Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] TSMC’s Kumamoto 3nm Upgrade Highlights Overseas Output Reportedly Hitting 20% by 2028

TSMC’s surprise move to upgrade Kumamoto Fab 2 to 3nm—lifting total investment to about US$17 billion—has put its overseas footprint back in the spotlight. Citing analysts, Economic Daily News reports that as U.S., Japan, and Germany fabs ramp, overseas capacity is set to reach ~20% or more of TSMC’s total output by 2028, including mature and specialty nodes.

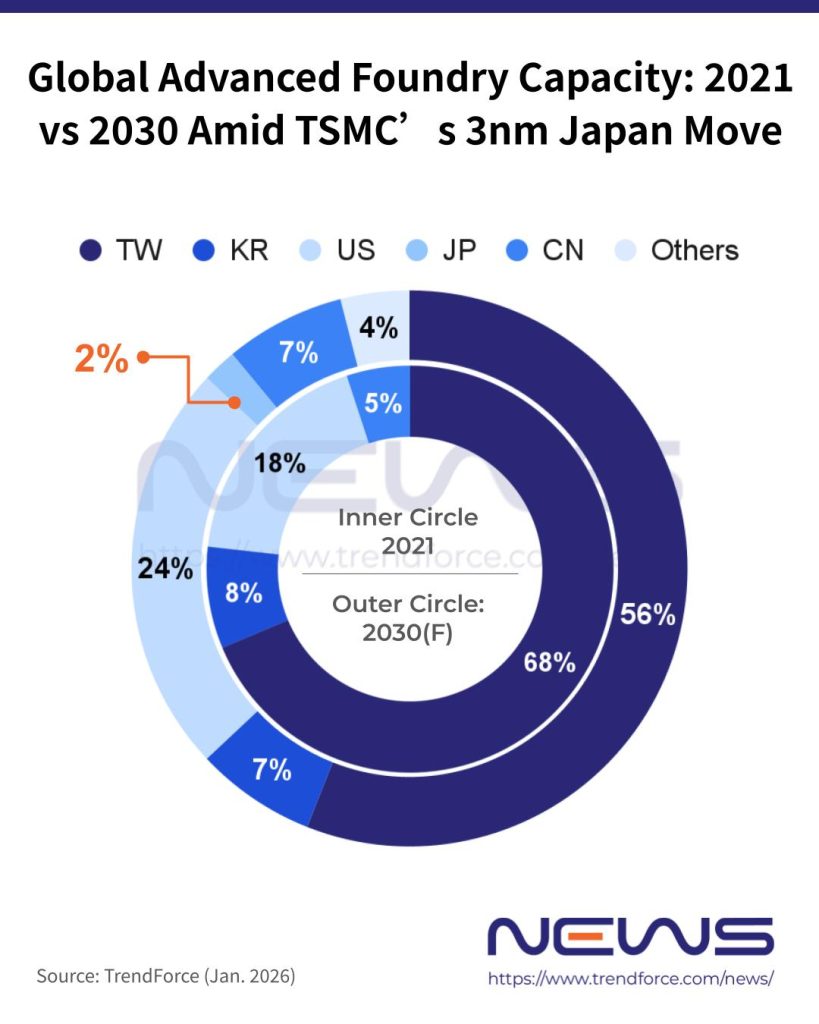

That said, the impact on Taiwan’s advanced-node capacity remains contained. According to Commercial Times, Taiwan’s Ministry of Economic Affairs estimates that sub-5nm production will still be concentrated in Taiwan, accounting for about 85% in 2030 versus 15% in the U.S., before shifting to roughly 80% and 20% by 2036, respectively.

Minister Kung Ming-hsin, as per Commercial Times, added that even after factoring in 3nm at Kumamoto Fab 2, the overseas share would rise by only 1–2 percentage points, underscoring that TSMC’s advanced-node capacity mix remains firmly Taiwan-centric.

Rethinking Kumamoto: TSMC’s Strategic Shift

Notably, TSMC’s rethink of its Kumamoto fab plan signals a potential shift from its usual approach. Traditionally, the company’s overseas fabs have focused on serving nearby customers and minimizing supply-chain risk. However, as noted by Commercial Times, Japan’s limited pool of advanced-node IC designers—such as Fujitsu and Socionext—may not sustain a standalone 3nm fab long-term.

As a result, Kumamoto Fab 2’s 3nm ramp could slip to around 2028, likely serving as backup capacity for TSMC’s Fab 18 in Taiwan rather than a primary hub. The report adds that by then, TSMC’s top customers are expected to have largely moved to 2nm, with Kumamoto Fab 2 absorbing mature 3nm orders, freeing Fab 18 to focus on A16 and more advanced nodes to meet demand from AI giants like NVIDIA.

Commercial Times suggests that the move also highlights Japan’s semiconductor struggles: Sony, a major JASM shareholder, is spinning off its TV business, its CIS unit faces pressure from Samsung encroaching on Apple orders, and Kumamoto Fab 1 remained loss-making through Q3 last year.

Germany Fab: TSMC Takes a Cautious Approach

However, TSMC’s attitude for its expansion in Germany seems more conservative. The Economic Daily News notes that Chairman C.C. Wei has stressed the site is fully focused on automotive demand, using 28/22nm and 16/12nm nodes for car and industrial chips—unlikely to expand into sub-5nm advanced processes.

Supply chain sources cited by the report say China’s EV price war has spilled into Europe, weighing on auto demand and triggering inventory corrections at three major automotive chipmakers (Bosch, Infineon, and NXP) partnered with TSMC. While construction of TSMC’s Germany fab remains on schedule, mass production is being pushed back under a wait-and-see approach, with the original 2027 ramp-up timeline now uncertain until automotive demand shows a clear rebound, the report notes.

Read more

- [News] TSMC Reportedly to Upgrade Kumamoto 2nd Plant to 3nm, Boosting Japan’s Chip Capabilities

- [News] TSMC’s Bold Pivot: Kumamoto Fab 2 Reportedly Leaps from 6nm to 2nm amid JASM Losses

(Photo credit: Prime Minister’s Office’s X)