HBM Industry Analysis - 1Q26

Last Modified

2026-02-04

Update Frequency

Quarterly

Format

In 2026, the HBM market continues to grow, with SK hynix maintaining its lead and Samsung recovering significantly via HBM3e and HBM4 contributions. Micron also expands aggressively. While HBM3e dominates and HBM4 adoption begins, overall growth momentum slows due to chip upgrade delays and inventory buildup, leading to a converging supply-demand scenario.

Key Highlights

- Supplier Dynamics: SK hynix retains the top position; Samsung sees the strongest recovery in share driven by HBM4; Micron aggressively expands capacity.

- Tech Trends: HBM3e remains the mainstream consumption driver, while HBM4 starts contributing to revenue as validation progresses.

- Market Outlook: Growth rates for shipment and consumption decelerate due to AI chip delays and existing inventory, leading to a market correction phase.

- Capacity Strategy: Major manufacturers are repurposing NAND facilities and expanding TSV capacity (notably in Taiwan and Korea) to support advanced HBM production.

Table of Contents

- Introduction

- Memory Suppliers' Figures for HBM Output and TSV Processing Capacity

- Three Major Memory Suppliers' HBM Output Figures and Corresponding Market Shares

- Analysis of HBM Generations and Die Stack Levels

- Updates on New Backend Packaging and Testing Facilities

- Analysis of HBM Demand

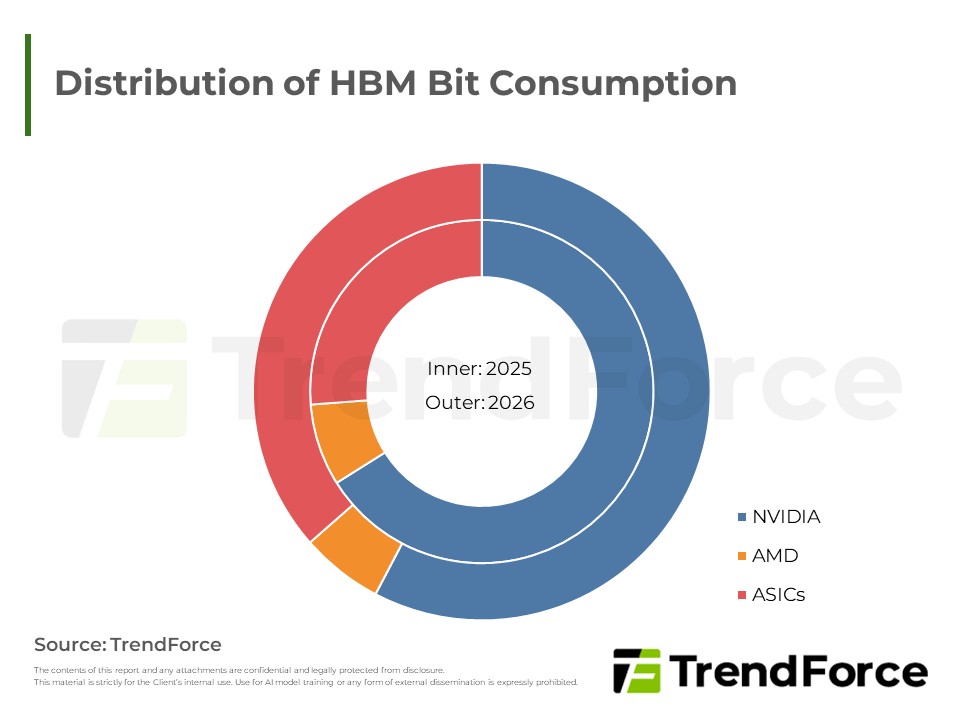

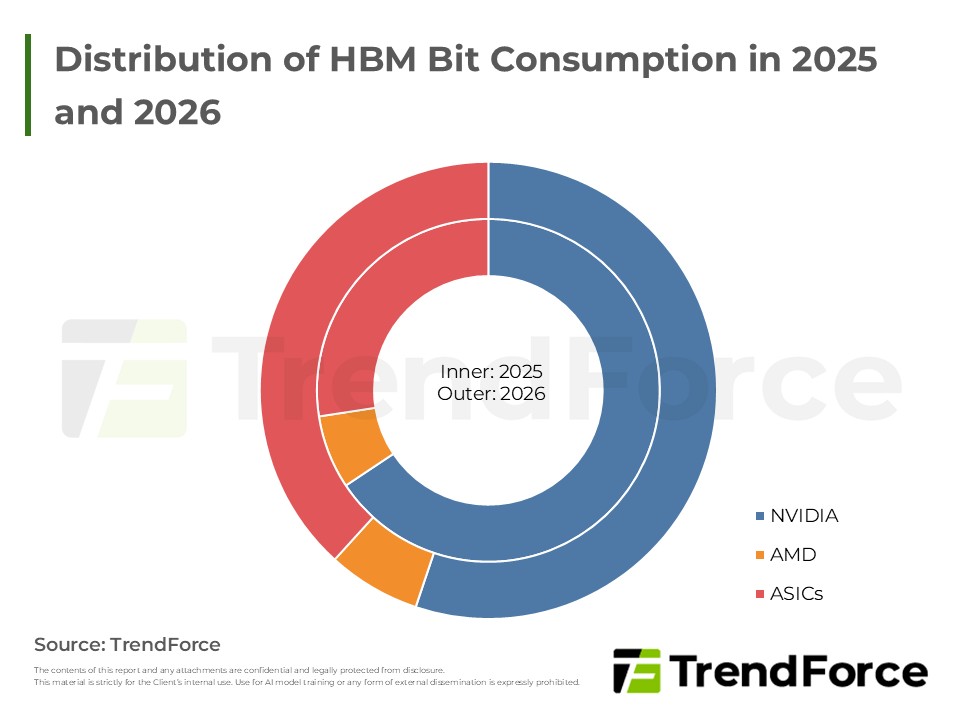

- Distribution of HBM Bit Consumption in 2025 and 2026

- HBM S/D Ratio

- HBM S/D Ratio

- Analysis on Prices and Revenue of HBM

- Blended ASP of HBM

- Revenue Share of HBM Products

- Revenue Share of HBM Suppliers

<Total Pages: 16>

Category: AI/HBM/Server

Spotlight Report

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

HBM Quarterly ReportRelated Reports

Download Report

USD $25,000

Membership

Spotlight Report

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF