- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

TrendForce’s latest research indicates that the global client SSD market experienced a price low in 2023, followed by gradual stabilization of supply and demand and a price rebound in 2024. However, retail SSD sales face challenges due to ongoing weak consumer electronics demand and notebook SSD attach rates reaching 100%. This has led to reduced shipments from SSD module makers. Channel SSD shipments for 2024 are projected at 101 million units, reflecting a 14% YoY decrease.

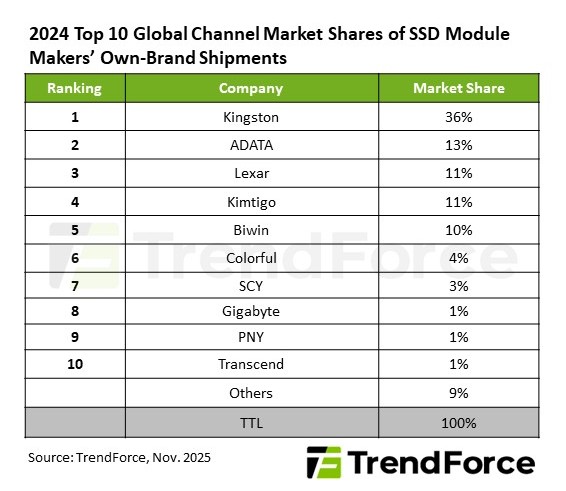

TrendForce has released its 2024 rankings for SSD module makers based on shipment data of their own-brand SSDs in the channel market. The top five companies now control over 80% of the market, signaling ongoing consolidation. Kingston remains the leading brand with a 36% market share, supported by its extensive channel presence and product reliability. ADATA ranks second with 13%, driven by aggressive marketing of gaming and premium consumer products, along with the quick deployment of PCIe 4.0 and 5.0 SSDs.

Lexar took third place with an 11% share, propelled by ongoing growth in China and across global retail channels. Kimtigo and Biwin—ranked fourth and fifth, respectively, by a small margin—both capitalized on strong domestic demand and actively expanded internationally. Colorful held sixth place, sustaining a competitive price-performance edge through its in-house controller and NAND development.

SCY reached the top 10 for the first time, securing the seventh position, thanks to increasing penetration in China’s retail channels. Gigabyte, PNY, and Transcend occupied the eighth to tenth places: Gigabyte continued to benefit from its gaming brand influence, PNY maintained a strong presence across North American and European markets, and Transcend remained concentrated on industrial and professional applications.

TrendForce observes that with the increasing adoption of AI in PCs and edge devices in 2025, the demand for high-capacity, high-performance SSDs will accelerate. SSD module makers that focus on improving technical integration, channel strategies, and brand positioning are likely to be better positioned to succeed in the upcoming growth cycle.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports