Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

Recent Posts

- [News] US Allocates USD 39 Billion Subsidy to Semiconductor Industry for Establishing Plants

- [News] SMIC’s Net Profit Halved Last Year, Faces Further Reductions This Year

- [Insights] Memory Spot Price Update: Limited DRAM Quotes, Weak NAND Flash Momentum

- [News] TSMC’s JASM Kumamoto Plant 2 Greenlit, Construction Expected to Commence by Year’s End

- [Insights] EV Development Faces New Challenges, Porsche CFO Suggests Delay in European Ban on New Fuel Cars

Recent Comments

Archives

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED

- LED Backlight

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 未分類

Meta

ADATA

News

[News] After Memory Price Hike, Shortages Emerge in Some Products?

According to Economic Daily News’ report, after a prolonged period of economy downturn, the market has gradually become optimistic about memories. The effective production reduction by the top five memory manufacturers has led to an increase in memory prices.

This, in turn, has prompted downstream module manufacturers to actively increase their procurement efforts, resulting in shortages of certain products. Industry source indicates that manufacturers, including Samsung and Micron, are expressing intentions to raise prices.

Memory Manufacturers Keen to Raise Prices, Future Demand Monitoring Required

On December 7th, Western Digital had sent out price increase notifications to its customers. In the notification, Western Digital stated that the company would review hard drive product pricing weekly, anticipating a price increase in the first half of the coming year.

Regarding flash memory components, the company expects prices to cyclically increase over the next few quarters, with the cumulative increase likely surpassing 55% of current levels.

It’s worth noting that, at present, many in the industry are optimistic about the cessation and rebound of NAND chip prices. However, currently, suppliers are individually notifying customers of adjusted quotes. In this context, Western Digital has directly issued a price increase notice to customers, with an expected remarkable increase, marking the industry’s first comprehensive significant price hike.

Meanwhile, the latest financial reports of many companies in the memory industry chain show significant improvement compared to the previous period.

Samsung Electronics reported a net profit of KRW 5.5 trillion (approximately USD 4.17 billion) in Q3, transitioning from a loss to profitability. In early November, South Korean media Pulse, citing conversations with numerous insiders in the semiconductor industry, reported that as the Q4 inventory clearance phase nears its conclusion, Samsung is considering a sequential price increase of 20% for Q1 and Q2 of the coming year.

On December 11th, SSD controller chip manufacturer Phison announced its performance report for November, with consolidated revenue reaching NTD 5.407 billion (approximately USD 171.8 million), representing nearly a 5% monthly growth.

According to Phison, the total shipment volume of SSD controller chips continued to recover in November. Among them, the total shipment volume of PCIe SSD controller ICs is expected to grow by nearly 40% year-on-year, setting a new record for the same period in history. This further substantiates the news of a significant surge in the memory market.

In the latest financial report from memory module manufacturer ADATA, the company’s consolidated revenue for October was NTD 3.791 billion (approximately USD 120.4 million), reflecting a monthly increase of 13.43% and a year-on-year increase of 39.59%.

ADATA’s Chairman, Simon Chen, recently mentioned that they anticipate the completion of NAND Flash inventory clearance by the end of this year or the end of January next year. There is an expectation that both DRAM and NAND Flash may face supply shortages next year.

In addition, DRAM manufacturer Nanya Technology observes a price increase in DDR5, while DDR4 prices have stabilized. There is an expectation of a slight improvement in DDR4 and DDR3 prices in the fourth quarter.

NAND Flash spot prices have surged since the end of September, driven by a collective production cut from suppliers. TrendForce analyst Avril Wu recently mentioned that Samsung’s production capacity has reduced by almost half from its peak, indicating that even cost-efficient manufacturers like Samsung can no longer endure losses. It is suggested that the average wafer price has likely passed its lowest point.

From the supply side, recent industry reports indicate that memory manufacturers are employing a “delaying tactic” in the supply of NAND Flash for the fourth quarter. Module manufacturers attempted to finalize orders for millions of chips in September, but memory manufacturers were reluctant to release the products, and even when they were willing, the quantities and prices were unsatisfactory. Meanwhile, Samsung is reportedly pausing quotations and shipments for NAND products.

