- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

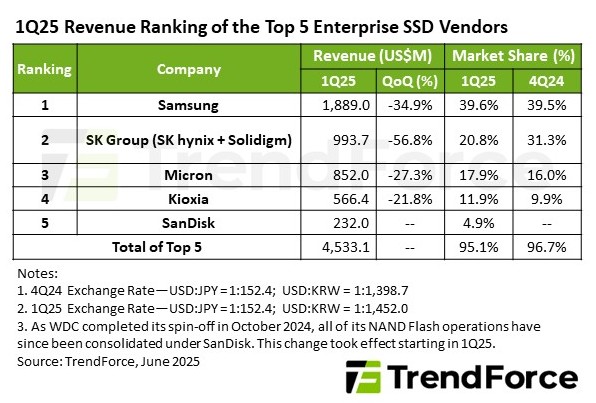

TrendForce’s latest investigations reveal that several negative factors weighed on the enterprise SSD market in the first quarter of 2025. These include production challenges for next-gen AI systems and persistent inventory overhang in North America.

As a result, major clients significantly scaled back orders, causing the ASP of enterprise SSDs to plunge nearly 20%. This led to QoQ revenue declines for the top five enterprise SSD vendors, reflecting a period of market adjustment.

However, conditions are expected to improve in the second quarter. As shipments of NVIDIA’s new chips ramp up, demand for AI infrastructure in North America is rising. Meanwhile, Chinese CSPs are steadily expanding storage capacity in their data centers. Together, these trends are set to reinvigorate the enterprise SSD market, with overall revenue projected to return to positive growth.

Samsung, the market leader, saw Q1 revenue decline by 34.9% to $1.89 billion due to seasonal effects and weakened demand. Nonetheless, shipments of its PCIe 5.0 products continued to rise, indicating steady gains in market share for advanced interface technologies.

SK Group (including SK hynix and Solidigm) recorded a steep revenue drop of over 50% to $993 million, largely due to strategic adjustments by key AI infrastructure clients. The company is accelerating development of next-gen storage technologies, including PCIe 5.0 SSDs based on TLC and QLC, as part of a broader transformation effort.

Micron reported Q1 revenue of $852 million. Despite market headwinds, the company benefited from carryover momentum in high-capacity shipments from 2024 and a gradual ramp-up of PCIe 5.0 products. Its 27.3% QoQ decline was relatively moderate.

Kioxia posted Q1 revenue of $566 million, down 21.8% QoQ, impacted by seasonal softness and lower-than-expected orders from server OEM customers.

SanDisk saw growth in product shipments during the quarter, with revenue reaching $232 million. The company is shifting focus toward high-capacity storage solutions and has launched SSD products with up to 1 PB of capacity, underscoring its leadership in both technology and market insight.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Subject

Related Articles

Related Reports