Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

Recent Posts

- [News] US Allocates USD 39 Billion Subsidy to Semiconductor Industry for Establishing Plants

- [News] SMIC’s Net Profit Halved Last Year, Faces Further Reductions This Year

- [Insights] Memory Spot Price Update: Limited DRAM Quotes, Weak NAND Flash Momentum

- [News] TSMC’s JASM Kumamoto Plant 2 Greenlit, Construction Expected to Commence by Year’s End

- [Insights] EV Development Faces New Challenges, Porsche CFO Suggests Delay in European Ban on New Fuel Cars

Recent Comments

Archives

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED

- LED Backlight

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 未分類

Meta

Broadcom

Press Releases

Wi-Fi 6/6e Expected to Become Mainstream Technology with Close to 60% Market Share in 2022, Says TrendForce

Exponential demand growth for remote and unmanned terminals in smart home, logistics, manufacturing and other end-user applications has driven iterative updates in Wi-Fi technology. Among the current generations of technologies, Wi-Fi 5 (802.11ac) is mainstream while Wi-Fi 6 and 6E (802.11ax) are at promotional stages, according to TrendForce’s investigations. In order to meet the connection requirements of industry concepts such as the Metaverse, many major manufacturers have trained their focus on the faster and more stable next generation 802.11be Wi-Fi standard amendment, commonly known as Wi-Fi 7. Considering technical characteristics, maturity, and product certification status, Wi-Fi 6 and 6E are expected to surpass Wi-Fi 5 to become mainstream technology in 2022, with global market share expected to reach 58%.

TrendForce states, in common residential applications of Wi-Fi, Wi-Fi 6E supports 6GHz and expands bandwidth by at least 1200MHz, delivering higher efficiency, throughput, and security than Wi-Fi 6, and can optimize remote work, VR/AR, and other user experiences. Moreover, in terms of the vertical IoT sector with the highest output value, smart manufacturing still mostly employs Ethernet and 4G/5G mobile networks as the central communication technologies in current smart factories. However, as early as 2019, major British aerospace equipment manufacturer, Mettis Aerospace, and the Wireless Broadband Alliance (WBA) conducted phased testing of the practicality of Wi-Fi 6 in factories, and they believe that Wi-Fi 6 can be widely adopted for manufacturing.

Market not yet mature, practical application of Wi-Fi 7 must wait until the end of 2023 at the earliest

TrendForce believes that the introduction of Industry 4.0 technology tools will become more common and the degree of digitalization within companies will increase in the post-pandemic era, with 5G and Wi-Fi expected to bring complementary and synergistic effects to the manufacturing field. The primary reason for this is that 5G characteristics include wide connection, large bandwidth, and low latency. In addition, multi-access edge computing (MEC) and standalone (SA) network slicing can improve computing power and flexibility, all of which significantly upgrade smart manufacturing tools. Although the transmission range of Wi-Fi is small, it resists interference and enhances the physical penetration of wireless signals at smart manufacturing locations. Wi-Fi also reduces the cost of 5G distributed antennas and small base stations while extending communications range and improving equipment battery life.

Looking forward to next generation Wi-Fi 7, companies such as MediaTek, Qualcomm, and Broadcom, are already laying the groundwork for their forays into this standard. TrendForce believes, even though focus is currently shifting to Wi-Fi 7, scheduled application of Wi-Fi 7 is expected to fall between the end of 2023 and the beginning of 2024. Challenges remain in terms of overall development and issues such as equipment investment, spectrum usage, deployment cost, and terminal equipment penetration must all be overcome in order to demonstrate the technical benefits of Wi-Fi 7.

Press Releases

3Q21 Revenue of Global Top 10 IC Design (Fabless) Companies Reach US$33.7 billion, Four Taiwanese Companies Make List, Says TrendForce

The semicondustor market in 3Q21 is red hot with total revenue of the global top 10 IC design (fabless) companies reaching US$33.7 billion or 45% growth YoY, according to TrendForce’s latest investigations. In addition to the Taiwanese companies MediaTek, Novatek, and Realtek already on the list, Himax comes in at number ten, bringing the total number of Taiwanese companies on the top 10 list to 4.

