Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

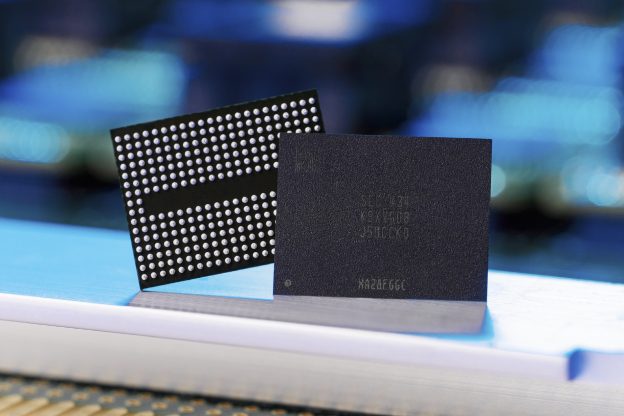

[News] Samsung Reportedly Plans Q4 Memory Price Hikes: DRAM Up 30%, NAND Up 10%

According to ICsmart, after earlier reports that Micron plans to raise DDR4/DDR5 prices by 20%–30%, Samsung is now also said to be increasing memory product prices by 15%–30% in the fourth quarter.

Sources state that Samsung has informed major customers that in Q4, contract prices for DRAM products such as LPDDR4X and LPDDR5/5X are expected to rise by more than 15%–30%. For NAND products, eMMC/UFS contract prices are projected to increase by 5%–10%. Production capacity for DDR4—now being gradually phased out—is expected in 2026 to fall to just 20% of 2025 levels, as the report indicates.

As noted by the report, one driver of the price hikes is rising demand for high-capacity DRAM and NAND Flash, as AI applications shift from “training” to “inference” and edge devices, tightening supply. Institutional investors, as cited by Anue, project that this wave of increases will last through year-end and possibly into the first half of next year.

ICsmart adds that as Samsung, SK hynix, and Micron shift capacity to DDR5 and HBM, DDR4 production is being gradually phased out. With demand still strong, DDR4 prices have continued climbing this year.

Taiwanese Suppliers Gain from DDR4 Shortage

This round of price increases is expected to benefit Taiwanese suppliers, with institutional investors cited by Commercial Times expecting Nanya Technology to gain the most. The report adds that Winbond and Powerchip are also profiting as DDR4 contract prices narrow the gap with spot prices.

QLC SSDs Poised for Explosive Growth by 2026

On the NAND side, momentum is also building. As highlighted by TechNews, tech giants like Google and Oracle are aggressively expanding AI infrastructure and pivoting toward high-performance inference applications, driving substantial growth in demand for high-capacity storage products. Industry sources indicate that lead times for high-capacity HDDs have now extended to nearly one year. In response, memory suppliers are actively developing Nearline SSD products, aiming to narrow the current price gap with HDDs—from the current 4–5x down to around 3x—to encourage customer adoption.

TrendForce’s latest investigations reveal that the massive data volumes generated by AI are straining the global infrastructure of data center storage. Nearline HDDs, traditionally the backbone of large-scale storage, are now facing severe supply shortages, pushing high-performance yet higher-cost SSDs into the market spotlight. In particular, shipments of high-capacity QLC SSDs could see explosive growth in 2026.

Read more

- [News] Micron Freezes Prices as Inference AI Fuels Surge in SSD Demand and Supply Shortages

- [News] DDR4, DDR5 October Prices to See Double-Digit Gains; Taiwan’s DRAM Makers Poised to Benefit

(Photo credit: Samsung)