The Development and Forecast of EV Traction Inverters and Power Semiconductors

Last Modified

2024-12-31

Update Frequency

Not

Format

Summary

In 2024, global sales of EV traction inverters are projected to reach 27 million units, representing an annual growth rate of 14% and highlighting continued market expansion. Technological advancements are bolstering inverter performance, driving the growth of the EV market.

The adoption of 800V high-voltage platforms and SiC technology—known for its high voltage resistance, low energy loss, and superior thermal conductivity—has emerged as a key trend. These technologies are particularly appealing for mid-to-high-end vehicle models due to their high efficiency and voltage tolerance. However, cost constraints remain a barrier to their widespread adoption in entry-level models.

Meanwhile, the integration of multi-in-one electric drive systems is advancing, showing potential for weight reduction and efficiency improvements despite ongoing challenges in reliability and cost control.

Additionally, the development and application of power devices and modules serve as critical pillars for the technological upgrade of traction inverters. Looking ahead, China’s localization strategy for semiconductor production is expected to reshape the global power semiconductor landscape.

Table of Contents

1.2024 Global EV Traction Inverter Market Trends and Forecast

2. Key Trends in EV Traction Inverters

(1) Demand trends across different voltage ranges

(2) Development of multi-in-one electric drive systems

(3) Development of SiC Traction Inverters

(4) China’s localization strategy drives transformation in the traction inverter industry

3. Development Forecast of Power Semiconductors in EV Traction Inverters

(1) Si-IGBT still holds value and will dominate the market in the short term

(2) Capacity expansion can lower SiC costs, but without market growth, it risks becoming

a red ocean industry

(3) International IDMs maintain competitiveness amid the rapid rise of China’s power

semiconductor industry

4.TRI’s View

(1) Driving traction inverter industry transformation: Higher integration and greater efficiency

(2) Localization trends in Chinese EV components to spark synergies in the power semiconductor

