Mobile DRAM Industry Analysis-4Q25

Last Modified

2025-12-05

Update Frequency

Quarterly

Format

Mobile DRAM revenue surged due to peak season demand and soaring contract prices, intensified by supplier bidding wars. While smartphone production saw a slight short-term upward revision, rising memory costs are eroding low-end brand profitability, threatening future output. The accelerated shift to high-end specifications continues to drive prices upward amid supply tightness.

Key Highlights

- Revenue & Price Trends: Mobile DRAM revenue grew significantly driven by soaring contract prices and peak demand. Intense supplier bidding and tight supply are expected to sustain price hikes into next year.

- Smartphone Industry Impact: Production forecasts were slightly raised, led by high-end brands. However, skyrocketing memory costs are squeezing low-end brand profits, likely causing future output reductions and deepening market polarization.

- Technology & Supply Shift: The accelerated transition to LPDDR5X is causing capacity crowding. Major manufacturers focus on high-end processes, while Chinese suppliers expand market share in legacy segments.

- Outlook: With the supply-demand gap persisting, consumer electronics prices may rise to reflect costs, potentially suppressing terminal demand.

Table of Contents

- 3Q25 Mobile DRAM Manufacturer Revenue Ranking

- 3Q25 Revenue Ranking among Mobile DRAM Suppliers

- 4Q25 Mobile DRAM Manufacturer Analysis and Outlook

- Market Supply Analysis

- Smartphone Shipments by Region

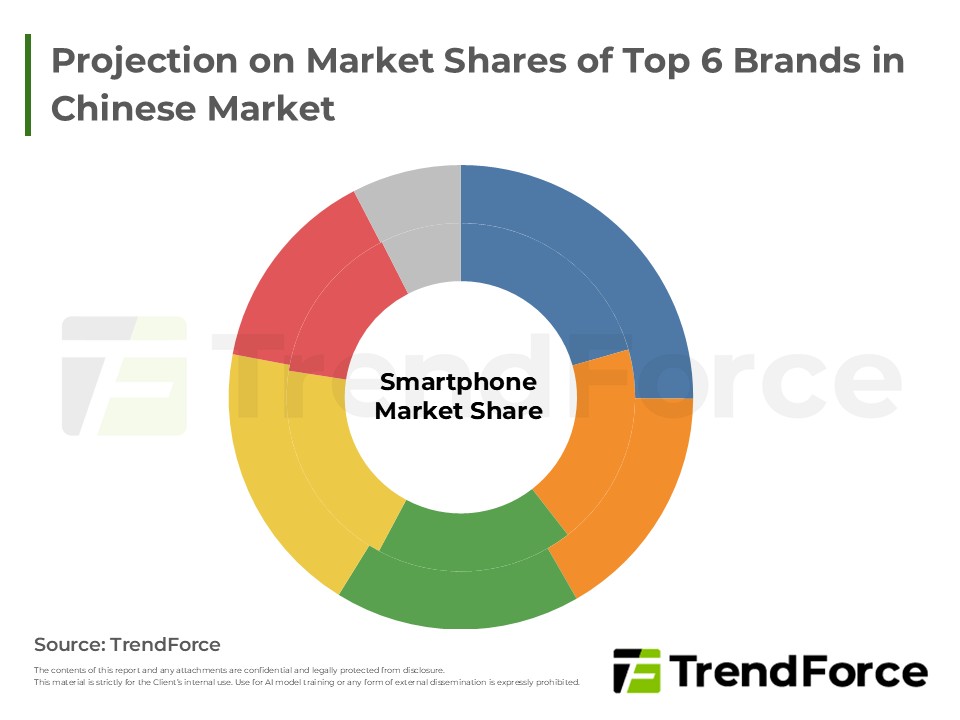

- Production Performance of Top 6 Smartphone Brands in 3Q25

- LPDDR5(X) Price Premium between NBs and Smartphone

- 4Q25 Mobile DRAM Contract Price

<Total Pages: 18>

Category: DRAM , Smartphones

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Semiconductors

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

Mobile PackageRelated Reports

Download Report

Membership

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Semiconductors

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF