Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

[News] Surge in Chip Manufacturing Equipment Imports from the Netherlands to China, Soaring Tenfold After U.S. Tightens Restrictions

In November 2023, China witnessed a remarkable 1050% surge in the import value of crucial chip manufacturing lithography equipment from the Netherlands, the primary exporter of photolithography equipment, according to the South China Morning Post.

This surge, measured in terms of value, indicates that Chinese semiconductor companies have managed to maintain a channel for ordering advanced equipment despite the tightened export restrictions imposed by the United States

Lithography equipment holds a paramount position among the ten types of equipment essential in the manufacturing process of integrated circuits (ICs).

Reportedly, despite substantial financial investments, China has been acknowledged to lag behind in this technology for many years. Despite allocating significant funds, the country has still struggled to narrow the gap with leading enterprises in this crucial aspect of IC manufacturing.

Meanwhile, in October, the U.S. Department of Commerce expanded its export control regulations on China, with the new provisions taking effect from November 2023.

These regulations specifically restrict the Dutch company ASML from selling certain immersion Deep Ultraviolet (DUV) lithography equipment to Chinese facilities engaged in advanced semiconductor manufacturing. Consequently, China’s import of equipment has seen a consecutive surge for nearly two months.

In November, China imported 16 lithography equipment units from the Netherlands, valued at USD 762.7 Million, marking a tenfold year-on-year increase. By comparison, in October, China imported 21 lithography equipment units valued at USD 672.5 million, with an average price difference of 46% per unit.

In November of this year, China imported a total of 42 lithography equipment, valued at USD 816.8 million, including 15 units from Japan. When combined, the imports from the Netherlands and Japan accounted for almost the entire amount spent by China on lithography equipment in November.

In response to the U.S. restrictions, ASML’s CEO, Peter Wennink, previously stated that these limitations would exclude the vast majority of Chinese customers. This exclusion is due to the fact that these customers are involved in mature or traditional semiconductor manufacturing, specifically in the production of semiconductors at 28nm and above.

Jan-Peter Kleinhans, Senior Researcher and Head of Technology and Geopolitics Projects at the Berlin-based think tank “Stiftung Neue Verantwortung” (New Responsibility Foundation), mentioned that the impact on sales would not be immediate following the new U.S. restrictions.

As per the report from South China Morning Post, this is because ASML has a lead time of approximately 18 months. This implies that the equipment shipped in the fourth quarter of 2023 would have been ordered in the second or third quarter of 2022, and ASML would apply for export licenses at some point thereafter.

Read more

- [News] EUV as a Strategic Asset in the Most Advanced Processes: Progress in Intel/TSMC/Samsung’s Adoptions

- [News] Reports of SMEE Successfully Developing 28nm Lithography Machine, Original Source Deleted Shortly After

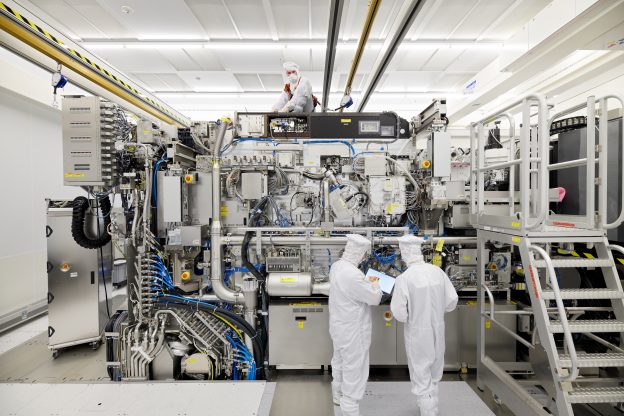

(Photo credit: ASML)

Please note that this article cites information from South China Morning Post

Subject

Related Articles

Recent Posts

- [News] US Allocates USD 39 Billion Subsidy to Semiconductor Industry for Establishing Plants

- [News] SMIC’s Net Profit Halved Last Year, Faces Further Reductions This Year

- [Insights] Memory Spot Price Update: Limited DRAM Quotes, Weak NAND Flash Momentum

- [News] TSMC’s JASM Kumamoto Plant 2 Greenlit, Construction Expected to Commence by Year’s End

- [Insights] EV Development Faces New Challenges, Porsche CFO Suggests Delay in European Ban on New Fuel Cars

Recent Comments

Archives

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED

- LED Backlight

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 未分類