Analysis on Impact of US Tariffs and Export Controls on China’s Semiconductor Industry in 2025

Last Modified

2025-04-30

Update Frequency

Not

Format

Summary

Since Donald Trump's first election as President of the United States, the US has consistently and systematically employed various policy tools to strictly limit China’s access to advanced semiconductor products and related manufacturing technologies. This has created significant obstacles to China's industrial upgrading and its ability to compete in high-end markets. By 2025, the accumulated impact of multiple tariffs has brought this trade competition to a new peak. In response to external pressures, China has adopted a series of policy measures to accelerate its self-reliance process and maintain certain export resilience. This report will examine the complex interactions between the US and Chinese semiconductor industries under continuous US policy pressure, China's coping strategies, and explore the implications of this dynamic for the future of bilateral economic and trade relations.

Table of Contents

1. Severe Changes to Global Semiconductor Structure: Restructuring of Supply Chain under US-China Competitions and Related Policies

(1) Semiconductor: Key Battlefield for Strategic Competitions between the US and China

(2) Full Trade Barriers Imposed by the US on China from Export Controls to Compound Tariffs

(3) US Strengthens Pressure through Institutional Tools

2. Forefront of Technology Battleground: Analysis on Containment Strategies between the US and China, Industrial Tenacity, and Structure Reformation

(1) Comprehensive Lockdown: Systematic Containment of Export Controls on China’s

Semiconductor Technology

(2) Driver of Tariffs: Progress of Localization in China under Actuation of Short-Term Impact

(3) Structural Constraints: The Three Core Bottlenecks That Are Created by US Trade Barriers

and Affect the Growth of China’s Semiconductor Industry

(4) Selective Decoupling: Structural Adjustments and Resilience Amidst the Trade War

3. Responding to External Pressures: Policies, Industry Actions, and Geopolitical Drivers in China’s Semiconductor Self-Sufficiency Strategy

(1) Policy Support: National Funding and Industry Blueprints

(2) Industry-Side Drivers: Acceleration of R&D, Domestic Substitution, and Alternative

Technological Solutions

(3) Geopolitical Leverage: Strategic Use of Key Materials

4. TRI’s View

(1) Reshaping the Landscape Amidst Trade Frictions: Asymmetric Competition Accelerates the

Reorganization of the Supply Chain

(2) Hastening China’s Semiconductor Self-Sufficiency: From Short-Term Breakthroughs to

Long-Term Strategic Planning

<Total Pages:19>

![]()