Qualcomm has been buoyed by continuing robust demand for 5G mobile phones form major mobile phone manufacturers with further revenue growth from its processor and radio frequency front end (RFFE) departments. Qualcomm’s IoT department benefited from strong demand in the consumer electronics, edge networking, and industrial sectors, posting revenue growth of 66% YoY, highest among Qualcomm departments. In turn, this drove Qualcomm’s total 3Q21 revenue to US$7.7 billion, 56% growth YoY, and ranking first in the world.

Second ranked NVidia, is still benefiting from gaming graphics card and data center revenue as the annual revenue growth for these two primary product departments reached 53% and 48%, respectively. In addition, professional design visualization solutions only accounted for 8% of total revenue. However, due to enduringly strong demand for mining and customers actively deploying the RTX series of high-performance graphics cards, NVidia’s product department revenue grew 148% YoY with overall revenue increasing by 55% to US$6.6 billion.

Third ranked Broadcom’s main revenue stream came from their network chip, broadband communication chip and storage and bridge chip businesses. Driven by post-COVID hybrid working models, companies are accelerating migration to the cloud, increasing demand for Broadcom chips, and driving revenue growth to US$5.4 billion or 17% YoY. AMD’s Ryzen, Radeon, and EPYC series of products in the fields of games, data centers, and servers performed well, driving total revenue to US$4.3 billion, 54% growth YoY, and fifth place overall.

In terms of Taiwanese companies, MediaTek continues to expand its global 5G rollout and, benefiting from optimization of product portfolio composition, product line specification enhancement, increase in sales volume, increases in pricing, and other factors, revenue of MediaTek’s mobile phone product line increased 72% YoY. Annual revenue of other product lines also posted double digit growth with total revenue in the 3Q21 reaching US$4.7 billion or 43% YoY, a fourth place ranking. Novatek continues to focus on its two primary product lines of system-on-chip and panel driver chips. The proportion of its OLED panel driver chip shipments has increased, product ASP has risen, and shipments have been smooth with 3Q21 revenue reaching US$1.4 billion or 84% YoY. In addition, Realtek’s revenue surpassed Xilinx to take the eighth position due to higher priced Netcom chips in 3Q21. Himax also saw significant growth in its three main product lines of TVs, monitors, and notebooks due to large-size driver chips. Revenue from large-size driver chips increased 111% YoY, driving total revenue to exceed the US$400 million mark, a 75% increase, and enough to squeeze onto this year’s ranking.

Overall, 3Q21 revenue for major IC design (fabless) companies has generally reached historic levels. Rankings for the top 7 companies remained the same as in 2Q21 with change coming in ranks 8 to 10. Looking forward to 4Q21, TrendForce believes Taiwanese IC design (fabless) companies will generally lean conservative. In addition to the electronics industry moving into the traditional off-season, a slowing of demand for consumer applications and customer-end materials supply issues reducing procurement will make continued revenue growth a challenge. In addition to consumer electronic products, global industry leaders are focused on the positive development of server and data center products to maintain an expected revenue growth trend.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email Ms. Latte Chung from the Sales Department at lattechung@trendforce.com

Press Releases

Revenue of Top 10 IC Design (Fabless) Companies Reaches US$29.8 Billion for 2Q21, Though Growth May Potentially Slow in 2H21, Says TrendForce

In view of the ongoing production capacity shortage in the semiconductor industry and the resultant price hike of chips, revenue of the top 10 IC design companies for 2Q21 reached US$29.8 billion, a 60.8% YoY increase, according to TrendForce‘s latest investigations. In particular, Taiwanese companies put up remarkable performances during this period, with both MediaTek and Novatek posting YoY growths of more than 95%. AMD, on the other hand, experienced a nearly 100% YoY revenue growth, the highest among the top 10.

TrendForce indicates that the ranking of the top five companies for 2Q21 remained unchanged from the previous quarter, although there were major changes in the 6th to 10th spots. More specifically, after finalizing its acquisition of Inphi, Marvell experienced a major revenue growth and leapfrogged Xilinx and Realtek in the rankings from 9th place in 1Q21 to 7th place in 2Q21.

Thanks to strong demand for major smartphone brands’ flagship and high-end 5G handsets, revenue leader Qualcomm’s processor and RF front-end businesses underwent remarkable growths, while its IoT business also benefitted from WFH and distance learning demands generated by the COVID-19 pandemic. Qualcomm’s revenue from its IoT business reached nearly US$1.4 billion, making IoT one of the major growth drivers for the company. For 2Q21, Qualcomm’s revenue reached US$6.47 billion, a 70.0% YoY increase. On the other hand, Nvidia’s revenues from gaming graphics cards and data center solutions each grew by 91.1% YoY and 46% YoY, respectively, in 2Q21. Strong demand from cryptocurrency miners for Nvidia’s high-end gaming graphics cards, along with the data center segment’s demand for Nvidia’s HPC products, propelled the company’s revenue for 2Q21 to US$5.84 billion, a 68.8% YoY growth, and secured the second place for Nvidia on the top 10 list.

Broadcom, which took third place on the top 10, attributed most of its revenue to wired connectivity and wireless products. Regarding wired connectivity products, the continued build-out of 5G base stations worldwide resulted in increasing demand for Broadcom’s high-speed Ethernet controller ICs, whereas for wireless products, the release of certain high-end 5G smartphones also created high demand for Broadcom’s Wi-Fi 6E chips. Similarly, Broadcom’s broadband and industrial solutions businesses both underwent double-digit growths in 2Q21, thereby driving the company’s revenue for 2Q21 to US$4.95 billion, a 19.2% YoY growth. Turning to AMD, the company’s revenue for 2Q21 reached US$3.85 billion, a staggering 99.3% YoY increase, owing to the following: first, the bullish gaming console market; second, massive earnings growths from enterprise, embedded, and semi-custom solutions; third, increased client adoption of AMD’s server CPUs (it should be noted that AMD’s server processor business grew by 183% YoY in 2Q21). AMD took fifth place in the top 10 list for 2Q21.

Regarding Taiwanese companies, MediaTek was able to sustain the momentum it gained in 1Q21 throughout 2Q21. MediaTek’s smartphone chip business, which generated the bulk of the company’s revenue, registered a 143% growth in 2Q21. At the same time, its revenues from other businesses also saw an overall double-digit growth. Hence, MediaTek posted a revenue of US$4.49 billion for 2Q21, a 98.8% YoY growth, and reached fourth place on the list. Finally, Novatek’s SoCs and display driver ICs both performed well in the market primarily due to its close partnerships with major foundries, including TSMC, UMC, and VIS. Revenue from display driver ICs, which had traditionally been Novatek’s primary revenue source, grew by 81% YoY in 2Q21.

Certain rumors in the end-devices markets indicate that demand will likely undergo a slowdown in 3Q21 and lead to decreased orders for certain components. However, given that foundries’ newly installed wafer capacities have yet to kick off mass production, the ongoing chip shortage is expected to persist for now. In addition, as some IC design companies’ client orders still remain unfulfilled, these companies’ revenues will likely experience further growths in 2H21, albeit to a relatively limited extent. It should also be pointed out that Marvell is expected to benefit from Inphi’s earnings for the next two quarters and increase its own revenue by more than 50% YoY in 2H21. Even so, Novatek’s sixth-place ranking is unlikely to be threatened by Marvell in the short run since Novatek will continue to benefit from the ongoing chip shortage and price hikes for the time being.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email Ms. Latte Chung from the Sales Department at lattechung@trendforce.com

Press Releases

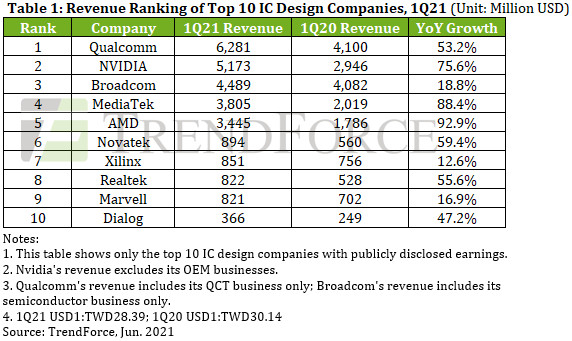

Global Cryptocurrency Mining Craze Becomes Key to Nvidia Overtaking Broadcom in Revenue for 1Q21, Says TrendForce

While foundry capacities remained tight, prompting IC design companies to compete over limited foundry capacities in order to fulfill rising demand for various end devices, the top 10 IC designe (fabless) companies posted remarkable revenues in 1Q21, according to TrendForce’s latest investigations. In particular, thanks to the global mining craze brought about by the cryptocurrency market, Nvidia was able to surpass Broadcom in revenue and take the second spot among the top 10. On the other hand, fifth-ranked AMD scored a staggering YoY growth of 92.9%, which is the highest % increase on the top 10 list.

Market leader Qualcomm saw growths in its smartphone, RF front end, IoT, and automotive departments in 1Q21, during which it posted a revenue of US$6.28 billion, a 53.2% increase YoY, placing Qualcomm firmly in the number one spot. Coming in second place is Nvidia, which overtook Broadcom with $5.17 billion in revenue. Nvidia’s revenue performance can primarily be attributed to massive gaming graphics card demand generated by the cryptocurrency market and the stay-at-home economy. In addition, Nvidia’s Cloud & Data Center business also saw positive growths in 1Q21, thereby contributing to its revenue for the quarter as well.

Broadcom, ranked third on the top 10 list, posted a $4.49 billion revenue in 1Q21. Broadcom’s performance took place on the back of the bullish broadband telecom market, with growths in passive fiber optics and wired networking for data transmission. AMD, on the other hand, continued to benefit from the stay-at-home economy and other such market demands, in addition to its growing foothold in the server market. The company experienced increasing market shares and led its competitors with an impressive 92.9% YoY increase in revenue, the highest on the top 10 list. It should be pointed out that the extreme volatility of the cryptocurrency market, as well as the strict surveillance policies imposed on cryptocurrency trading by several countries, may introduce uncertainties in the future of gaming graphics card revenue for both Nvidia and AMD.

Regarding the performance of Taiwanese IC design companies, MediaTek’s smartphone business unit registered a remarkable 149% YoY growth in revenue mainly on account of high demand from Chinese smartphone brands, which were particularly aggressive in seizing Huawei’s former market share. Furthermore, as Qualcomm’s recent performance in the entry-level and mid-range smartphone markets remained relatively lackluster, MediaTek therefore aimed to fulfill demand from its smartphone clients as its chief goal on a macro level. As a result, MediaTek’s revenue for 1Q21 reached about $3.81 billion, an 88.4% YoY increase, placing the company in the fourth spot.

Novatek derived its performance from high component demand from manufacturers of IT products, TVs, and smartphones. In view of the current shortage of foundry capacity and rising prices of foundry services, Novatek has been able to maintain a stable supply of components via increased prices due to its longstanding, stable, and flexible strategic relationships with Taiwanese foundries (UMC, VIS, and TSMC), China-based Nexchip, and Korea-based Samsung LSI. Hence, Novatek leapfrogged both Marvell and Xilinx for the sixth place while increasing its revenue for 1Q21 by 59.4% YoY.

On the whole, the second wave of the COVID-19 pandemic in India, which has resulted in decreased production targets for Chinese smartphone brands, is not expected to drastically affect IC design companies’ component demand in 3Q21 because of the following factors: First, price hikes of foundry services have already been reflected in chip prices; secondly, market demand for devices remains high; and finally, Chinese smartphone brands still need to maintain a safe level component inventory, as they have yet to resolve the discrepancies among their various materials’ sufficiency levels.

