- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

TrendForce’s latest investigations indicate that rising demand for satellite constellation deployment, driven by Starlink expansion and the U.S. Space Force’s regular defense satellite launches, has prompted SpaceX to shift its focus from partially reusable rockets to fully reusable systems.

Improvements in rocket recovery technology and new propellants are gradually reducing global commercial launch costs. Consequently, established launch companies like Arianespace, Mitsubishi Heavy Industries, and China Aerospace Science and Technology Corporation (CASC) are more eager to invest in programs that validate first-stage recovery.

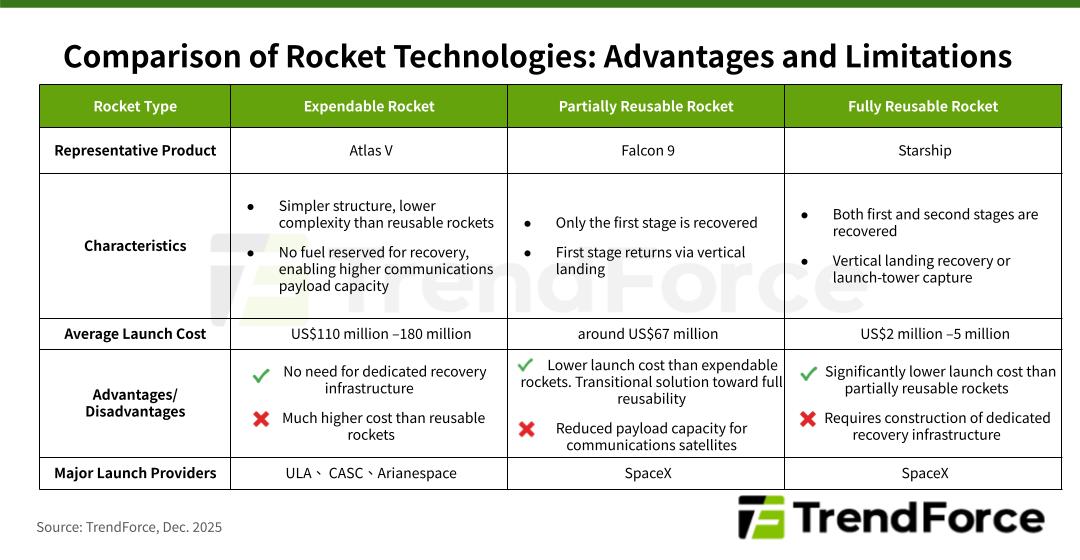

TrendForce reports that the average cost to launch expendable rockets is between US$110 million and US$180 million. In comparison, partially reusable rockets cost around $67 million per launch. Leading international companies are actively developing reusable technologies aiming for full reusability, potentially lowering launch costs to a range of $2 million to $5 million.

SpaceX’s Falcon 9 uses a reusable first stage powered by refined Rocket Propellant-1 (RP-1) kerosene and liquid oxygen (LOX). However, recovering the first stage involves extensive cleaning after each flight to remove carbon buildup, which adds both time and expense. To boost launch frequency, SpaceX transitioned to liquid methane as the fuel for second-stage recovery tests of Starship in October 2025. Methane greatly minimizes residue accumulation compared to kerosene, thereby decreasing cleaning needs and lowering overall launch costs.

While SpaceX dominates large-scale commercial rocket launches in the U.S., China is following a different path. The China National Space Administration (CNSA) has revealed several launch plans using Long March rockets from CASC, mainly to deploy low-Earth-orbit satellites under the G60 program and Earth observation satellites into existing orbits for precise, national-level missions. Additionally, Chinese rocket companies are actively testing reusable launch technologies, especially aiming to enhance vertical landing recovery efficiency.

Although progress has been made, reusable rocket technologies still face limitations. Partially reusable rockets need to keep fuel for recovery, which decreases their payload capacity for communications satellites. Fully reusable rockets, on the other hand, demand more investment in specialized recovery infrastructure. These technical and economic hurdles still need to be overcome.

Taiwanese manufacturers well-positioned to enter space-grade component supply chains

Taiwanese manufacturers possess significant expertise in CNC machining and precision component production. Multiple companies supply aerospace-grade fasteners, like bolts and nuts, to Tier-2 engine producers such as GE Aerospace, Pratt & Whitney, and Safran Group.

Building on this foundation, Taiwanese companies aiming to join the global rocket supply chain need to enhance their capabilities to fulfill space-grade certification standards, while also adapting to the characteristics of rocket components such as small-batch production, high levels of customization, and frequent design modifications.

For more information on reports and market data from TrendForce’s Department of ICT Applications Research, please email the Sales Department at TRI_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://www.trendforce.com/news/

Subject

Related Articles

Related Reports