Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DDR5 Prices Up 307% Since September as Module Costs Poised to Surge

According to TrendForce’s latest memory spot price trend report, regarding DRAM, from the start of September to the present, the spot price of DDR4 1Gx8 chips has experienced sequential increases reaching 158%, while the spot price of DDR5 2Gx8 chips has experienced sequential increases reaching 307%. It is anticipated that in the spot market, the pace of price increases for modules will accelerate, thereby narrowing the gap with chip prices. Meanwhile, in NAND, spot prices are ascending from the exceedingly tightening level of supply, where quotations are seeing changes every single day. Details are as follows:

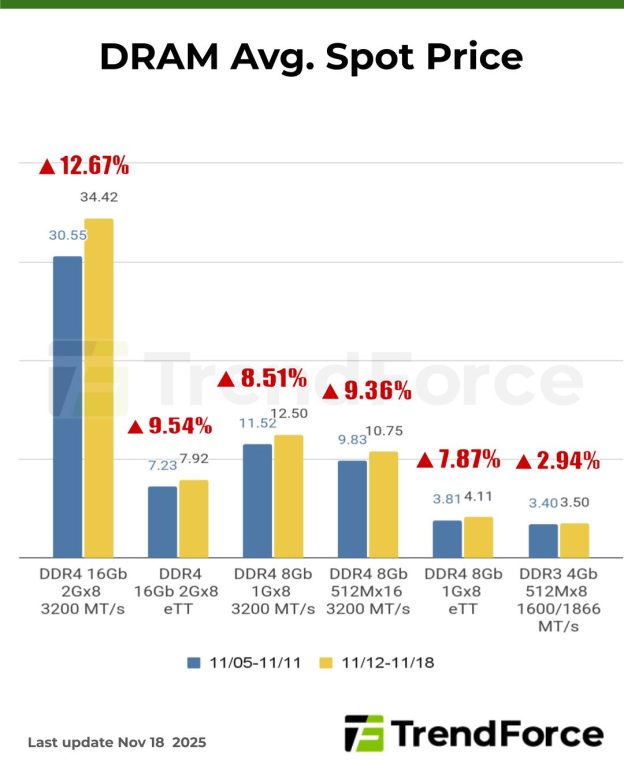

DRAM Spot Price:

Spot prices of DDR4 and DDR5 chips have already experienced significant hikes. From the start of September to the present, the spot price of DDR4 1Gx8 chips has experienced sequential increases reaching 158%, while the spot price of DDR5 2Gx8 chips has experienced sequential increases reaching 307%. Hence, buyers are now having difficulties to keep up with price hikes, and transaction volumes continue to shrink. Nevertheless, this has not altered the strong outlook for the DRAM market. TrendForce continues to emphasize that the spot market is not the best indicator for observing current price trends, and that attention should be focused on movements of contract prices. It is anticipated that in the spot market, the pace of price increases for modules will accelerate, thereby narrowing the gap with chip prices. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 4.75% from US$12.179 last week (November 12) to US$12.757 this week (November 18).

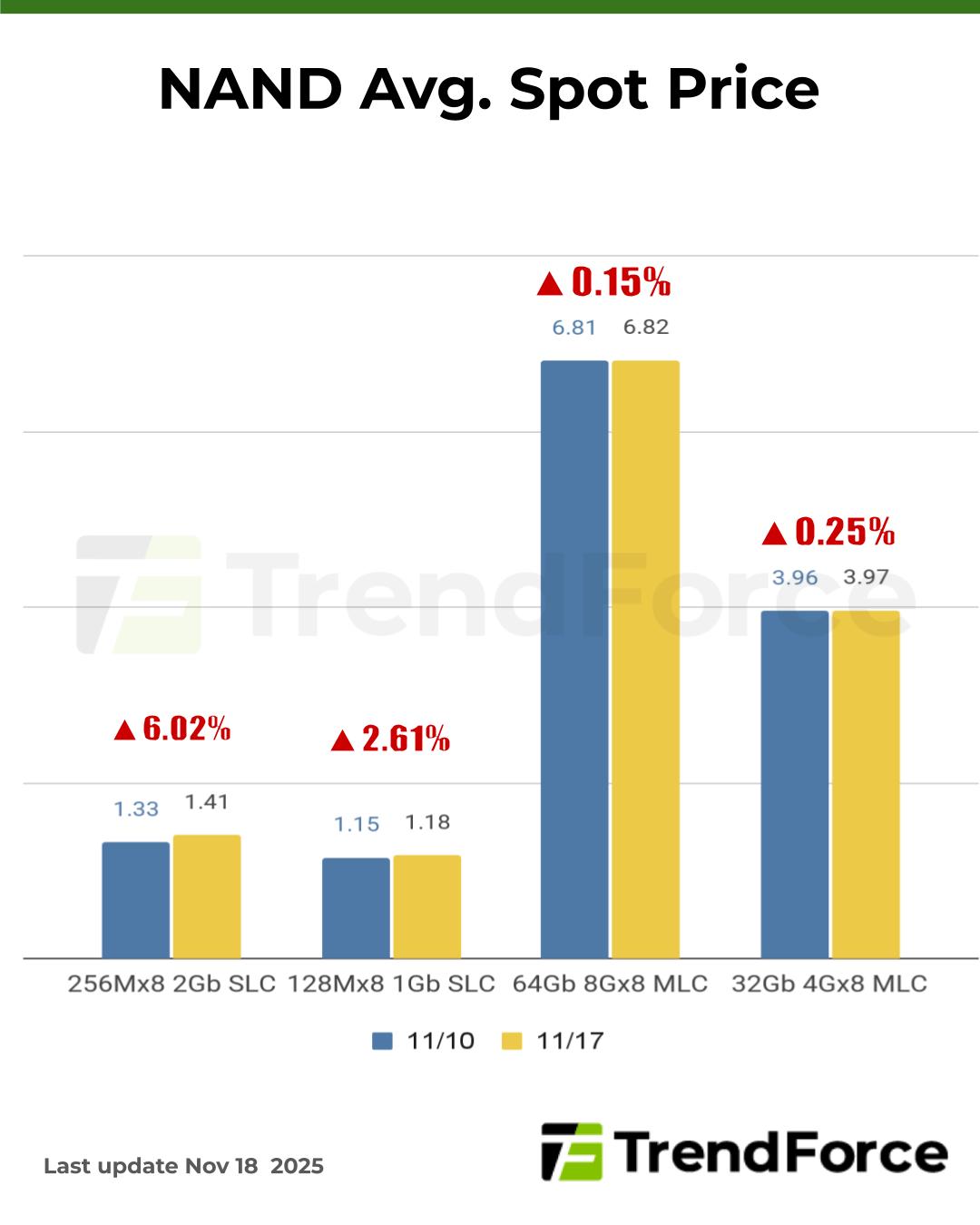

NAND Flash Spot Price:

Spot prices are ascending from the exceedingly tightening level of supply, where quotations are seeing changes every single day. Small and medium-sized clients can only turn to the spot market for products as suppliers are unable to release additional capacity, which continues to actuate prices, though overall supply remains way below demand. Spot prices of 512Gb TLC wafers rose by 14.97% this week, arriving at US$7.421.