Looking ahead to the fourth quarter, the estimated average selling price increase for all NAND Flash products is expected to reach 13%, with an overall quarter-over-quarter revenue growth rate of over 20% in the NAND Flash industry.

It is worth noting that according to TrendForce analyst Avril Wu, with demand not showing explosive growth, the market will be focused on three key considerations. First, after production cuts, the decline in memory manufacturers’ inventory levels has begun, but it remains to be seen whether inventory can continue to shift towards buyers.

Second, it is anticipated that memory manufacturers’ production capacity will slowly increase, and if the market warms up, an early resumption of capacity could lead to supply-demand imbalances again. Lastly, whether end-demand can meet expectations for a recovery, with a particular focus on the sustained orders related to AI, will be crucial.

Read more

(Photo credit: Samsung)

Please note that this article cites information from Weibo.

News

[News] Samsung’s Announcement of a 20% Quarterly Price Increase for NAND Signals Promising Industry Trends

As reported by UDN News, Samsung Electronics is making a significant move by increasing the prices of NAND Flash memory by 20% every quarter until the second quarter of 2024. This price surge exceeds industry expectations.

Within the semiconductor industry, Samsung initially raised NAND wafer prices by 10% to 20% this quarter, Pulse reported. Now, the company has decided to continue this trend by progressively increasing prices by 20% during the first and second quarters of the next year. This strategic decision reflects Samsung’s determination to stabilize NAND wafer prices with the aim of reversing the market’s direction in the first half of the upcoming year.

Based on TrendForce’s research in October, with NAND wafer prices leading the increase since August and suppliers adopting a firmer stance in negotiations, Q4 enterprise SSD contract prices are projected to rise by approximately 5~10%. Meanwhile, reduced production of mainstream processes and fewer suppliers for high-end client SSDs have endowed suppliers with better bargaining power. Consequently, both high-end and low-end products are expected to increase concurrently, with 4Q23 PC client SSD contract prices projected to rise by 8~13%.

TrendForce also reports that Q4 contract prices for mobile DRAM are poised to see an increased quarterly rise of 13–18%. But that’s not all—NAND Flash is also joining the party, with contract prices of eMMC and UFS expected to climb by approximately 10–15% in the same quarter. This quarter is set to star mobile DRAM, traditionally the underperformer in profit margins compared to its DRAM counterparts, as it takes the lead in this round of price increases.

TrendForce foresees that memory prices are expected to continue trending upward in 1Q24. The rate of increase will depend on whether suppliers maintain a conservative production strategy and whether there is enough consumer demand to bolster the market.

Samsung’s Strategy on NAND Affect the Market and Company Performance

Following the latest financial report, NAND is a staple memory chip alongside DRAM, and together they account for around half of Samsung Electronics’ memory chip sales. In conjunction with the aggressive price hikes, Samsung is also curbing production to manage market supply effectively, promoting a positive market environment, and enhancing profitability.

At a recent financial conference on October 31st, Kim Jae-jun, Vice President of Samsung Eletronics, publicly stated, “There will be selective production adjustments to normalize inventories in a short time. A supply cut will be larger for NAND flash than for DRAM.”

Financial analysts estimate that as memory production cuts take effect and prices rise, Samsung’s operations will see a significant improvement starting from the fourth quarter of this year.

NAND Industry Foresee Bright Future amid Memory Price Surge

NAND-related businesses in Taiwan are also optimistic about the industry’s future. Khein Seng Pua, CEO of Phison Electronics Corp, indicated that the adjustment of OEM customer inventories, spanning the past six to nine months, is nearly complete. Consequently, Phison has secured more design-in projects, resulting in a gradual increase in wafer demand. Furthermore, Phison’s controller IC products have advanced into a new process generation, leading to a rise in value-added custom development projects.

Simon Chen, Chairman and CEO of ADATA, anticipates a prolonged period of rising memory prices, starting from the fourth quarter of this year and continuing into the first half of the next year. This is expected to create a two-year era of prosperity in the memory market, with supply shortages predicted in the coming years.