industry

(3) Maintaining design flexibility to navigate unpredictable market changes

<Total Pages:11>

Category: Automotive & EV

Spotlight Report

-

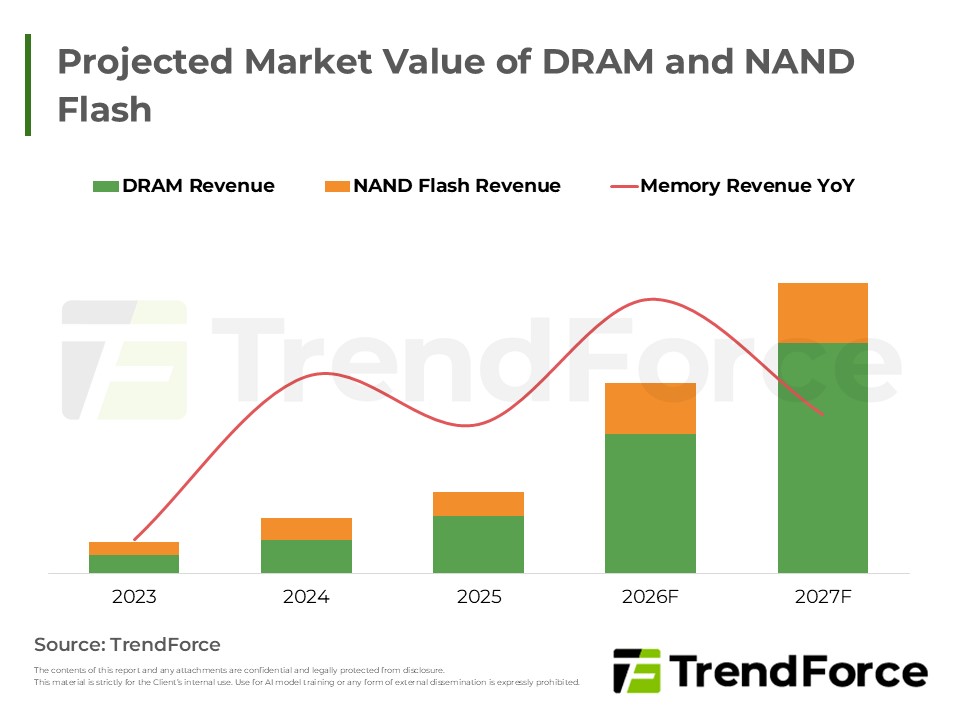

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Selected Topics

PDF

-

High Server DRAM Demand Drives Expansion by Major Suppliers

2025/11/24

Selected Topics

PDF

-

CSP CapEx Fuels 12.8% Server Growth: 2026 Forecast

2025/12/18

Selected Topics

PDF

-

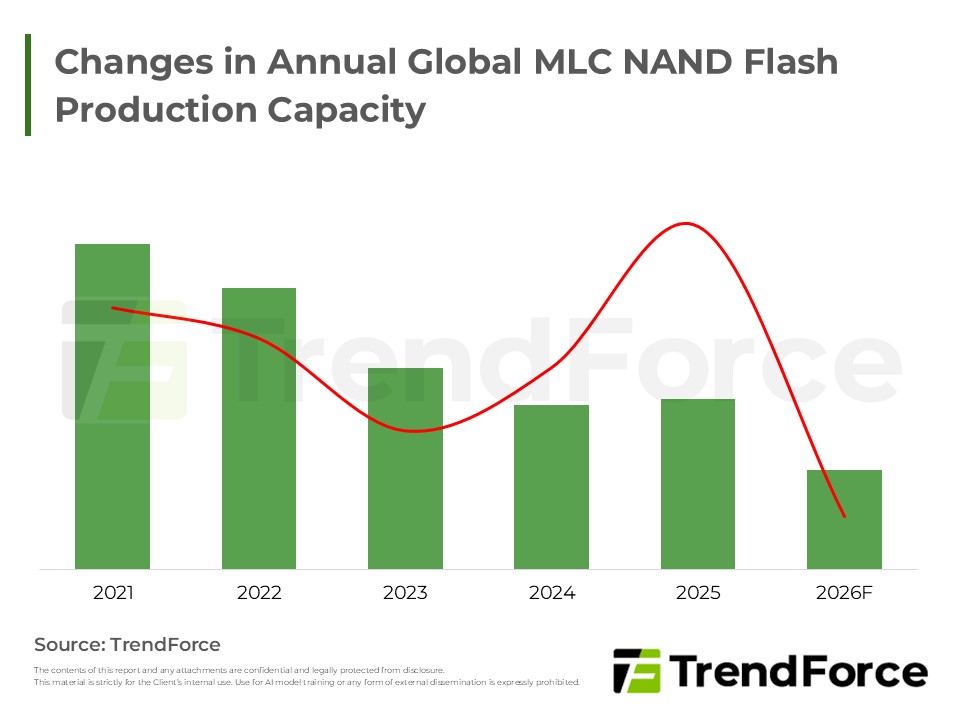

MLC Supply Cliff: Majors Exit & MXIC's Gain

2026/01/06

Selected Topics

PDF

-

Smartphone Production May Drop Over 15%: 2026 Memory Surge Ignites Cost Storm

2026/01/23

Selected Topics

PDF

-

DRAM/NAND Flash 2026 Capex: AI-Driven Revisions, Capacity Limited

2025/11/07

Selected Topics

PDF

Selected TopicsRelated Reports

Download Report

USD $2,000

Membership

- Selected Topics

- Selected Topics-0123_The Development and Forecast of EV Traction Inverters and Power Semiconductors

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Selected Topics

PDF

-

High Server DRAM Demand Drives Expansion by Major Suppliers

2025/11/24

Selected Topics

PDF

-

CSP CapEx Fuels 12.8% Server Growth: 2026 Forecast

2025/12/18

Selected Topics

PDF

-

MLC Supply Cliff: Majors Exit & MXIC's Gain

2026/01/06

Selected Topics

PDF

-

Smartphone Production May Drop Over 15%: 2026 Memory Surge Ignites Cost Storm

2026/01/23

Selected Topics

PDF

-

DRAM/NAND Flash 2026 Capex: AI-Driven Revisions, Capacity Limited

2025/11/07

Selected Topics

PDF