Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Samsung & SK hynix Earnings Showdown on 1/29: Profit, CAPEX, HBM4 in Focus

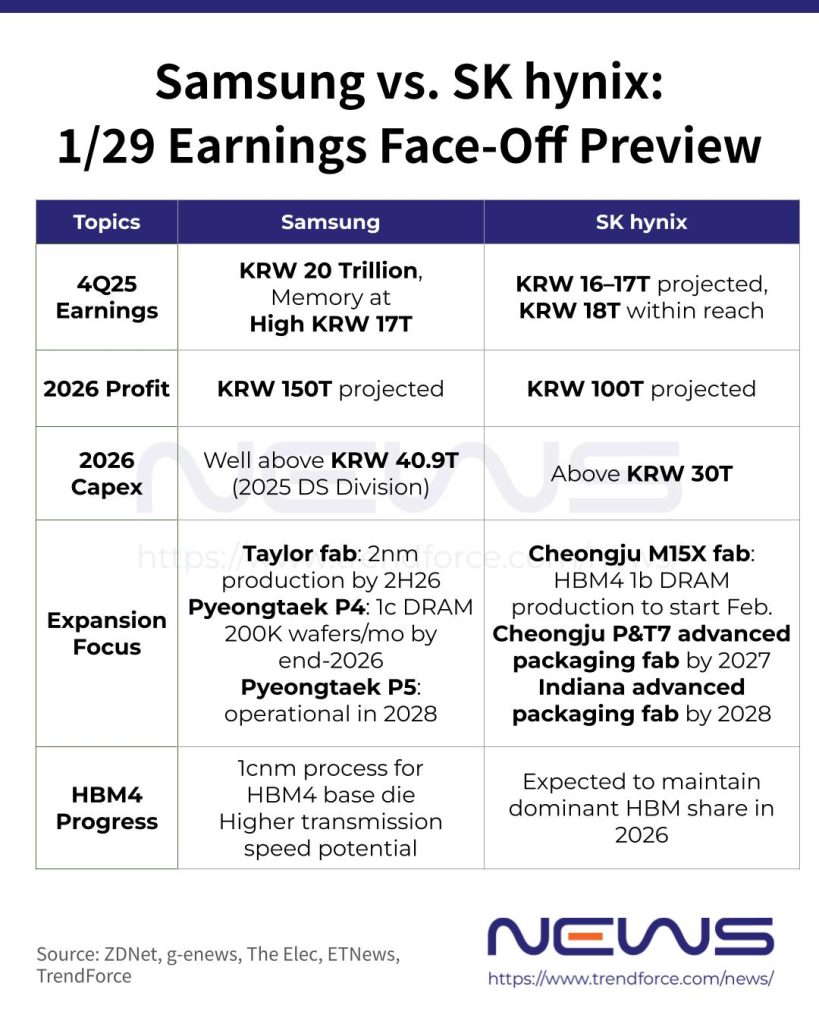

Amid soaring memory prices driven by tight supply and strong demand, Samsung and SK hynix are set to release their fourth-quarter 2025 earnings on January 29, attracting keen market attention as it marks the first time both giants will report on the same day. Ahead of their earnings calls next week, here’s a preview of the key topics investors are likely to focus on.

Profit Gap to Close Significantly

In early January, Samsung has kicked off the year with a historic Q4 forecast: revenue is set to top 90 trillion won, up 22.7% from a year ago, while operating profit is projected to surge 208% year on year. Chosun Daily notes that, if the forecast materializes, Samsung would become the first South Korean company to report quarterly operating profit of 20 trillion won ($13.82 billion). Of that total, ZDNet suggests operating profit from its memory semiconductor business is estimated to be in the high-KRW 17 trillion range.

The figures show Samsung’s memory division is closing in on SK hynix in profitability. ZDNet notes the rebound in commodity DRAM prices since H2 2025, along with higher shipments of mainstream DRAM, has fueled Samsung’s gains, while SK hynix’s heavier reliance on HBM has limited its upside from the recent DRAM price surge.

Despite this, SK hynix, initially expected to post KRW 16–17 trillion in operating profit, is now projected by industry sources cited by ZDNet to reach at least KRW 18 trillion in Q4.

However, ZDNet also flags that Samsung’s memory division is widely expected to overtake SK hynix in operating profit in the first quarter of 2026, as commodity DRAM prices are set for another sharp rise. According to TrendForce, average selling prices for mainstream DRAM are projected to jump 55–60% quarter on quarter during the period.

Set Sights on 2026 Peak Performance

Amid tight memory supply stretching into 2027, SK hynix and Samsung Electronics are poised for peak performance in 2026, according to g-enews.com. Analysts cited in the report forecast SK hynix to post 2026 sales above KRW 165 trillion, with operating profit exceeding KRW 100 trillion.

Meanwhile, investment bank reports from Macquarie and KB Securities cited by the report suggest Samsung’s 2026 operating profit could reach around KRW 150 trillion, placing both companies firmly in the “100 trillion won operating profit club.”

Against this backdrop, though neither company has released official CAPEX plans, g-enews.com reports that SK hynix is already channeling tens of trillions of won into its Cheongju M15X fab and Yongin Cluster. The Bell previously noted that the firm’s CAPEX reached the high KRW 10 trillion range in 2024 and the mid-20 trillion range in 2025, with projections pointing to over KRW 30 trillion in 2026.

On the other hand, g-enews.com reports that Samsung plans to sharply boost memory investment in 2026, building on KRW 40.9 trillion spent in the DS division in 2025. Key priorities include boosting HBM output, expanding the Pyeongtaek DS site, and advancing the Taylor fab in Texas.

HBM4 Battle Intensifies

The two memory giants will also be competing fiercely in the HBM4 race this year. As per TrendForce, NVIDIA has revised the HBM4 specifications for its Rubin platform in 3Q25, raising the required per-pin speed to above 11 Gbps. This change has necessitated that the three major HBM suppliers modify their designs.

As SeDaily reported in late 2025, both Samsung and SK hynix have begun delivering paid final HBM4 samples to NVIDIA, with the industry expecting volumes and pricing to be locked in during the first quarter of 2026. TrendForce adds that a definitive outcome will only become clear in the mid-to-late part of the quarter, once contracts are formally finalized.

Samsung’s chance to challenge SK hynix hinges on its adoption of a 1Cnm process for HBM4 and the use of advanced in-house foundry technology for the base die, which could deliver higher transmission speeds. Still, TrendForce notes SK hynix has already secured contracts and is expected to maintain a dominant share of total HBM supply bits in 2026.

Read more

- [News] Lutnick Reportedly Signals 100% Memory Tariff on Non-U.S. Output, Pressuring Samsung and SK hynix

- [News] Samsung, SK hynix Reportedly Plan ~20% HBM3E Price Hike for 2026 as NVIDIA H200, ASIC Demand Rises

- [News] SK hynix, Samsung Reportedly Deliver Paid HBM4 Samples to NVIDIA Ahead of 1Q26 Contracts

(Photo credit: SK hynix)