Industry experts highlight the reinvigoration of the NAND wafer market, with customers progressively returning. Samsung, being the global memory chip leader, is spearheading the price hikes, thereby contributing to a favorable pricing trend across the overall market.

(Image: Samsung)

Explore more:

Press Releases

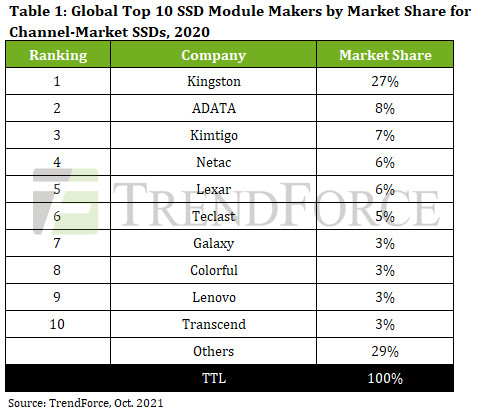

Global Ranking of Top 10 SSD Module Makers for 2020 Shows 15% YoY Drop in Annual Shipment, Says TrendForce

The emergence of the COVID-19 pandemic led to severe delays in manufacturing and logistics. In particular, governments worldwide began implementing border restrictions in 2Q20 to combat the ongoing health crisis, leading to a sudden decline in order volumes for channel-market SSDs, according to TrendForce’s latest investigations. Annual shipment of SSDs to the channel (retail) market reached 111.5 million units in 2020, a 15% YoY decrease. In terms of market share by shipment, Kingston, ADATA, and Kimtigo once again occupied the top three spots, respectively.

Looking at the channel market for SSDs as a whole, NAND Flash suppliers (among which Samsung possessed the largest market share) accounted for around 35% of the total shipments in 2020, while SSD module makers accounted for the other 65%. The top 10 module makers accounted for 71% of channel-market SSD shipments from all SSD module makers. Taken together, these figures show that the market remained relatively oligopolistic in 2020. However, it should be noted that TrendForce’s ranking of SSD module makers for 2020 takes account of only products bound for the channel market and under brands owned by the module makers themselves; NAND Flash suppliers were therefore excluded from the top 10 ranking.

As the pandemic eliminated tier-2 and tier-3 suppliers at an increasingly rapid pace, the collective market share of the top 10 module makers continued to rise

Kingston demonstrated the competitive advantage that it derived from having a global strategy while the pandemic took place. The company saw its market share increase by 1% against market headwinds in 2020 and comfortably took the number one spot among the top 10 SSD module makers. At the same time, Kingston sourced its SSD controller ICs from a diverse group of suppliers in order to avoid potential issues with SSD production due to insufficient foundry capacities. By ensuring a stable supply of controller ICs, Kingston will likely raise its market share even further going forward. On the other hand, ADATA had previously shifted the focus of its R&D and manufacturing operations to SSD products. Not only did ADATA release high-end products ahead of most of its competitors, but it also raised its markets share thanks to the increased demand for its gaming products during the pandemic. ADATA took the second spot on the top 10 list.

Kimtigo, ranked third on the list, shifted its focus to mid-range and high-end products due to their relatively high profitability. Furthermore, Kimtigo successfully expanded its market share both overseas and online, in turn taking the number one position in China. In light of China’s policies prioritizing domestic semiconductor production as well as Kimtigo’s ongoing efforts to cultivate a presence in tier-3 and tier-4 cities in China, the company will likely continue to increase its market share going forward. Netac similarly possessed comprehensive sales networks in China and the overseas markets, in addition to having committed to long-term developments in online sales channels. As the pandemic drove up online sales last year, Netac was able to leapfrog to fourth place in the rankings. Likewise, Lexar saw a slight growth in its market share last year due to not only the comprehensive global sales network it had previously developed, but also its gradually maturing manufacturing operations and aftersales customer services.

