Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DRAM Buyers Rush In as DDR5 Spot Prices Jump 30% Amid Tight Supply

According to TrendForce’s latest memory spot price trend report, regarding DRAM, buyers are snapping up quotes immediately, sending spot prices soaring. DDR5 chips have surged 30% this week, as overall supply remains tight and major module houses like Kingston continue to limit shipments. Meanwhile, in NAND, limited spot supply led to only sporadic trading, with prices expected to climb further as the market tightens. Details are as follows:

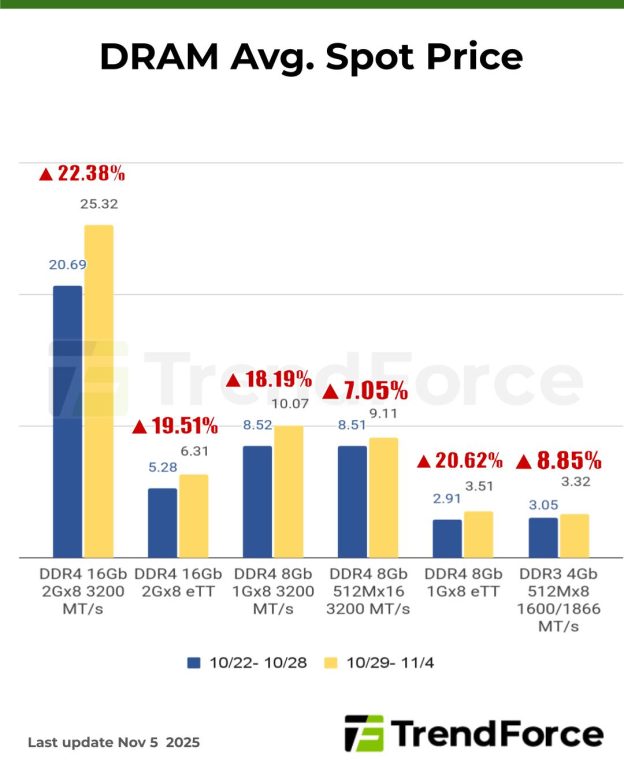

DRAM Spot Price:

This week, the spot market has witnessed severe hoarding, with buyers purchasing as soon as they receive quotes, leading to soaring spot prices. This phenomenon is attributed to the persistently tight supply from suppliers and major module houses such as Kingston limiting their shipments. Consequently, other module houses are under pressure to replenish their inventories. Despite significant differences between actual spot transaction prices and official prices, buyers are not deterred and are rushing to stockpile. Driven by strong demand, spot prices of DDR5 chips have surged by 30% this week. The market’s supply-demand imbalance is becoming increasingly apparent, with short-term supply issues remaining unresolved. As a result, buyers are stocking up in advance to ensure a stable supply through the end of this year and into early next year. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 11.61% from US$9.523 last week to US$10.629 this week.

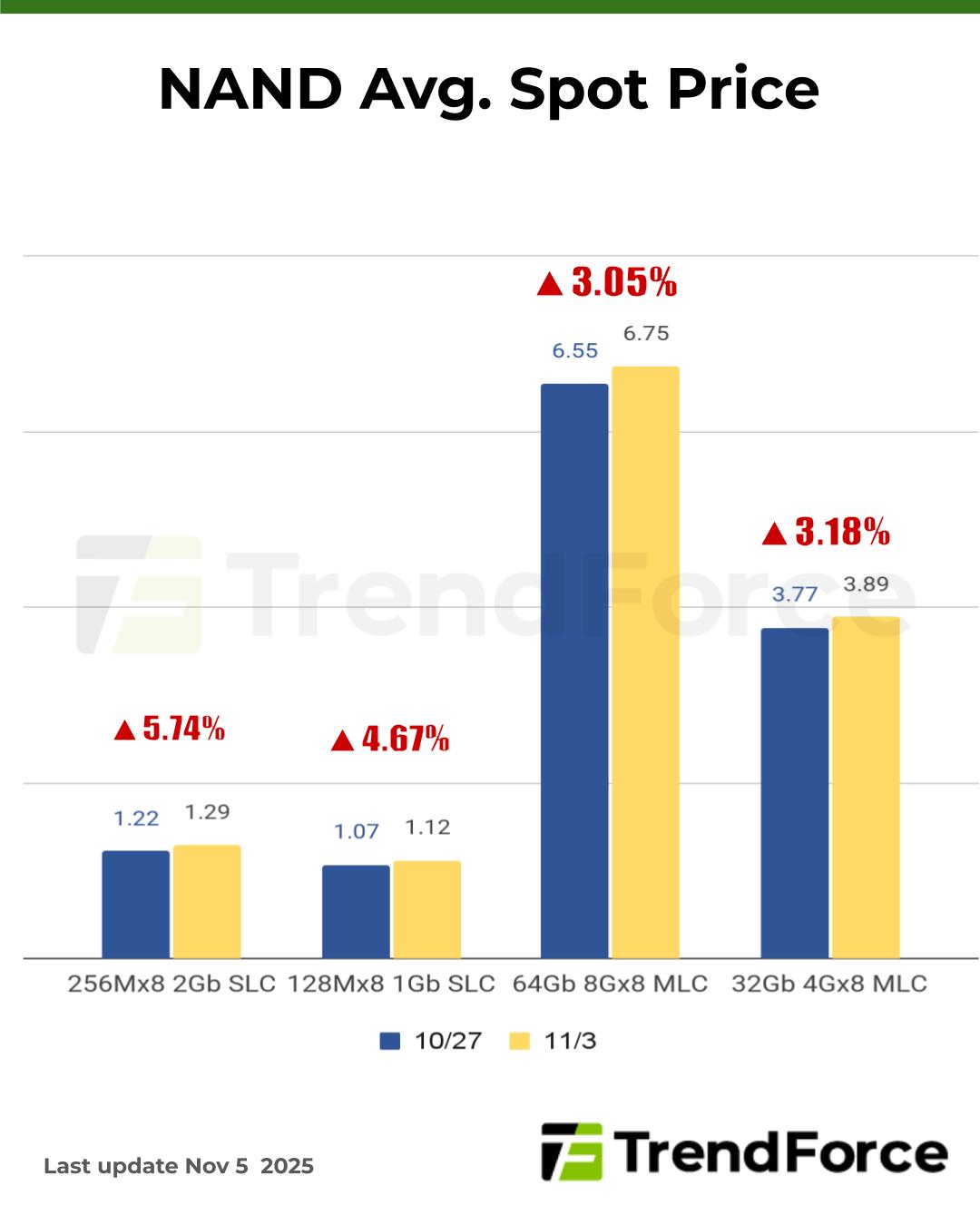

NAND Flash Spot Price:

Spot prices surged at a much more apparent degree on account of the successive releases and significant increases of contract prices. With that said, suppliers are releasing a confined level of wafer resources under their orientation of maximized profitability, while those with products, who are anticipating continuous increments of prices, have become reluctant in sales. This led to a zero availability of products on the market. Constrained supply of spots resulted in sporadic market transactions, and subsequent prices are likely to increase further as supply continues to tighten. Spot price of 512Gb TLC wafers rose by 14.21% this week, arriving at US$5.514.