- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

Solid-state batteries, hailed as the “dream battery” for their combination of high energy density and superior safety, are rapidly transitioning from concept to commercial reality thanks to recent technological breakthroughs and industrial progress. TrendForce reports that nearly 100 companies worldwide are racing to commercialize solid-state batteries, with the majority focusing on sulfide-based solid electrolytes.

Automakers including Toyota, Mercedes-Benz, BMW, Chery, and Stellantis have already begun vehicle integration testing of solid-state batteries. With strong backing from industry and capital markets, key regions such as Japan, South Korea, and China are accelerating the development of solid-state battery supply chains, investing in upstream and downstream capacity.

Currently, planned global production has surpassed 100 GWh, with some facilities—particularly for semi-solid-state batteries—already operational. All-solid-state batteries (ASSBs) have entered pilot runs at the hundreds of MWh level, suggesting that the years leading up to 2030 will be critical for large-scale commercialization.

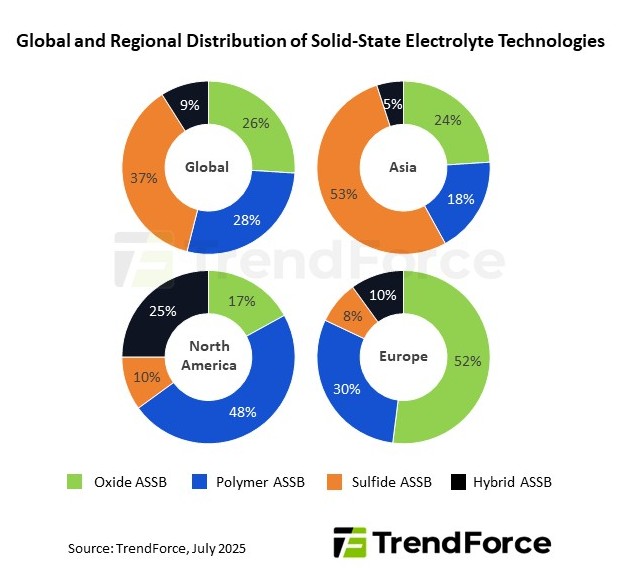

TrendForce data shows that over half of Asian companies developing solid-state batteries are opting for sulfide-based electrolyte solutions. Industry leaders such as Toyota, Honda, Samsung SDI, LGES, SK On, CATL, BYD, and Gotion have all prioritized this route. Meanwhile, North American and European startups, including QuantumScape, Solid Power, Factorial Energy, Ilika, Adden Energy, and Basequevolt, most of them tend to favor polymer- and oxide-based electrolytes.

TrendForce notes that sulfide-based electrolytes offer high ionic conductivity and are relatively easy to process, making them a strong contender for mainstream adoption. However, their poor air stability and tendency to release toxic hydrogen sulfide gas upon contact with water pose significant manufacturing challenges and cost barriers.

Additionally, the high patent barriers in this domain lead many cash-strapped startups to favor polymer or oxide alternatives. In contrast, established companies are able to invest in multiple technological routes, with a strategic focus on the high-performance potential of sulfide-based solutions.

Over the end of the decade, the solid-state battery industry has aimed to transform technical feasibility into commercial viability. China has taken the lead in commercializing semi-solid-state batteries using oxide and polymer electrolytes, achieving GWh-level deployment in EVs and energy storage systems, with energy densities reaching up to 300–360 Wh/kg.

All-solid-state batteries have yet to enter mass production due to technological complexity, high manufacturing costs, and immature supply chains. However, companies such as Toyota, Honda, Samsung SDI, CATL, and BYD have already expanded their R&D efforts to pilot-scale production, with plans to bring ASSBs with energy densities above 400 Wh/kg into use by around 2027.

For more information on reports and market data from TrendForce’s Department of Green Energy Research, please click here, or email the Sales Department at GER_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://www.trendforce.com/news/