The COVID-19 pandemic drove up orders for Teclast’s self-branded notebook computers and displays. As a result, Teclast’s shipment of SSDs last year underwent an increase that in turn led to a corresponding increase in its market share. As for Colorful and Galaxy, the two companies primarily focused on the gaming market. Hence, the increase in demand for gaming consoles and high-end notebooks allowed Colorful and Galaxy to enjoy increased visibility in the SSD market. Lenovo’s shipments fell slightly in 2020 because the other competing brands increased their efforts in developing the overseas markets. As a result, its place in the ranking also dropped from 2019. As the ranking indicates, the competition among brands in the Chinese market remained very intense. There is the possibility that the brands’ positions in the ranking will undergo more reshuffling for 2021.

It should be pointed out that TrendForce has noted the participation of additional brands in the SSD module market in recent years. One such brand is Gigabyte, which has registered remarkable performances. Gigabyte grew its shipment of SSD products by more than 30% YoY in 2020 through leveraging its preexisting reputation in the motherboard and graphics card markets. Although Gigabyte has yet to enter the top 10 list at the moment, it will likely do so within the coming years thanks to its comprehensive global sales network and the growing visibility of its SSD products.

Rise of YMTC strengthens China’s domestic NAND Flash production, and Chinese SSD manufacturers are gradually gaining a brand advantage

As the trend of the localization of semiconductor manufacturing comes to the forefront of the Chinese memory market, YMTC is carrying out a massive capacity expansion plan. In terms of layer technology, YMTC is steadily advancing to 128L and catching up to the major NAND Flash suppliers. Among Chinese SSD brands, Biwin secured financial support from the China IC Industry Investment Fund (the Big Fund) this September; it is now expanding the production capacity of its plant in Huizhou. Besides this, Biwin has also acquired sufficient product development capability to meet clients’ demand for customized products and services. The company is therefore expected to experience a wave of growth in the future.

Turning to Taiwan-based SSD brands, Liteon’s shipments of branded SSDs have slowed down significantly after the company was fully incorporated into Kioxia in July 2020. Due to certain considerations pertaining to the allocation of internal resources, Kioxia will assign the Liteon SSD team to support the development of SSDs for PC OEMs. In the future, Kioxia’s focus will not be on brand development. As for other Taiwan-based SSD brands, they will unlikely return to the top 10 ranking because they have not been able to catch up to the brands based in Mainland China with respect to the economies of scale. TrendForce believes that Taiwan-based brands will continue to be on the decline.

PCIe G4 SSDs become new main offerings, and module makers have adopted QLC solutions

The effects of the COVID-19 pandemic have contributed to a significant increase in the average memory density of SSDs this year. With 512GB becoming the mainstream capacity size, the cost advantage of QLC will become increasingly recognizable. Hence, module makers will be introducing QLC products into their SSD offerings. In the aspect of interface technologies, the proportion of SATA in the retail SSD market has been declining over the years, and module makers are switching to PCIe for their new products. TrendForce’s research finds that PCIe products accounted for almost 30% of retail SSDs shipped in 2020. With shipments of PCIe G4 SSDs expected to grow rapidly in the future, module makers will assign PCIe as the mainstream interface for new products.

Also, an increasing number of Chinese IC design houses are now involved in the development of SSD controller ICs. This, in turn, has led to more PCIe G4 SSD controllers entering mass production. As China pursues the localization of semiconductor manufacturing, module makers will be tested to develop suitable solutions that can maintain growth in the Chinese market.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email Ms. Latte Chung from the Sales Department at lattechung@trendforce.com

Press Releases

DRAM Module Revenue Undergoes 5% YoY Growth for 2020, with Varying Performances Among Suppliers, Says TrendForce

Annual shipment of notebook computers and desktop PCs underwent a massive increase in 2020 thanks to the proliferation of the stay-at-home economy brought about by the COVID-19 pandemic last year, according to TrendForce’s latest investigations. In particular, notebook shipment increased by a staggering 26% YoY, thereby generating a corresponding demand for DRAM chips. Although the movement of DRAM prices remained stable in 2020, there was a palpable growth in actual DRAM bit demand. Hence, global DRAM module revenue increased by about 5% YoY to US$16.9 billion for 2020.