Category: Semiconductors

Spotlight Report

-

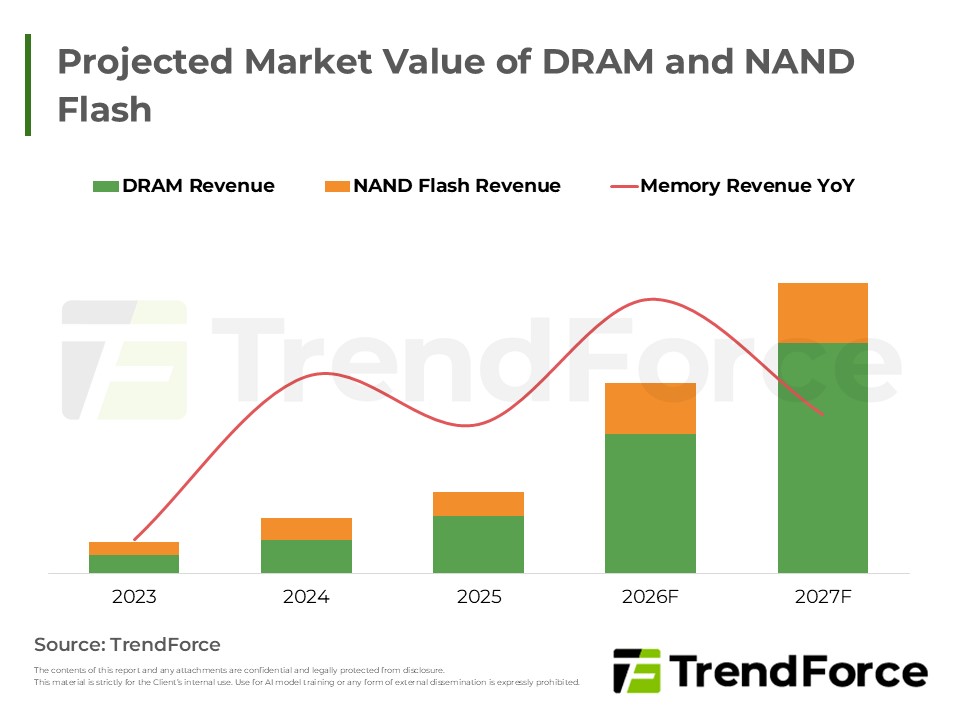

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Selected Topics

PDF

-

DRAM/NAND Flash 2026 Capex: AI-Driven Revisions, Capacity Limited

2025/11/07

Selected Topics

PDF

-

High Server DRAM Demand Drives Expansion by Major Suppliers

2025/11/24

Selected Topics

PDF

-

CSP CapEx Fuels 12.8% Server Growth: 2026 Forecast

2025/12/18

Selected Topics

PDF

-

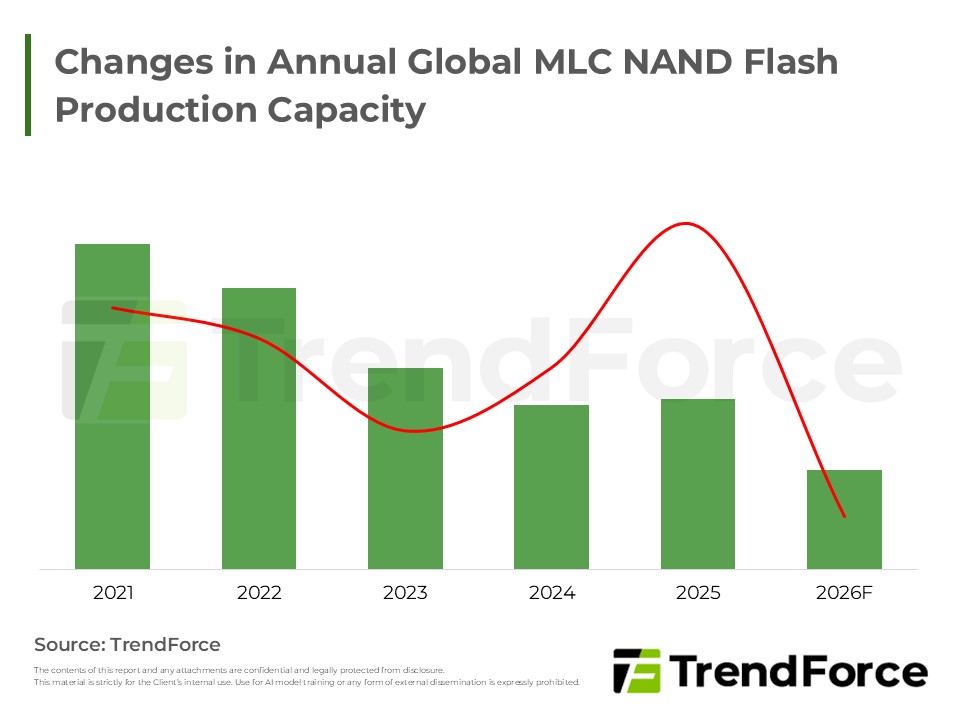

MLC Supply Cliff: Majors Exit & MXIC's Gain

2026/01/06

Selected Topics

PDF

-

Smartphone Production May Drop Over 15%: 2026 Memory Surge Ignites Cost Storm

2026/01/23

Selected Topics

PDF

Selected TopicsRelated Reports

Download Report

USD $2,000

Membership

- Selected Topics

- Selected Topics-0139_Analysis on Impact of US Tariffs and Export Controls on China’s Semiconductor Industry in 2025

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Selected Topics

PDF

-

DRAM/NAND Flash 2026 Capex: AI-Driven Revisions, Capacity Limited

2025/11/07

Selected Topics

PDF

-

High Server DRAM Demand Drives Expansion by Major Suppliers

2025/11/24

Selected Topics

PDF

-

CSP CapEx Fuels 12.8% Server Growth: 2026 Forecast

2025/12/18

Selected Topics

PDF

-

MLC Supply Cliff: Majors Exit & MXIC's Gain

2026/01/06

Selected Topics

PDF

-

Smartphone Production May Drop Over 15%: 2026 Memory Surge Ignites Cost Storm

2026/01/23

Selected Topics

PDF