Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Second-Tier No More: Kioxia and SanDisk Balance Alliance and Rivalry in AI NAND Race

Ahead of Samsung and SK hynix’s earnings calls, Micron’s $24 billion Singapore investment is drawing attention, signaling a renewed industry focus on NAND. EE Times reports that as AI workloads shifted from training to inference, SSDs powered by NAND are widely deployed in AI data centers, a trend that propelled once-underdogs like Kioxia and SanDisk into the spotlight.

The market impact is clear. Nikkei notes that Kioxia’s market value topped ¥10 trillion on January 27, just over a year after its December 2024 IPO, fueled by soaring NAND prices. Meanwhile, ETNews says SanDisk plans a 100% NAND price hike in the new year.

Notably, beyond South Korea, Kioxia and SanDisk are forming a strategic NAND alliance across Japan and the U.S., using a mix of cooperation and competition to capture the AI-driven NAND market—laying the groundwork for analyzing their competitive and technological strategies.

SanDisk and Kioxia: A 25-Year Strategic Alliance

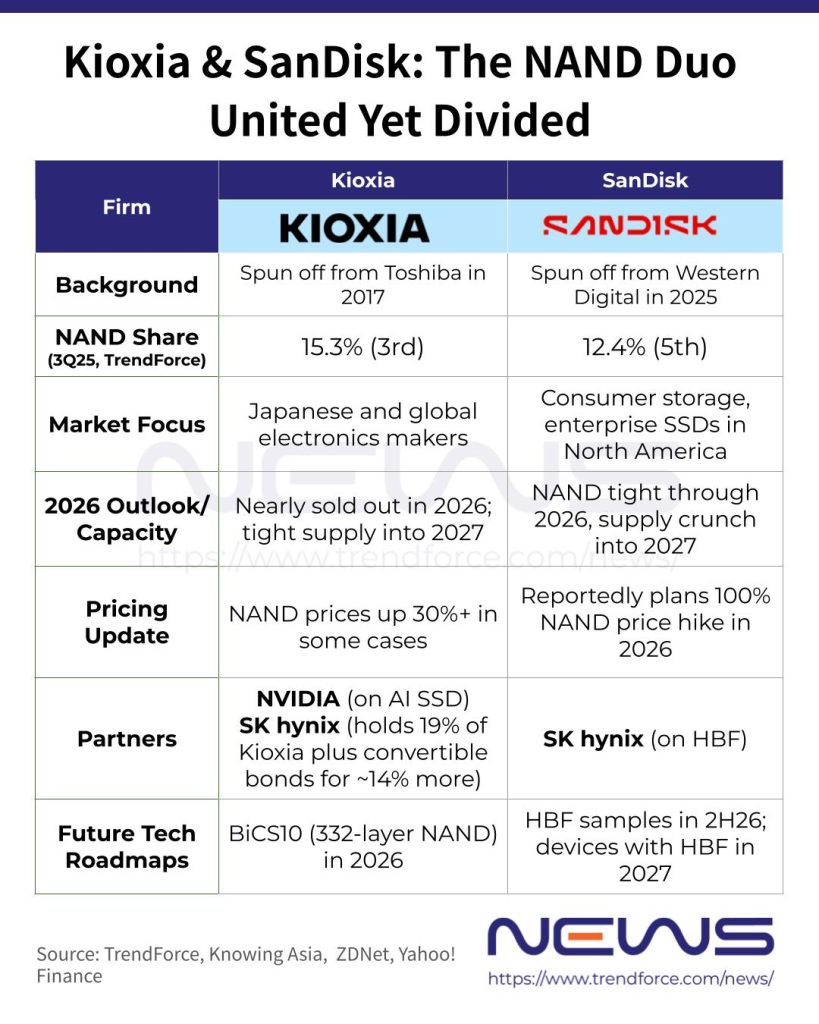

As Knowing.asia explains, they have maintained a deep, long-standing partnership spanning over 25 years. Even after Western Digital spun off SanDisk in 2025, their collaboration strengthens. The report points out that the two companies operate the world’s largest NAND flash memory production sites in Japan, including the Yokkaichi and Kitakami fabs, giving them unmatched manufacturing scale.

On the technology front, they co-developed BiCS FLASH 3D NAND, now in its 8th generation (BiCS8, 218 layers). Knowing.asia adds that production of the 10th generation—over 300 layers—is set to begin in 2026, with Nikkei noting that Kioxia plans to repurpose its recently opened Kitakami K2 fab for the new node. According to EE Times, BiCS10—a 332-layer 3D NAND technology for AI and hyperscale storage—was originally slated for production in 2H27.

Knowing.asia highlights that through joint ventures, Kioxia and SanDisk share the costs of expensive semiconductor equipment and R&D, achieving economies of scale to compete with South Korean memory giants. Data from TrendForce shows the impact: in Q3 2025, Samsung led with a 32.3% NAND market share, followed by SK hynix at 19.3%. Kioxia held 15.3%, surpassing Micron, while SanDisk captured 12.4%, underscoring the growing influence of their collaboration in the global NAND landscape.

However, Knowing.asia notes a clear split in market focus. Kioxia mainly supplies NAND to major Japanese and global electronics makers, while SanDisk commands the consumer storage segment and holds a strong position in enterprise SSDs across North America and overseas markets. Despite deep integration on the manufacturing side, the two continue to compete directly in channels and branded end products, the report adds.

Aligned With Giants on Different Fronts

Notably, while the two collaborate closely on 3D NAND development and continue to push layer counts higher, they are also actively forging partnerships with tech giants to tackle AI’s memory bottlenecks. With HBM limited by capacity and cost, NAND flash—through HBF (high-capacity near-memory) and AI SSDs (intelligent preprocessing)—is increasingly optimizing AI architectures, redefining its role and value in next-generation compute.

According to Sisa Journal, Samsung and SanDisk are targeting late 2027 to early 2028 to integrate HBF into products from NVIDIA, AMD, and Google. While HBF mirrors HBM in using TSV-based vertical stacking, it is built on NAND flash, delivering far greater capacity at a lower cost. The report adds that although HBM remains faster, HBF can offer roughly ten times the capacity.

In August 2025, SanDisk announced its collaboration with SK hynix on HBF, which targets to deliver first samples in the second half of calendar 2026 and expects samples of the first AI-inference devices with HBF to be available in early 2027.

On the other hand, Kioxia is setting its sights on the SSD market. Nikkei reported the company plans to launch drives by 2027 that are nearly 100 times faster than current models. Developed in partnership with NVIDIA for generative AI servers, the SSDs could connect directly to GPUs, partially replacing HBM (high-bandwidth memory) to boost GPU memory capacity, the report adds.

Notably, Kioxia announced plans for a “Super High IOPS SSD” at its June 2025 management briefing, aiming to meet NVIDIA’s demand for a tenfold increase in random read performance. The drives are designed to boost IOPS—reads and writes per second—from roughly 10 million to 100 million, the company stated. The move, in a way, underscores Kioxia’s ambition to court hyperscaler clients.

As AI inference workloads continue to surge, demand for NAND across the entire supply chain is skyrocketing. In this context, the Japan–U.S. duo of Kioxia and SanDisk—once secondary players—are emerging as key forces to watch.

Read more

- [News] Micron, SanDisk Reportedly Turn to PSMC to Fast-Track Memory Output Amid Tight Supply

- [News] SanDisk, Samsung Reportedly Delay NAND Delivery, Hitting Transcend with 50–100% Price Spike

(Photo credit: SanDisk)