Looking back at the price trend of DRAM modules for 2020, TrendForce indicates that the market adopted a relative conservative outlook going forward in view of the ongoing pandemic. In turn, various end-products differed wildly in their respective market performances as well. For instance, while demand for notebooks remained strong, smartphone demand was relatively bearish. Server shipment, on the other hand, was at the same time consistent yet indicative of uncertainties, to some degree. In light of the varying performances in the end-markets, PC DRAM prices did not undergo drastic fluctuations throughout the year, and DRAM module suppliers posted earnings performances that were a direct result of their sales strategies, with certain suppliers, including Kimtigo and ADATA, able to raise their revenues by a massive margin.

As Kingston once again took pole position, ADATA recaptured the second spot on the top 10 list

Whereas the top five suppliers accounted for nearly 90% of the DRAM module market in terms of sales revenue in 2020, the top 10 suppliers accounted for nearly 95% of the market. In particular, Kingston alone possessed a nearly 80% market share, which represented a minor drop compared to 2019 yet was sufficient for the company to secure the leadership position once again. Kingston turned to a relatively conservative sales strategy last year in response to uncertainties in the pandemic-influenced market and grew its revenue by about 2% YoY for 2020.

As PC DRAM products occupied a relatively large share of ADATA’s products, the rising popularity of WFH and distance learning, along with ADATA’s foray into the gaming segment, propelled the Taiwanese company’s revenue from DRAM module sales to a 47% YoY growth in 2020. On the other hand, Shenzhen-based Kimtigo continued to cultivate its presence in the Chinese market and saw remarkable returns in both commercial and gaming segments. Not only did Kimtigo’s revenue from its DRAM module business experience a 50% YoY growth, the highest among the top 10 suppliers last year, but its ranking also leapfrogged from sixth place in 2019 to fourth place in 2020.

Major Chinese DRAM module supplier Ramaxel fell to the third spot on the top 10 list last year, although it still recorded an 11% YoY revenue growth thanks to an increase in its annual shipment. Conversely, Smart Modular Technologies, which was ranked third in 2019, fell to sixth place in 2020. This decline can be attributed to the fact that Smart primarily sells its products in the US and South American countries such as Brazil – regions which were most heavily affected by the pandemic. As physical storefronts in these regions closed due to local health and safety measures, Smart’s revenue also suffered a 7% YoY decline. Shenzhen-based POWEV posted a 10% YoY increase in its revenue, though it still dropped to fifth place because its competitors registered higher growths.

US-based Patriot Memory joined the top 10 list for the first time ever while Team Group maintained its seventh-place ranking

Team Group performed exceptionally well in spite of the ongoing pandemic by registering a 14% YoY revenue growth. This growth took place on the backs of its continued expansion in the gaming segment and increased promotional efforts. The company’s sales volume and product ASP both experienced considerable growths as a result. Along with achieving excellent online sales performances in recent years, Team Group maintained its seventh place among the top 10. Patriot Memory, a US-based supplier which likewise specializes in the gaming segment, entered the rankings of the top 10 DRAM module suppliers for the first time and immediately took eighth place. The company will likely put up similarly impressive growths going forward.

Ninth-ranked Apacer and tenth-ranked Innodisk focused on the niche industrial automation, automotive, and AIoT markets

Taking the ninth place in 2020, Apacer was able to score a growth of about 10% YoY in its revenue from DRAM modules. The company began gradually shifting its focus to the industrial automation, medical, and automotive segments in order to benefit from supplying specialty products with high gross profits. With PC DRAM products now accounting for less than half of Apacer’s offerings, the company has also been expanding into the gaming market, which is expected to bolster the company’s operations going forward.

Tenth-ranked Innodisk increased its revenue from DRAM modules by nearly 10% in 2020 and maintained a stable profit growth that demonstrated its longstanding competency in the relatively stable industrial automation market with products that have relatively high ASPs. Innodisk has been developing not only medical and AIoT products in response to the COVID-19 pandemic, but also DDR5 DRAM products. Taken together, these efforts represents the company’s commitment to leveraging its existing R&D abilities for emerging commercial opportunities.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email Ms. Latte Chung from the Sales Department at lattechung@trendforce.com

(Cover image source: Unsplash)

- Page 1

- 1 page(s)

- 4 result(s)