Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Trump’s 100% Chip Tariff Impact: TSMC, GlobalWafers Protected While UMC & Others at Risk

Just ahead of the reciprocal tariffs taking effect on August 7, U.S. President Trump announced plans to slap a 100% tariff on imported chips. According to Politico, the U.S. imported over $60 billion worth of chips in 2024, with Taiwan emerging as the top supplier at roughly $12 billion. As a result, the impact of the chip tariff on the island is drawing close attention.

As Reuters highlights, Trump’s tariff plan comes with a major caveat: it exempts companies already manufacturing in the U.S. or committed to doing so. That puts Taiwanese foundry giant TSMC in a strong position. With its $165 billion U.S. investment, TSMC is expected to largely dodge the blow—shielding key clients like NVIDIA from higher tariffs on chips made in America, the report notes.

Key details of the proposed 100% chip tariff remain unclear, but what does this mean for major Taiwanese semiconductor firms? Here’s a quick look.

GlobalWafers, ASE Poised for Tariff Relief

As TrendForce observes, U.S. semiconductor imports primarily consist of modular components and assembled devices, which is a category not explicitly addressed in the current administration’s trade policies.

For foundries, the most significant impact is expected to come from tariffs on imported capital equipment and materials. However, companies with established manufacturing operations in the U.S., such as TSMC and its key suppliers, are likely to face minimal disruption, as per TrendForce.

Thus, Commercial Times notes that besides TSMC, GlobalWafers—with its 12-inch silicon wafer plant in Texas—is also likely to be exempted. Apple recently announced its partnership with GlobalWafers America in Sherman, Texas, to supply advanced wafers for U.S.-based chip fabs. Factories like TSMC in Arizona and Texas Instruments in Sherman will use GWA’s 300mm wafers to produce chips powering iPhones and iPads sold both in the U.S. and worldwide.

On the other hand, the report also names ASE, the world’s top chip packaging and testing provider, as a likely beneficiary. As MoneyDJ reported in June, the company said they are actively planning a semiconductor testing facility in Arizona to meet NVIDIA’s demand, while cautiously evaluating opportunities with other clients.

Challenges Ahead for Mature-Node Foundries

However, foundries focused on mature nodes may face tougher hurdles due to their limited U.S. presence. Taiwan’s second-largest foundry, UMC, is drawing particular attention amid these challenges.

As per Commercial Times, UMC is collaborating with Intel at the Intel Ocotillo Technology Fabrication plant in Arizona to develop and manufacture 12nm FinFET chips, with production expected to start in 2027. However, since this is a partnership rather than a wholly owned new facility built by UMC, whether it qualifies for tariff exemptions remains uncertain and will require further scrutiny, the report adds.

Meanwhile, TSMC affiliate Vanguard International Semiconductor (VIS), as reported by Yahoo! Finance, has previously stated it has no plans to build a U.S. plant. Now, with the new semiconductor tariffs still lacking clear details, the company says it’s too early to gauge the full impact. Vanguard plans to keep evaluating the situation once the regulations are finalized, the report adds.

VIS’s latest overseas expansion would be building a 12-inch wafer fab with NXP in Singapore. The new facility is slated to begin production in 2027, ramping up to a monthly capacity of 55,000 300mm wafers by 2029.

Read more

- [News] U.S. Slaps 20% Tariff on Taiwan: Foundries Unscathed, Downstream Burned—Section 232 Looms

- [News] Trump Reportedly Set to Announce Chip Tariffs Soon – Nearly 20% of Taiwan’s Listed Revenue at Risk

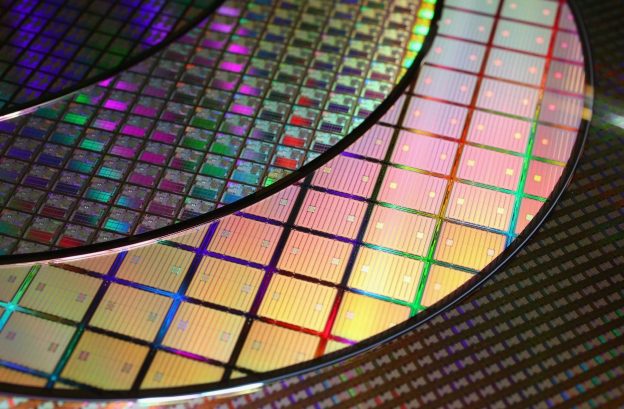

(Photo credit: UMC)