2025 Global Smartphone Outlook: Peak Season Lifts Output, DRAM Impacts Entry Segment

Last Modified

2025-11-27

Update Frequency

Aperiodically

Format

In 3Q25, the smartphone industry benefited from the traditional peak season and the launch of new device models. Smartphone production registered both QoQ and YoY growth. However, moving into 4Q25, the sharp increase in memory costs is expected to significantly impact the profitability of low-end smartphone brands, potentially causing these brands to make downward revisions in their quarterly production volumes. Additionally, the trend of increasing differentiation between the high-end and low-end segments continues. Therefore, the successful implementation of AI features and effective cost control measures will be critical for competitive advantage.

Key Highlights

- In 3Q25, the smartphone industry outperformed the previous quarter in terms of production volume. This was attributed to stockpiling for the traditional peak season and new model launches.

- Rising memory costs are exerting increasing pressure on the profitability of low-end brands, which may negatively affect their shipment performances in 4Q25.

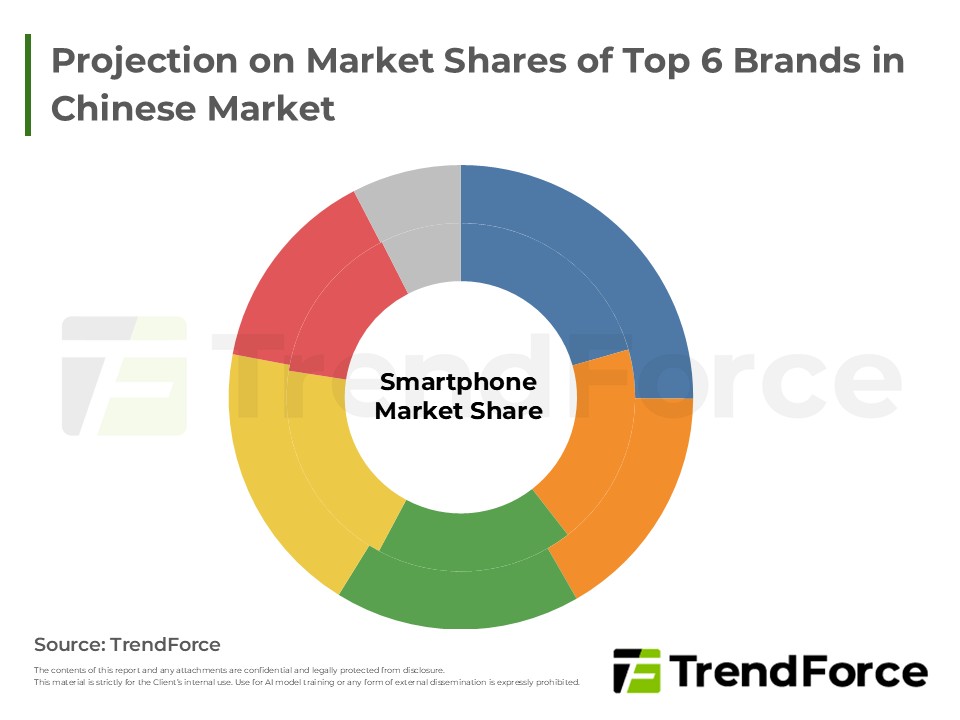

- The top six smartphone brands held around 80% of the market share in 3Q25, indicating a high level of market concentration.

- The differentiation between the high-end and low-end segments is intensifying, with AI integration and cost management emerging as key factors for success.

- Global smartphone production is projected to increase marginally for 2025. However, if the production volumes of low-end models continue to undergo downward revisions, there is also the possibility of an adjustment to the global production figure.

Table of Contents

- Traditional Peak Season and New Device Models Drove Increase in 3Q25 Smartphone Production

- Smartphone Shipments by Region

- Sharp Rise in DRAM Prices Will Impact Production of Low-End Smartphones

- Production Performance of Top 6 Smartphone Brands in 3Q25

- Smartphone Industry Continues to Reshape under Further Distinction in Divergence between High-End and Low-End Models

<Total Pages: 8>

Category: DRAM , Smartphones

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Semiconductors

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

Mobile PackageRelated Reports

Download Report

Membership

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Semiconductors

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF