Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DDR4/DDR5 Hit Highs, Buyers Hesitant; DDR3 Sees Uptick

According to TrendForce’s latest memory spot price trend report, regarding DRAM, rising DDR4/DDR5 prices and challenges in passing on costs have stalled factory procurement, leaving spot market transactions stagnant, yet quotations stay elevated amid ongoing supply shortages. Meanwhile, in NAND, spot prices have been rising, though some buyers are hesitant amid high prices, weak consumer demand, and uncertainty over fab utilization during the upcoming Chinese New Year. Details are as follows:

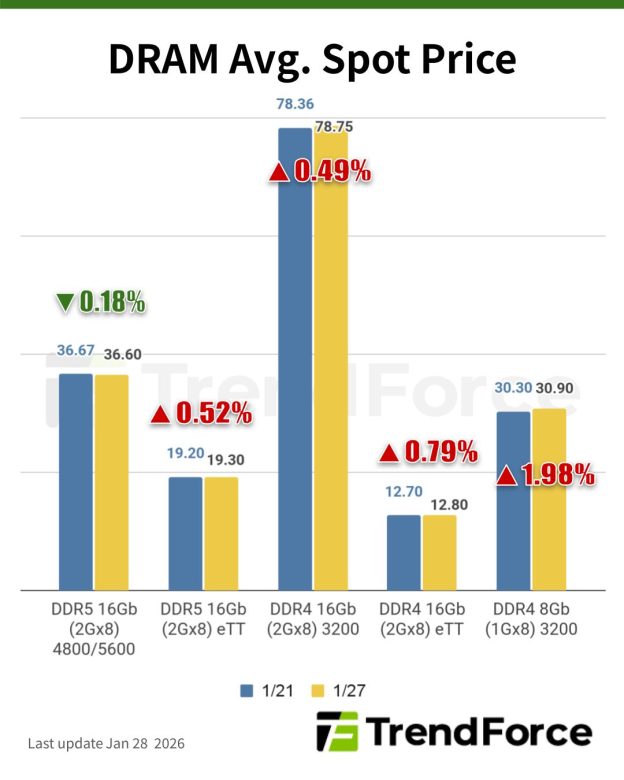

DRAM Spot Price:

Due to massive price increases in DDR4/DDR5 and difficulties in passing on costs, factories have suspended procurement, leading to stagnant spot market transactions. However, due to continued supply shortages, quotations remain at high levels. In contrast, DDR3, leveraging its low-price advantage, is attracting buyer interest. Warming inquiries and sustained transactions have pushed prices modestly higher, making DDR3 the only source of momentum in the spot market. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 1.98% from US$30.30 last week (1/21) to US$30.90 this week (1/27).

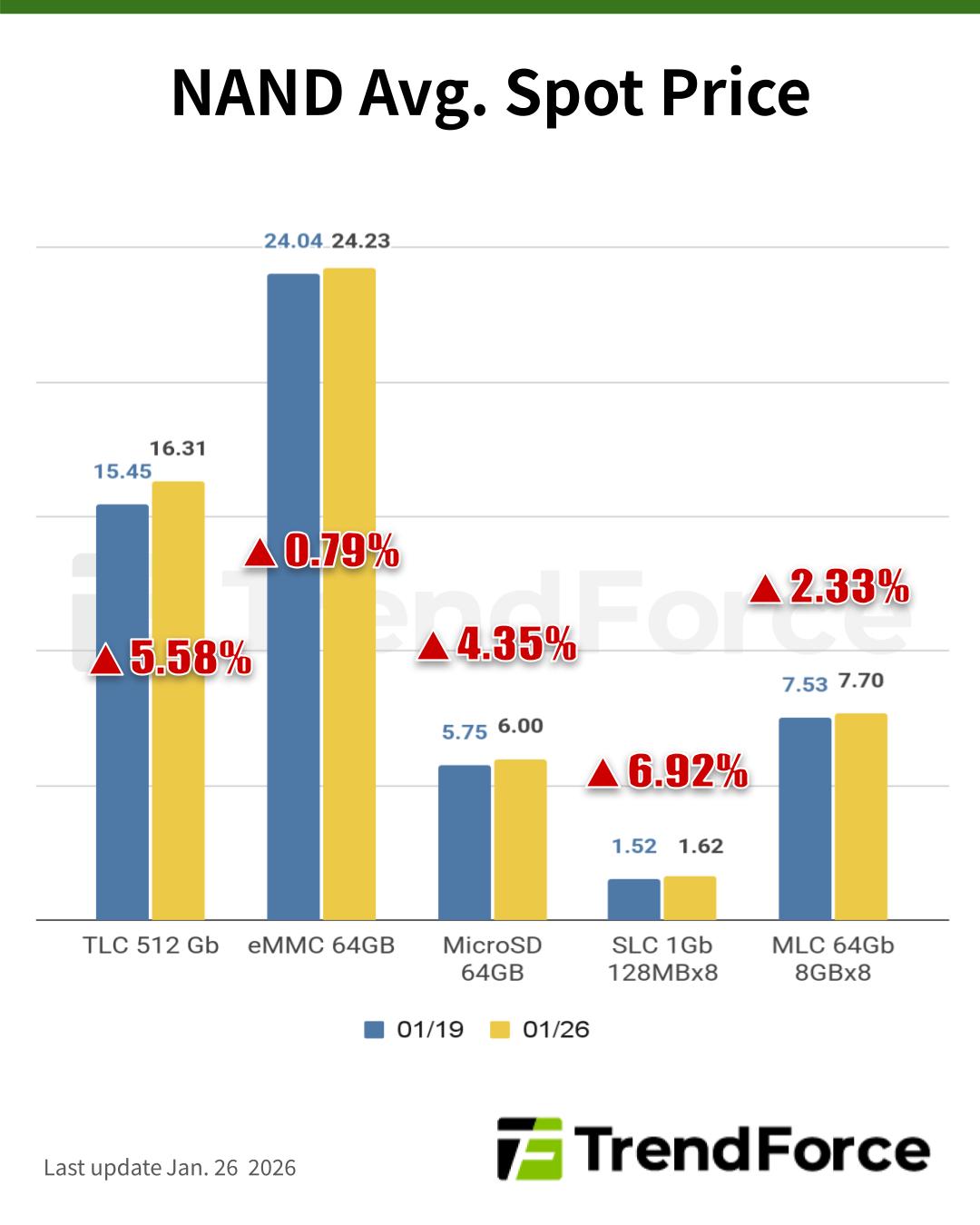

NAND Flash Spot Price:

Spot prices have been increasing recently, though some of the buyers are on the fence temporarily due to the high level of spot prices, sluggish consumer demand, as well as how the approaching Chinese New Year holiday would affect utilization rate of fabs. Having said that, spot traders have yet to compromise on their prices for shipment as they remain positive towards the subsequent price trend, which led to lethargic market transactions. Spot prices of 512Gb TLC wafers rose by 5.58% this week (1/26), arriving at US$16.310.