Incidentally, although some expect that the recent spread of COVID-19 among KYEC employees may impact the procurement activities of IC designers that are part of KYEC’s clientele, TrendForce’s investigations of financial reports from various companies in April and May indicate that infections in KYEC facilities will unlikely result in major impacts on the revenues of IC designers in 2Q21.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email Ms. Latte Chung from the Sales Department at lattechung@trendforce.com

Press Releases

Revenue of Top 10 IC Design (Fabless) Companies for 2020 Undergoes 26.4% Increase YoY Due to High Demand for Notebooks and Networking Products, Says TrendForce

The emergence of the COVID-19 pandemic in 1H20 seemed at first poised to devastate the IC design industry. However, as WFH and distance education became the norm, TrendForce finds that the demand for notebook computers and networking products also spiked in response, in turn driving manufacturers to massively ramp up their procurement activities for components. Fabless IC design companies that supply such components therefore benefitted greatly from manufacturers’ procurement demand, and the IC design industry underwent tremendous growth in 2020. In particular, the top three IC design companies (Qualcomm, Broadcom, and Nvidia) all posted YoY increases in their revenues, with Nvidia registering the most impressive growth, at a staggering 52.2% increase YoY, the highest among the top 10 companies.

According to TrendForce’s latest investigations, Qualcomm was able to overtake Broadcom for the leading position in the top 10 list primarily due to two reasons: First, the sudden demand surge for network devices; and second, Apple’s decision to once again adopt Qualcomm’s baseband processors. Incidentally, US sanctions against Huawei also prompted other smartphone brands to ramp up their production volumes in an attempt to seize additional market shares. Taken together, these factors collectively drove up Qualcomm’s revenue last year. Likewise, although the US-China trade war hampered Broadcom’s performances in 1H20, its smartphone RF front-end became a crucial part of Apple’s supply chain in 2H20. Even so, Broadcom fell to second place in the rankings, since its revenue growth was relatively minor. The Mellanox acquisition substantially bolstered the depth and breadth of Nvidia’s data center solutions, which generated nearly US$6.4 billion in revenue, a 121.2% increase YoY. Owing to its data center solutions and gaming graphics cards, which performed well in the market, Nvidia posted the highest YoY revenue growth among the top 10 companies, at 52.2% as previously mentioned.

The three Taiwanese companies delivered remarkable performances as well. In particular, MediaTek’s revenue underwent a 37.3% YoY increase in 2020, an overwhelming improvement over the 1% YoY increase in 2019. MediaTek’s growth last year took place due to several reasons, including the skyrocketing demand for notebooks and networking products, the success of MediaTek’s 5G smartphone processors, and improved specs as well as cost optimizations for MediaTek’s networking products. Novatek’s revenue grew by 30.1% YoY, as the US-China trade war and the stay-at-home economy brought about by the pandemic resulted in strong sales of its driver ICs and TV SoCs. Finally, Realtek benefitted from the high demand for its various offerings, most notably networking products and notebooks, although sales of its audio products and Bluetooth chips were also respectable. Realtek’s revenue increased by 34.1% YoY.

Capitalizing on the capacity limitations of Intel’s 10nm process, AMD made significant inroads in the notebook, desktop, and server CPU markets, resulting in a $9.7 billion revenue, a remarkable 45% increase YoY. Although Xilinx’s revenue declined by 5.6% YoY in the wake of the US-China trade war, recent QoQ changes in Xilinx’s revenue show that the company is well on its way to recovery going forward.

Although vaccines are being administered across the globe at the moment, the pandemic has yet to show any signs of slowdown in 1Q21. While device manufacturers remain active in procuring components, the shortage of foundry capacities is expected to persist throughout the year. IC design companies are likely to raise IC quotes given the need to ensure sufficient foundry capacities allocated to IC products, in turn propelling IC design revenue to new heights in 2021.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email Ms. Latte Chung from the Sales Department at lattechung@trendforce.com

- Page 2

- 3 page(s)

- 11 result(s)