Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] CPU Prices Reportedly Diverge as Consumer Stays Flat Despite Potential 15% Server-Grade Hikes

To what extent are CPU prices rising, and how is this playing out in the consumer market? Despite growing speculation about price hikes, a report by Cailian Press finds that consumer CPU prices have so far remained largely stable. According to the report, based on observations in Shenzhen’s Huaqiangbei—widely regarded as China’s largest electronics market—several PC vendors said they have not seen clear signs of price increases.

To provide some background, the report notes that speculation around CPU price hikes has mainly been driven by the server segment. Industry sources cited in the report say Intel’s and AMD’s server CPU capacity for 2026 has already been largely sold out, prompting plans to raise server CPU prices by around 10%–15%. Wccftech notes that server CPU shipments are projected to rise by as much as 25% this year, highlighting significant room for companies such as AMD and Intel to expand their data-center businesses through server CPU offerings.

CPU Pricing Diverges Between Consumer and Server Segments

More specifically, institutional investors cited by Cailian Press say prices for mainstream PC- and notebook-related consumer CPUs remain broadly stable for now, as channel inventories still need to be absorbed and intense competition limits manufacturers’ ability to pass on cost increases.

By contrast, server CPUs—particularly mid- to high-end products—are showing signs of tightness. This has been reflected more in longer delivery lead times and improved pricing power for certain models and customized products, rather than across-the-board increases in list prices, Cailian Press notes.

CPU Prices Poised to Rise as Market Remains Segmented

Looking ahead, Cailian Press indicates that as computing demand continues to rise, prices for mechanical hard drives, memory, and CPUs are likely to move higher, making a 15% CPU price increase possible. Still, the report adds that the CPU market is expected to remain segmented, with relatively balanced supply and demand in the consumer segment and short-term volatility in server CPUs.

Meanwhile, sources cited in the report say many large companies are not yet facing immediate hardware shortages but are instead building up inventories, with recent price increases partly driven by aggressive stockpiling by these major players. Many CPU vendors are also reportedly holding back supply in anticipation of further gains.

China’s CPU Sellers Reportedly Switch to Memory as Market Heats Up

Notably, Cailian Press states that several CPU sellers in China have recently shifted their focus to memory products. As the report notes, these vendors said they are temporarily scaling back CPU sales in favor of memory, citing limited price movement and a prior downward trend in CPU pricing. By contrast, with memory markets currently running hot, they say memory offers significantly higher margins.

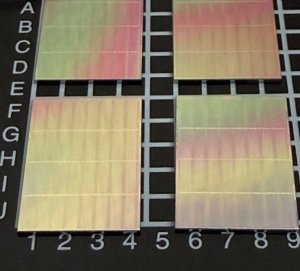

According to TrendForce, sustained AI and data-center demand in 1Q26 is further exacerbating the global memory supply–demand imbalance. As a result, TrendForce has sharply raised its 1Q26 price forecasts, revising the quarter-over-quarter increase in conventional DRAM contract prices from 55–60% to 90–95%, while lifting its NAND Flash forecast from 33–38% to 55–60%.

Read more

- Dual Pressure from Rising CPU and Memory Prices to Drive Global Notebook Shipments Down 14.8% QoQ in 1Q26, Says TrendForce

- [News] Supply Constraints Hit Intel Q1 Forecast; 14A Customer Demand Expected 2H26–1H27

(Photo credit: Intel)