Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Global 8-Inch Wafer Market Tightens: Samsung Giheung S7, TSMC Closures Put China Fabs in Spotlight

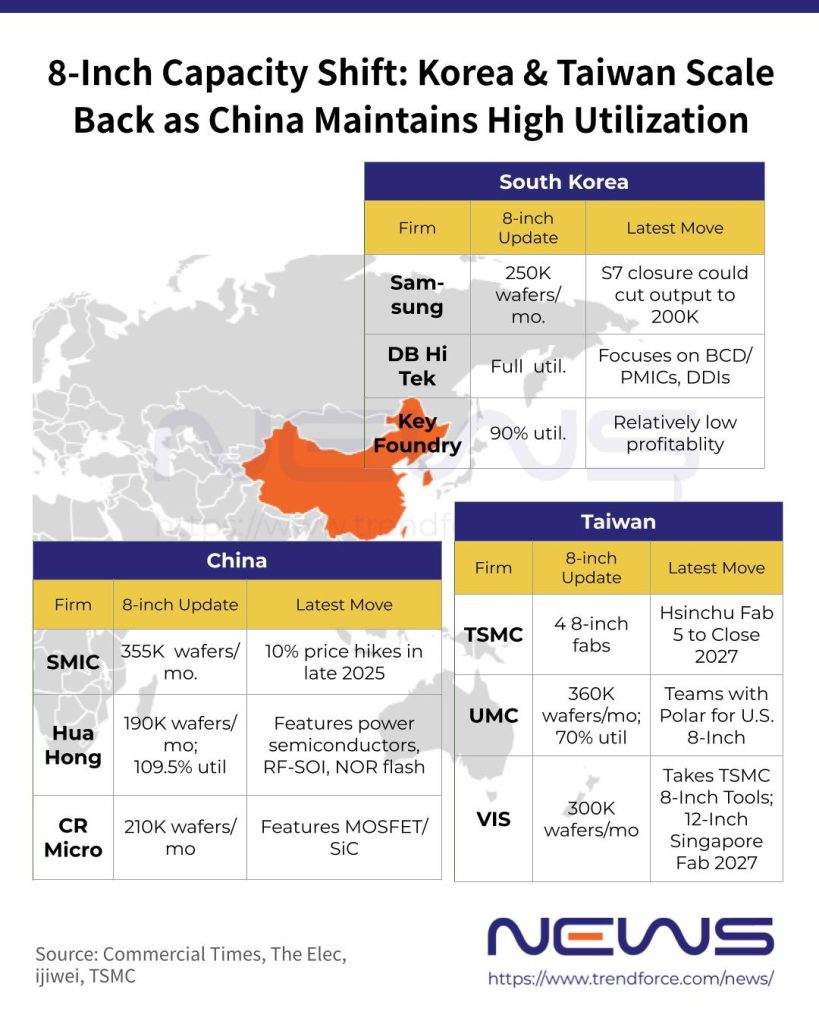

Global 8-inch wafer capacity seems to be entering a contraction phase, driven by major foundries shifting focus to advanced nodes. TSMC began scaling back in 2025, aiming to fully close selected fabs by 2027, and Samsung appears to be following the same path, with plans to shutter its Giheung-based 8-inch “S7” fab in the second half of 2026, according to The Elec.

As Liberty Times previously reported, TSMC has notified customers that its Wafer Fab 2 (6-inch) and Fab 5 (8-inch) will shut down by the end of 2027, offering guidance to help clients transfer production or move to 12-inch lines.

Meanwhile, The Elec reports that Samsung’s Giheung S7 8-inch fab is set to go offline, cutting monthly capacity from around 250,000 wafers to under 200,000, with its future use still undecided. Observers cited by the report note that Samsung’s 8-inch lines now run at about 70% utilization, as key products like CMOS image sensors and display driver ICs move to 12-inch platforms, making continued operation increasingly uneconomical.

Thus, TrendForce notes that TSMC and Samsung’s 8-inch capacity cuts are set to drive global 8-inch wafer output down by an estimated 2.4% year on year in 2026.

China’s 8-Inch Foundries Under the Spotlight

However, as rising AI demand for power ICs still keeps 8-inch fabs busy, TrendForce points out that tier-2 Chinese and Korean foundries maintain high 8-inch utilization, while foundries in other regions are also seeing a clear recovery. The Elec notes that DB HiTek, specializing in high-mix, low-volume PMICs and DDIs, is running at full capacity, and further 8-inch cuts by Samsung or TSMC could shift a sizable share of demand its way.

Thus, TrendForce projects that global average 8-inch utilization will rise to 85–90% in 2026, up significantly from 75–80% in 2025.

Looking ahead to tighter 8-inch capacity in 2026, some foundries have already notified customers of planned price hikes of 5%–20%, TrendForce reports. China’s largest foundry, SMIC, for example, raised 8-inch BCD process prices by about 10% in late 2025, sparking a broader industry response, with the upward trend now gradually spreading to other process platforms, as per ijiwei.

According to ijiwei, China’s 8-inch wafer capacity is heavily concentrated among top players such as SMIC, Huahong Group, and CR Micro. As the country’s largest foundry, SMIC operates three 8-inch fabs in Shanghai, Tianjin, and Shenzhen, with total capacity reaching 355,000 wafers per month by Q3 2025 and utilization rising to 96% in Q4.

On the other hand, the report notes that Huahong Group, focused on specialty processes, runs two 8-inch fabs in Wuxi and Shanghai with a combined monthly capacity of 190,000 wafers, and saw utilization top 109.5% in Q3 2025, signaling sustained overloading. Notably, ijiwei adds that its Wuxi site is the world’s largest 8-inch power semiconductor production line, with monthly capacity of 175,000 wafers and customers including Infineon and onsemi, while the Shanghai fab focuses on RF-SOI and NOR flash.

As ijiwei reports, other Chinese 8-inch foundries include CR Micro, the leading domestic IDM, with 8-inch lines in Chongqing and Wuxi totaling around 210,000 wafers per month, as well as specialty-process players like GTA Semiconductor, CanSemi, and Silan Microelectronics.

However, ijiwei cautions that structural constraints remain, as nearly half of China’s domestic 8-inch tools are over 10 years old, and key equipment such as steppers and etchers relies heavily on the secondary market. New tool procurement is difficult and delivery cycles exceed 18 months, limiting the pace of capacity expansion, the report notes.

Read more

- [News] 8-Inch Foundries May Raise Prices 5–20%, Benefiting UMC, PSMC, Vanguard

- Rising AI-Driven Demand for Power ICs and Capacity Cuts Fuels Potential 8-Inch Foundry Price Hikes, Says TrendForce

(Photo credit: Samsung)