Smartphone Market Bulletin - Jan. 8, 2026

Last Modified

2026-01-08

Update Frequency

Biweekly

Format

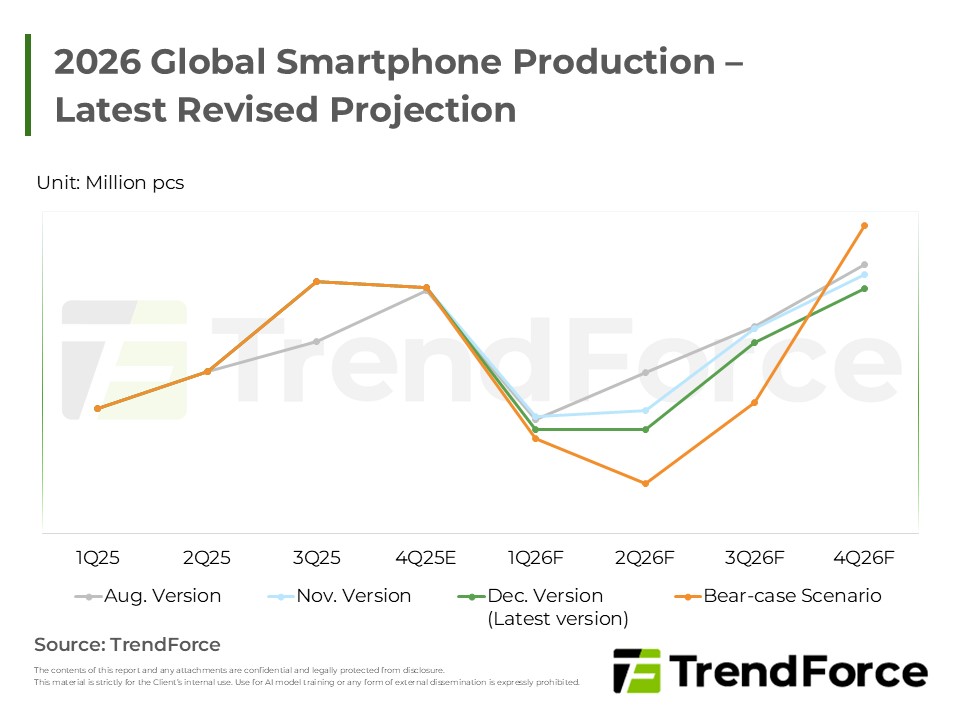

Since the second half of 2025, the smartphone market has been trapped in a closed cycle: tight memory supply and skyrocketing costs have forced up end-device prices, subsequently weakening demand. To cope with this adverse environment, smartphone brands are expected to revise production volumes downward and adjust product specifications and price bands. While brands have not yet significantly lowered their production targets for 1Q26, they are bound to scale back subsequent production plans if the decline in demand exceeds expectations.

Key Highlights

- With significant memory price hikes confirmed for 1Q26, the impact on smartphone production will be felt primarily during 2Q26–3Q26.

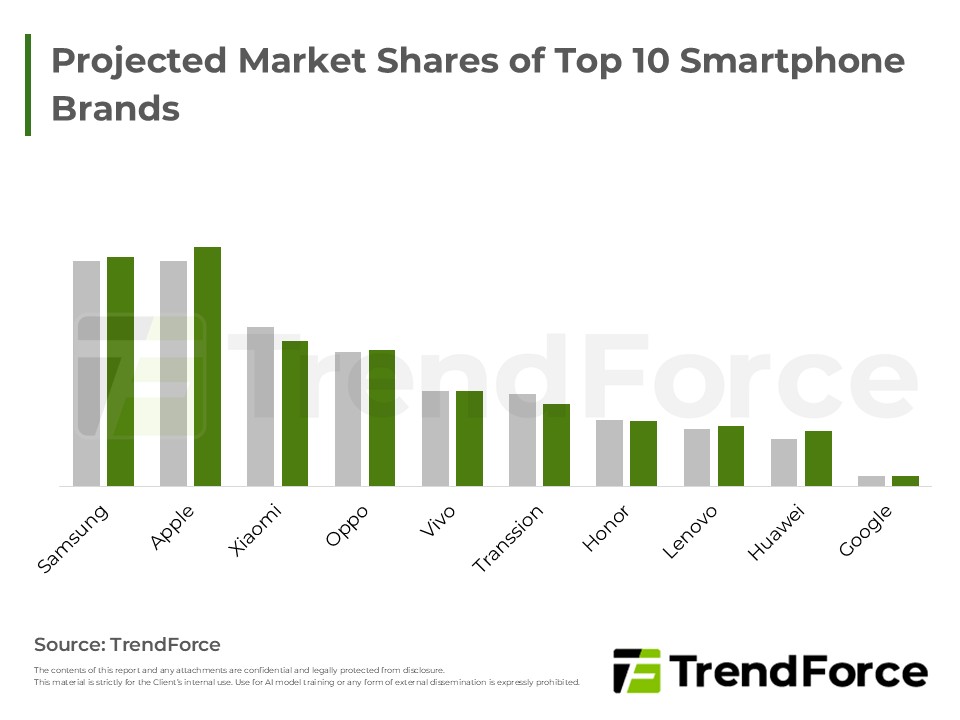

- Given the tight memory supply and high component costs, leading brands remain relatively secure regarding inventory and capital. However, operational risks are rising for small and medium-sized brands.

- The average DRAM/NAND Flash inventory held by smartphone brands currently stands at approximately 6–8 weeks. There is a significant disparity in supply: leading clients mostly hold more than 6 weeks of inventory, while other brands generally hold less than 4 weeks.

- Due to aggressive volume pushes, the fading benefits of national subsidies, and lower-than-expected sales following price hikes, Samsung and Xiaomi are seeing finished goods inventory reach approximately 10 weeks. Consequently, their production plans may be scaled back earlier than anticipated.

- Faced with continuously climbing memory contract prices, smartphone brands are expected to respond by downwardly revising production volumes and adjusting specifications and price bands.

Table of Contents

- Key Points

- Updates on Smartphone Market

- Updates on Mobile Memory Price Trends

<Total Pages: 3>

Category: Smartphones

Spotlight Report

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Consumer Electronics

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Consumer Electronics

PDF

-

Soaring Memory Prices Impact End Products, Specification Downgrading Becomes a Trend

2025/12/09

Consumer Electronics

PDF

-

Memory Price Surge Cuts Console Forecast

2025/11/28

Consumer Electronics

PDF

-

4Q25 Mobile Datasheet

2025/11/27

Consumer Electronics

EXCEL

-

DRAM Cost Spike Reshapes Notebook Brand Resilience in 2026

2025/12/30

Consumer Electronics

PDF

Smartphone Market BulletinRelated Reports

Download Report

USD $4,500

Membership

Spotlight Report

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Consumer Electronics

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Consumer Electronics

PDF

-

Soaring Memory Prices Impact End Products, Specification Downgrading Becomes a Trend

2025/12/09

Consumer Electronics

PDF

-

Memory Price Surge Cuts Console Forecast

2025/11/28

Consumer Electronics

PDF

-

4Q25 Mobile Datasheet

2025/11/27

Consumer Electronics

EXCEL

-

DRAM Cost Spike Reshapes Notebook Brand Resilience in 2026

2025/12/30

Consumer Electronics

PDF