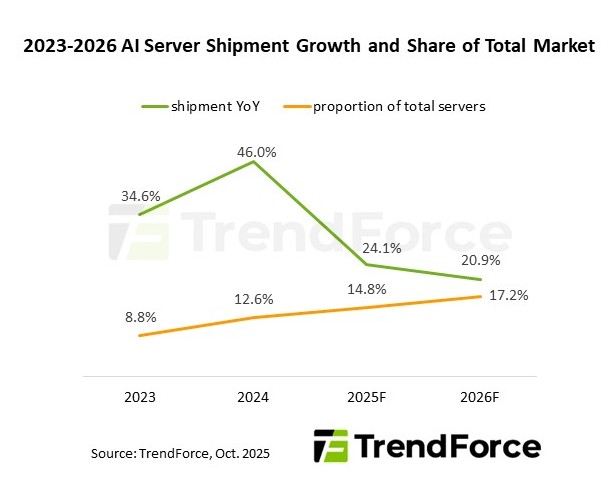

TrendForce’s latest analysis of the AI server market shows that demand from CSPs and sovereign cloud deployments will remain robust through 2026. This momentum will fuel stronger pull-ins for GPUs and ASICs, alongside the rapid expansion of AI inference applications. As a result, global AI server shipments are forecast to grow by more than 20% in 2026, with AI servers accounting for an increased 17% share of overall server shipments.

Looking at 2025 performance, restrictions on NVIDIA’s H20 shipments to China and minor delays in launching GB300 and B300 platforms have led TrendForce to slightly lower its growth forecast to about 24%. The market value is projected to rise substantially, primarily due to the new Blackwell platforms, such as GB200 and GB300 full-rack solutions, which are anticipated to increase AI server revenue by almost 48% in 2025.

In 2026, with GPU vendors pushing integrated rack-level systems and CSPs expanding investments in ASIC-based AI infrastructure, AI server revenue is projected to grow by more than 30% once again, accounting for 74% of the overall server market value.

TrendForce estimates that NVIDIA will maintain approximately 70% of the AI chip market share in 2025. However, as North American CSPs and Chinese companies increase their development and deployment of custom AI ASICs by 2026, ASIC shipments are expected to surpass those of GPUs, leading to a gradual reduction in NVIDIA’s market share.

HBM Consumption Expected to Surge by 70% in 2026

High-end AI chips continue to rely heavily on HBM, while mid-range products primarily use Graphics DRAM. Sustained high demand for GPUs, coupled with rising per-chip HBM capacity as new models launch, is significantly boosting HBM consumption.

AI chip shipments in 2025 alone are projected to boost HBM demand by over 130%. In 2026, HBM usage will keep rising—still surpassing 70% annual growth—driven by wider adoption of B300, GB300, R100/R200, and VR100/VR200 platforms, along with Google TPU and AWS Trainium’s rapid shift to HBM3e.

When it comes to pricing, high demand from NVIDIA and AMD’s HBM3e-based chips, along with increased ASIC adoption of HBM3e, have caused HBM3e prices to rise 5–10% in 2025. However, with Samsung completing HBM3e qualification, the market will move to a three-supplier competitive environment in 2026. This will give buyers more bargaining power, leading to greater downward pressure on contract prices.

HBM4 samples are still progressing through qualification, and ongoing developments are worth watching as customers start stockpiling. TrendForce predicts that in 2026, HBM4 prices will remain much higher than HBM3e prices, allowing manufacturers to enjoy better profit margins. However, if all three main memory suppliers complete qualification next year, it is very likely that buyer–seller price negotiations will resume.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports