Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DDR4 Price Surge Slows Amid Samsung EOL Delay Rumors

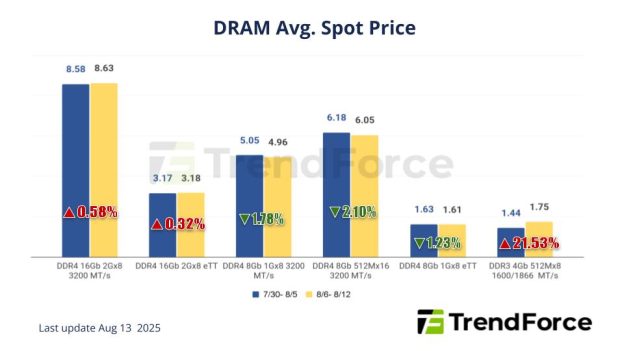

According to TrendForce’s latest memory spot price trend report, regarding DRAM, rumors about a delay in Samsung’s DDR4 EOL plan have been circulating. While TrendForce finds these claims inaccurate, they have nonetheless dampened the upward price momentum. Meanwhile, NAND flash demand remains cautious, unlike DRAM, which is seeing price surges and panic buying due to shortages. Details are as follows:

DRAM Spot Price:

The trading momentum in the spot market is still sluggish, showing no noticeable change from before. However, there have been no significant changes in the prices of either DDR4 or DDR5 products, with daily price fluctuations being very minor. Regarding DDR4 products, there have been persistent rumors about the possible delay in Samsung’s EOL plan, which has dampened the upward price momentum. However, according to TrendForce’s latest investigation, this claim is inaccurate. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has fallen by 1.22% from US$4.990 last week to US$4.929 this week.

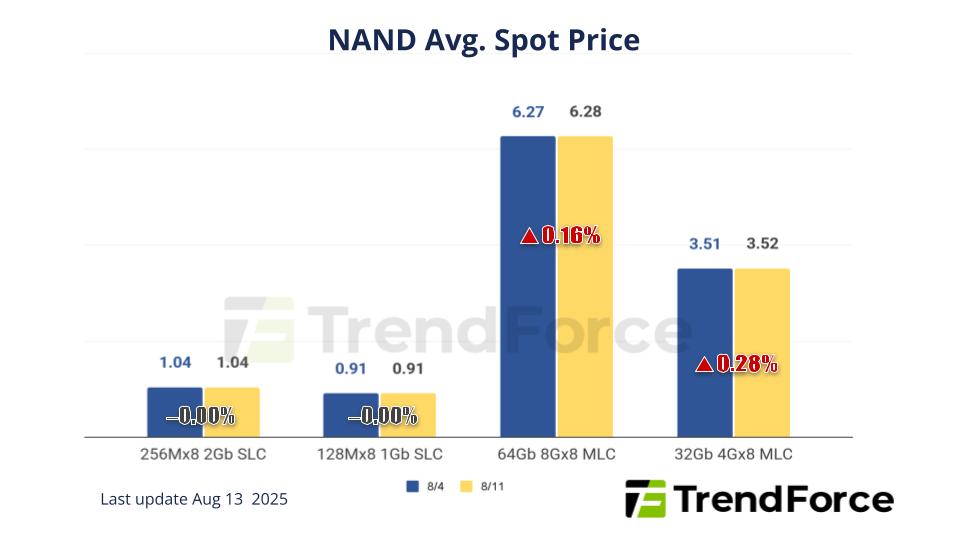

NAND Flash Spot Price:

The spot market saw a reduction in transactions due to weak demand for consumer products, where the demand end remains on the fence towards NAND Flash, unlike price surges and panic purchases for DRAM on account of shortages. Spot price of 512Gb TLC wafers rose slightly by 0.86% this week, arriving at US$2.808.