Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] 8-Inch Foundries May Raise Prices 5–20%, Benefiting UMC, PSMC, Vanguard

8-inch foundry prices are rising. According to Economic Daily News, the tightening global supply of 8-inch wafer foundry capacity has led institutional investors to turn more bullish on related Taiwanese players, expecting the trend to benefit UMC, PSMC, and Vanguard.

Regarding the supply-side backdrop to the rise, TrendForce notes that TSMC formally began phasing down its 8-inch capacity in 2025 and plans to fully shut down some fabs by 2027. Samsung likewise initiated 8-inch capacity reductions in 2025. As a result, global 8-inch capacity is estimated to decline by about 0.3% year over year in 2025, marking the beginning of negative growth. Although players such as SMIC and Vanguard have planned modest capacity additions in 2026, TrendForce says these will be insufficient to offset the reductions by the two leading foundries, widening the projected capacity decline to 2.4%.

TrendForce adds that rising compute intensity and power consumption in AI servers and edge AI applications are expected to sustain strong demand for power-related ICs, making them the primary support for 8-inch fab utilization in 2026. Average global 8-inch utilization is projected to rise to 85–90% in 2026, up from 75–80% in 2025. With capacity tightening, several foundries have already notified customers of planned price increases ranging from 5% to 20%.

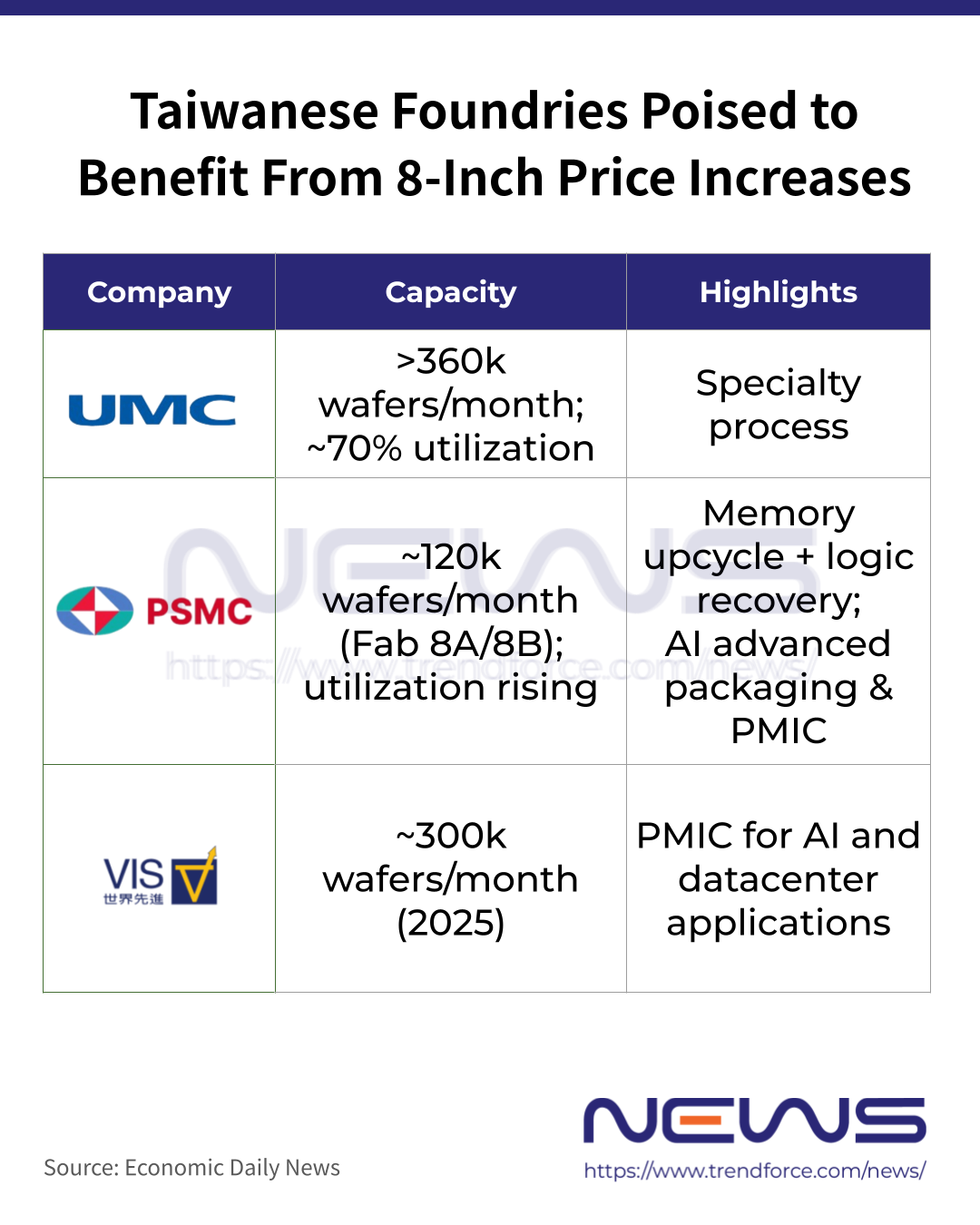

8-Inch Capacity Levels at UMC, PSMC, and Vanguard

The situation is expected to benefit related foundries. In terms of capacity, Economic Daily News notes that UMC operates monthly 8-inch wafer capacity of over 360,000 wafers, with utilization currently around 70%. PSMC has monthly 8-inch capacity of roughly 120,000 wafers—across its Fab 8A and 8B facilities in Hsinchu and Zhunan—with utilization continuing to trend upward. As for Vanguard, its annual 8-inch capacity in 2025 is estimated at about 3.45 million wafers. These 8-inch fabs mainly produce power management ICs, display driver ICs, and discrete devices such as MOSFETs, IGBTs, and GaN components.

UMC, PSMC, Vanguard Set Their Sights on 2026

Looking ahead, Economic Daily News adds that UMC remains positive on its 2026 outlook, with growth expected to continue as it deepens investment in specialty process technologies to strengthen market share. PSMC is seen as benefiting from a dual engine of rising memory prices and a recovery in logic products, while its push into high value-added segments, including AI advanced packaging and power management ICs, supports a more constructive 2026 outlook. Meanwhile, Vanguard’s long-standing focus on power management is said to provide it with solid technical foundations and well-aligned capabilities for AI server and data center applications.

Read more

- Rising AI-Driven Demand for Power ICs and Capacity Cuts Fuels Potential 8-Inch Foundry Price Hikes, Says TrendForce

- [News] Micron Reportedly Weighs Acquiring PSMC 12-Inch Tongluo Fab, With Multiple Partners Also Interested

(Photo credit: UMC)