- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

TCL Technology recently announced that its subsidiary TCL CSOT had successfully acquired an 80% equity stake—along with creditor rights—in Prima. This transaction marks TCL CSOT’s formal entry into the LED chip segment. It represents a critical step toward completing a vertically integrated supply chain spanning from LED chips to Mini LED video wall applications.

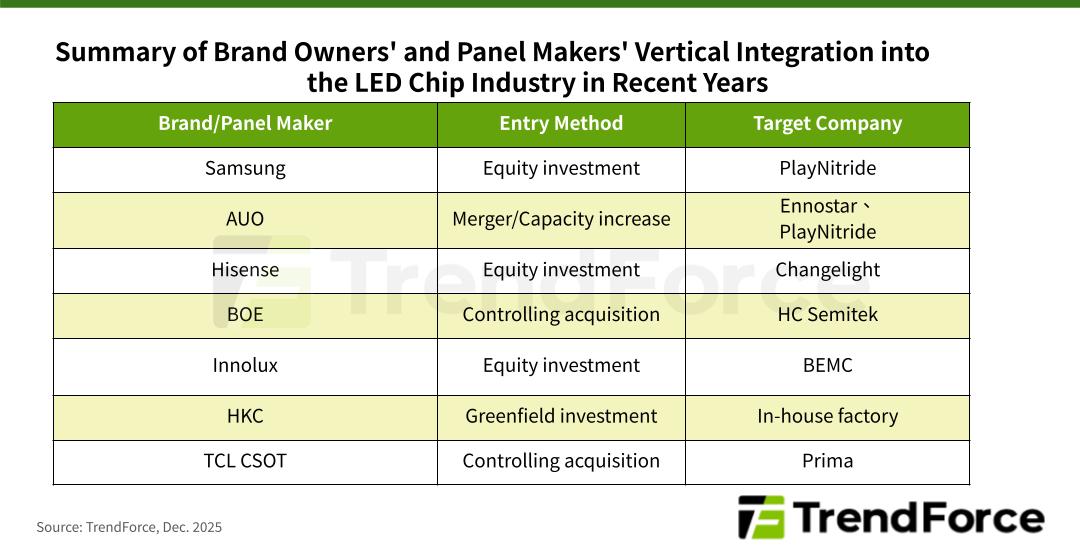

This acquisition underscores the increasing trend of brand owners and panel manufacturers venturing into the upstream LED chip market. Since 2018, companies like Samsung, AUO, Hisense, BOE, Innolux, and HKC have been progressively expanding their involvement in this sector.

TrendForce estimates that the global merchant market value for LED chips (external sales) will reach US$ 2.841 billion in 2025. Prima, ranked ninth by revenue, derives most of its LED chip sales from lighting, backlight, and Mini LED video wall applications.

TrendForce analysis indicates that as brand owners and panel makers advance critical integration in the LED chip industry, coordination costs between chip supply and end-product development are being significantly reduced. A strategy of leveraging economies of scale and closer technological cooperation is likely to speed up the adoption of Micro/Mini LED technologies in both display and non-display sectors, helping to sustain growth in the overall LED chip market.

TCL CSOT’s recent acquisition of an 80% stake in Prime for CNY 490 million (approximately US$ 70 million) highlights the growing trend of brand owners and panel makers extending upstream into LED chip manufacturing. Similar moves have been observed across the industry: Samsung launched Micro LED TV products following its investment in PlayNitride; AUO, after investing in Ennostar and PlayNitride, has entered mass production of Micro LED smartwatches and automotive communication displays; and Hisense introduced TVs featuring RGB Mini LED backlight after acquiring a stake in Changelight.

Meanwhile, BOE introduced glass-based Mini LED video walls after acquiring a controlling stake in HC Semitek, while HKC achieved mass production of Mini LED video walls in 2023. TCL CSOT’s Suzhou Mini LED video wall production line commenced operations in 2025 and currently has a monthly capacity of 6,000 m2. With the added support of Prima’s LED chip capabilities, TCL CSOT is expected to strengthen its product competitiveness and further emerge as a leading player among brand and panel makers.

For more information on reports and market data from TrendForce’s Department of Optoelectronics Research, please click here, or email the Sales Department at OR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://www.trendforce.com/news/

Subject

Related Articles

Related Reports