Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DDR4 Sees Larger Hikes Amid Tight Supply; DDR5 Up Incrementally

According to TrendForce’s latest memory spot price trend report, regarding DRAM, the spot market shows prices of DDR4 products registering larger hikes compared with prices of DDR5 products due to the anticipation of supply tightening in the future. As for NAND flash, buyers have slowed down inquiries and transactions. Details are as follows:

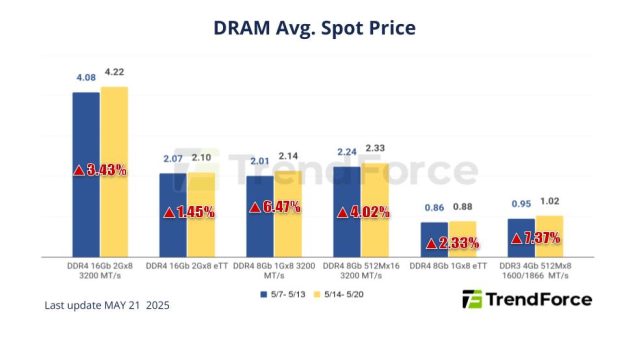

DRAM Spot Price:

Similar to the situation in the contract market, the spot market shows prices of DDR4 products registering larger hikes compared with prices of DDR5 products due to the anticipation of supply tightening in the future. Prices of DDR5 products also continue to rise incrementally because module houses are eager to build up their inventories. TrendForce believes that overall, spot prices will remain on an upward trend throughout 2Q25, and the gap between prices of DDR4 and DDR5 products will shrink further. Currently, the price premium that DDR5 commands over DDR4 for 2Gx8 chips comes to around 29%. As for the mainstream chips (i.e., DDR4 1Gx8 3200MT/s), their average spot price has risen by 1.55% from US$2.129 last week to US$2.162 this week.

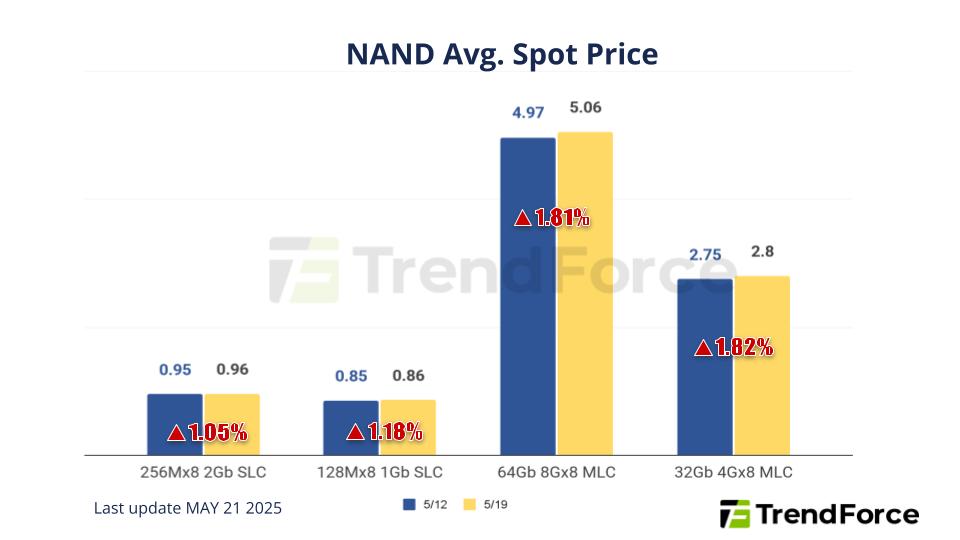

NAND Flash Spot Price:

Spot prices are currently at a relatively high point since the early price hike at the end of February, while suppliers’ releases of extra products for buyers have slowed down inquiries and transactions for the particular market. Spot prices of 512Gb TLC wafers have dropped by 0.18% this week, arriving at US$2.730.