Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Samsung, SK hynix Reportedly Projected to Post Record-High NAND Margins of 40–50% in 1H26

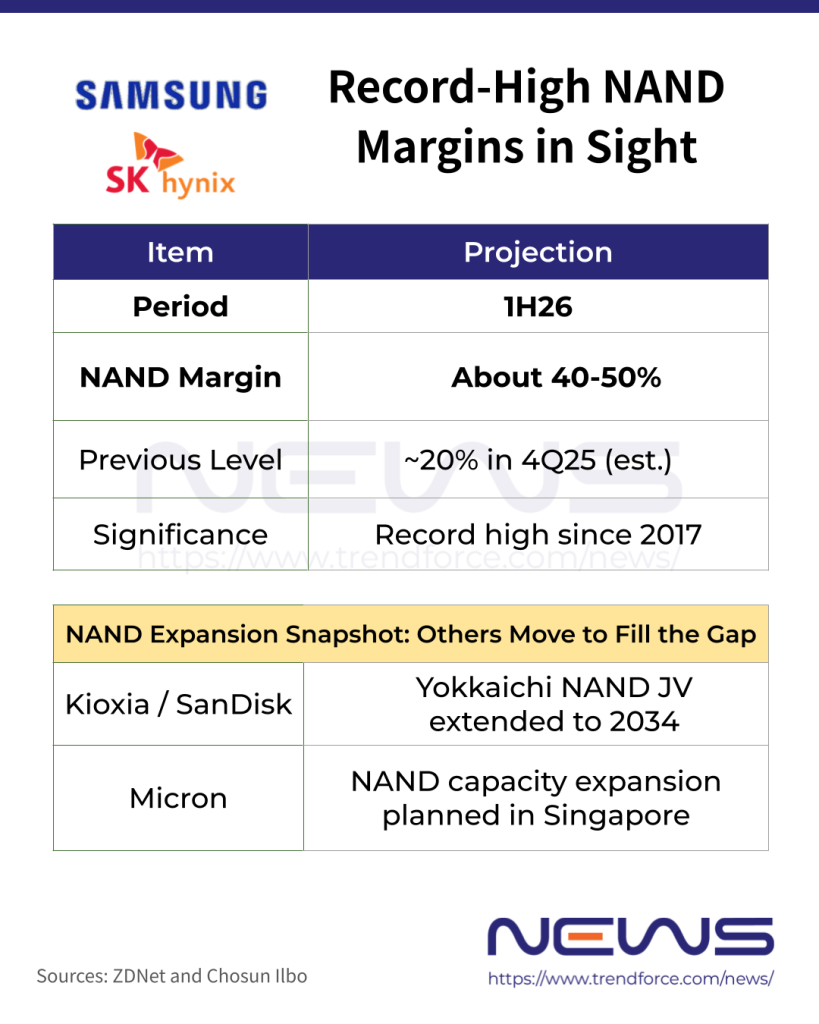

As memory price hikes persist, Samsung Electronics and SK hynix are projected to post record-high NAND margins. According to ZDNet, both companies are expected to maintain aggressive NAND price increases in the first half of the year, with industry estimates placing margins in the 40–50% range.

ZDNet notes that the industry expects NAND products to reach record profitability for the first time in nearly a decade, since the 2017 memory supercycle. The report adds that NAND margins are already estimated to have climbed into the 20% range in the fourth quarter of last year.

Sources cited in the report add that NAND prices are now widely expected to rise in stages across the first and second quarters. Conservative capital spending by memory suppliers on NAND has tightened supply, contributing to an increasingly acute shortage.

Notably, the report indicates that SK hynix—whose product mix carries a higher share of quad-level cell (QLC) NAND—is widely viewed as enjoying higher profitability than Samsung Electronics. QLC technology stores four bits per cell, making it well suited for high-capacity applications and increasingly adopted in server SSDs.

The report further says that as global big-tech firms accelerate investment in AI infrastructure, demand for server SSDs has been rising rapidly. Notably, as highlighted by Economic Daily News, NVIDIA’s Vera Rubin system is expected to feature 18 compute trays, each equipped with four GPUs. Each GPU is paired with roughly 16 TB of TLC SSD storage, implying that a single Vera Rubin server could require as much as 1,152 TB of NAND capacity.

TrendForce notes that persistent AI and data-center demand in 1Q26 is further exacerbating the global memory supply-demand imbalance. As a result, according to TrendForce, NAND Flash contract price increases are now expected to be revised up to 55–60%, from earlier projections of 33–38%, with further upward adjustments still possible.

“NAND Spring” Could Reshape Competitive Landscape

Meanwhile, Chosun Ilbo notes that as the semiconductor industry anticipates a potential “NAND spring,” a seismic shift in the NAND market could emerge as smaller suppliers ramp up investment to fill the gap left by Samsung Electronics and SK hynix. As the report adds, while Samsung and SK hynix are scaling back NAND output and prioritizing DRAM, rivals such as Japan’s Kioxia and U.S.-based SanDisk are accelerating investment. Kioxia and SanDisk have extended their Yokkaichi joint venture by five years, through December 31, 2034, to meet surging NAND demand. In addition, Micron has announced plans to expand its existing NAND manufacturing site in Singapore.

Read more

- [News] Samsung Readies New Price Hikes: Consumer DRAM, SSD Reportedly Doubled, NAND Set for 50%+ Rise

- [News] SK hynix Flags Ongoing DRAM Tightness in 2H26, NAND at Similar Levels; HBM4 in Focus

(Photo credit: Samsung)