- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

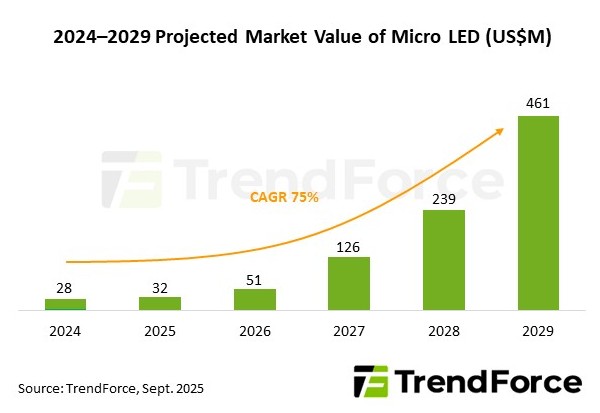

Micro LED penetration in consumer electronics is accelerating. Following Samsung’s launch of its 140-inch Micro LED TV in 2023, Garmin is set to introduce the Fenix 8 Pro smartwatch with Micro LED in 2025, alongside Sony Honda’s planned 30-inch automotive display in its Afeela model at the end of the same year. These milestone products mark Micro LED’s entry into key application segments. TrendForce believes their rollout will gradually boost the Micro LED chip market revenue, which is projected to reach US$461 million by 2029.

The high power consumption and cost of Micro LED remain significant challenges despite these advances, limiting its ability to compete in the short term with more mature and cost-effective OLED technology. Nevertheless, Micro LED offers unique advantages for outdoor sports watches, such as extreme brightness and strong potential for integrating sensors, laying the groundwork for future product innovation and differentiation.

For the Garmin Fenix 8 Pro, AUO plays a central role in the supply chain, supported by PlayNitride (equivalent to ~15 x 30 μm Micro LED chips) and Raydium (Micro LED driver ICs). AUO’s proprietary image calibration technology further enhances the 1.39-inch display. This collaboration illustrates how early investments in the Micro LED ecosystem are beginning to take hold, and as adoption expands, the technology’s maturity and cost competitiveness are expected to advance significantly.

Commercialization of Micro LED is gradually materializing across TVs, smartwatches, and automotive displays, with each flagship launch representing a fresh technological breakthrough. Thanks to its superior brightness and contrast, Micro LED has already been adopted by some next-generation smart glasses startups.

Looking ahead, as global tech giants enter the market and Micro LED light source suppliers push forward, the technology is poised to gain momentum in near-eye displays, further enhancing overall industry value.

For more information on reports and market data from TrendForce’s Department of Optoelectronics Research, please click here, or email the Sales Department at OR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://www.trendforce.com/news/

Subject

Related Articles

Related Reports