Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DRAM Surges as Sellers Hold Back Inventory, Mainstream DDR4 Up 10%

According to TrendForce’s latest memory spot price trend report, regarding DRAM, spot prices continue their daily climb, even as trading stays muted with suppliers and traders holding back inventory, pushing the average price of mainstream DDR4 1Gx8 3200MT/s chips up 9.64%. Meanwhile, in NAND, while some buyers have adopted a wait-and-see approach, spot traders—optimistic about future price trends—have refused to lower prices to spur sales. Details are as follows:

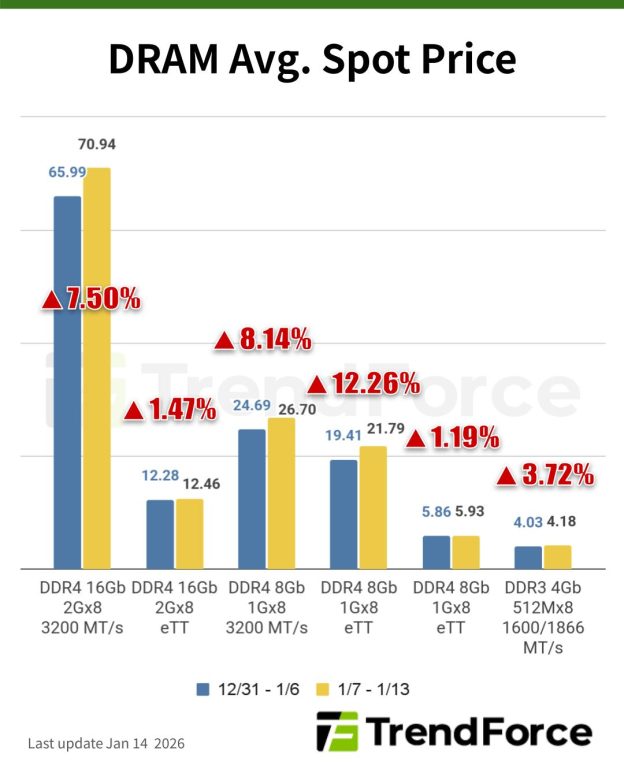

DRAM Spot Price:

Driven by robust contract price increases, spot prices have maintained consecutive daily gains. However, trading volumes remain constrained as suppliers and traders are reluctant to release inventory. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 9.64% from US$25.407 last week (Jan.7) to US$27.857 this week (Jan.14).

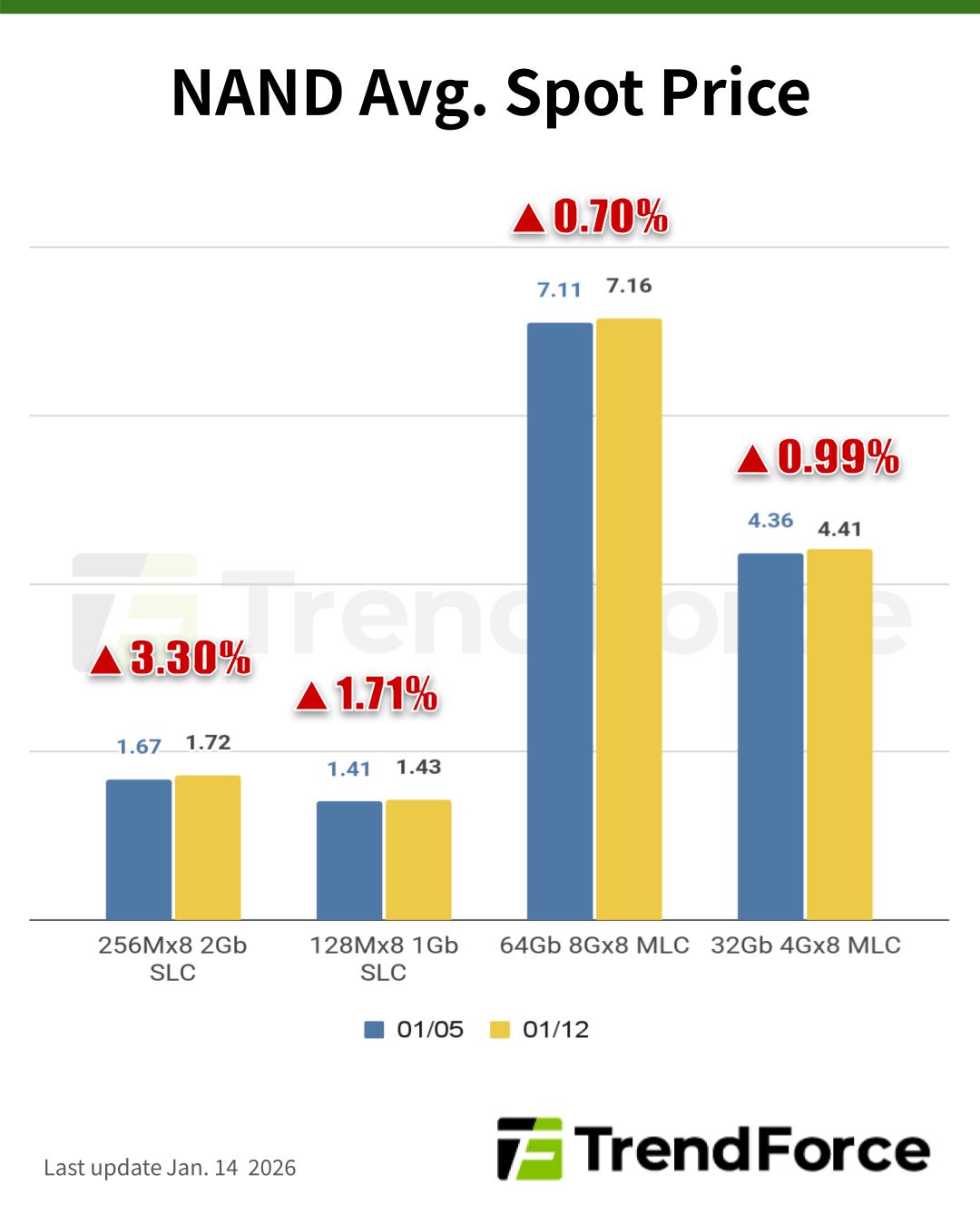

NAND Flash Spot Price:

Spot prices have kept rising recently. However, transaction volumes remain lackluster due to a combination of factors: significantly elevated spot prices, sluggish demand for consumer products, and impending factory shutdowns for the Lunar New Year. While some buyers have adopted a wait-and-see approach, spot traders—optimistic about future price trends—have refused to lower prices to spur sales. This standoff has resulted in a tepid spot market. This week, the average spot price of 512Gb TLC wafers has risen by 9.68%, reaching US$15.052.